September 19, 2024 Federal Reserve’s Aggressive Move Hints At Bold Economic Strategy

September 11, 2024 Top Stocks For Smart Investment Choices

September 8, 2024 S&P 500 In Freefall: Is This The End Of The Bull Market?

September 6, 2024 Jobs Report Spotlight As Fed Weighs Rate Cut Decision

Tesla: 4680 Battery On Cybertrucks Could Be A Big Deal

Selling Amazon On Recession Risks (Downgrade)

Amazon: See The Company From A Different Perspective

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Lumen Technologies (LUMN) Stock Forecast for 2024, 2025, 2026. Sell or Buy?

Updated: September 21, 2024 (00:04)

Sector: Communication servicesThe share price of Lumen Technologies, Inc. (LUMN) now

News Impact Analyzer

Full report|

This Week

|

Na | Impact: Na | News: Na |

|

Previous Week

|

Na | Impact: Na | News: Na |

|

Two Weeks Ago

|

Bearish | Impact: 5 | News: 2 |

|

Three Weeks Ago

|

Bearish | Impact: 5 | News: 1 |

Analysts predictions

Full report|

This Week

|

Neutral | Opinions: 1 |

|

Previous Week

|

Neutral | Opinions: Na |

|

Two Weeks Ago

|

Bearish | Opinions: 1 |

|

Three Weeks Ago

|

Neutral | Opinions: Na |

Analyzing the Most Important LUMN news

Lumen Technologies Sees Stock Drop Amid Latest Hedgeye Short Call, Predicts 40% Downside

Top Stocks to Watch: August's Rollercoaster Ride Comes to an End

Lumen Technologies Plummets 13% After Kerrisdale Capital's Short Report

Historical and forecast chart of Lumen Technologies stock

The chart below shows the historical price of Lumen Technologies stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Lumen Technologies stock price can be found in the table below.

Long-term forecasts by years.

Lumen Technologies, Inc. Analysts predictions review

As of now, Panda has combed through 2 analytical articles which are directly related to LUMN from the last 30 days. Out of these, 0 clearly showcase a bullish trend, while 1 see a bearish trend as the more likely scenario, and 1 stay neutral.

To identify the dominant trend, we took into account analytical articles from the past 30 days, spanning from Aug 28, 2024 to Sep 13, 2024.

Lumen's Balancing Act: Navigating High Interest Amid Debt Restructuring

In this comprehensive review of Jeremy LaKosh's analytical financial article, we delve into his nuanced examination of LUMN stock, where he maintains a neutral stance. Renowned for his balanced and insightful financial analyses, LaKosh has consistently contributed valuable perspectives since 2014. With 449 publications over his tenure and 4,955 subscribers who engage regularly with his insights, LaKosh demonstrates a prolific output that underscores his dedication to financial journalism. His viewpoints carry significant weight, given his outstanding credibility in the field, which places him among the most authoritative voices. This review will explore the key takeaways from his article, reflecting both his analytical expertise and objective approach, which have earned him a well-regarded reputation among investors and readers alike.

Key Theses from the Article

- Lumen Technologies is implementing debt exchanges to manage maturities and reduce overall debt, impacting earnings through increased interest expenses.

- The latest exchange offers involve trading existing notes for new 10% secured notes due in 2032, impacting both Lumen and Level 3 debt.

- The exchanges will introduce an additional $30-$35 million in annual interest which could pressure earnings but should have minimal immediate effect on the stock price.

- A larger class of secured debt holders poses potential risks to unsecured notes, although the shrinking unsecured debt class slightly mitigates this risk.

Factors Influencing Lumen's Stock Price

Increase in Interest Expenses

The additional $30-$35 million in annual interest costs will act as a headwind against Lumen's earnings, potentially leading to lower profitability if not offset by other revenue gains.

Debt Exchange Strategy

The debt exchange strategy might alleviate some short-term liquidity concerns and encourage institutional interest, aiding in maintaining share stability amidst other growth opportunities.

AI Boom and Sales Opportunities

The ongoing AI boom and sales initiatives offer potential revenue growth that may offset increased costs, although this factor is less certain in its immediate financial impact.

Risks from Secured Debt Holders

The higher subordinated status of unsecured note holders may enhance risks if operations don't improve significantly, yet the diminishing unsecured debt class slightly alleviates pressure.

Review the original Analysis

Lumen Technologies Surges 400%, but Overvaluation Signals Trouble Ahead

In his latest analytical piece, Michael Dion takes a bearish stance on Lumen Technologies (LUMN) stock, cautioning investors about potential drawbacks. Michael, a contributor since 2023, has quickly gained a significant following, with 500 subscribers and an impressive 86 publications. His viewpoints hold average credibility, reflecting a balanced influence within the financial community. Given his prolific output in a relatively short span, Michael’s analyses are both popular and timely. This review delves into his arguments, shedding light on why he advises caution regarding LUMN stock.

Key Theses

- Rating on Lumen Technologies, Inc. has been downgraded from buy to sell.

- The recent 400% surge in the stock's price is deemed unsustainable.

- Updated DCF analysis indicates a price target of $3.57, suggesting a 32% downside.

- AI market overvaluation and unrealistic growth expectations do not support Lumen's current price.

- Potential growth from data centers and fiber business exists but isn't enough to sustain the current price.

Factors Influencing LUMN Stock Price

400% Price Surge

The rapid and significant increase in stock price is considered unsustainable. Such a steep surge often leads to a correction, indicating potential downside.

Discounted Cash Flow (DCF) Analysis

Updated DCF analysis shows a price target of $3.57, suggesting the stock is currently overvalued. This valuation is based on lower-end management guidance and a 7.9% discount rate.

AI Market Overvaluation

The AI market's current valuation is perceived as inflated, and the article suggests that Lumen cannot sustain its price based on unrealistic growth expectations in AI. This weakens the bullish sentiment around Lumen driven by AI hype.

Data Center and Fiber Business Potential

While there is potential in Lumen's data center and fiber business, this is not seen as sufficient to support the elevated stock price. The growth prospects in these sectors are encouraging but don't justify the current valuation.

Insider Activity

The lack of insider selling amidst a rapid price increase may suggest confidence within the company. However, this factor alone is not strong enough to counterbalance the overvaluation indicated by the DCF analysis.

Review the original Analysis

Commentary

Lumen Technologies' recent 400% stock price surge has raised eyebrows for its unsustainability. An updated DCF analysis pegs a realistic price target at $3.57, significantly lower than the current stock price. This suggests a looming correction, bringing apprehension among investors. The average influence strength across all discussed factors stands at a considerable level of 7, indicating substantial pressure on the stock's trend in the near future.

The overvaluation in the AI market and tempered growth expectations for Lumen's data center and fiber businesses further complicate its lofty valuation. While insider confidence remains high, it's not strong enough to overshadow the analytical indicators of overvaluation. With a calculated downside of 32%, investors should brace for potential market adjustments in the coming month.

Comprehensive Analysis of Lumen Technologies (LUMN) Stock Market Performance

Our multifaceted analysis of Lumen Technologies's stock market is grounded in the company's key news stories, insights from reputable analysts, as well as mathematical and technical evaluations. Taking into account assessments from each of these aspects in real-time helps us address the most crucial questions for investors in the most objective way possible:

- When should I take profit in Lumen Technologies stock?

- When should I record a loss on Lumen Technologies stock?

- What are analysts' forecasts for Lumen Technologies stock?

- What is the future of Lumen Technologies stock?

We forecast Lumen Technologies stock performance using neural networks based on historical data on Lumen Technologies stocks.

Lumen Technologies, Inc. News influencing stock rates

As of now, Panda has combed through 3 news items directly related to LUMN from the last 30 days. Out of these, 0 clearly showcase a bullish trend, while 2 display bearish tendencies, and 1 events are neutral.

Based on an analysis of the most crucial news from the last 30 days affecting LUMN stocks, it's clear that bearish sentiments are completely overshadowing bullish ones. The impact of negative news is more than five times dominant over positive developments.

The news analyzed fell within the period from Aug 27, 2024, to Sep 03, 2024.

Top Gainers and Losers: Stocks See Major Shifts in Short Interest

Lumen Technologies Embraces Blue Planet to Revolutionize Network Inventory

Wells Fargo Downgrades Lumen Technologies to Underweight, PT Raised to $4

Lumen Surges as $5B in AI Data Center Deals Ignite Stocks

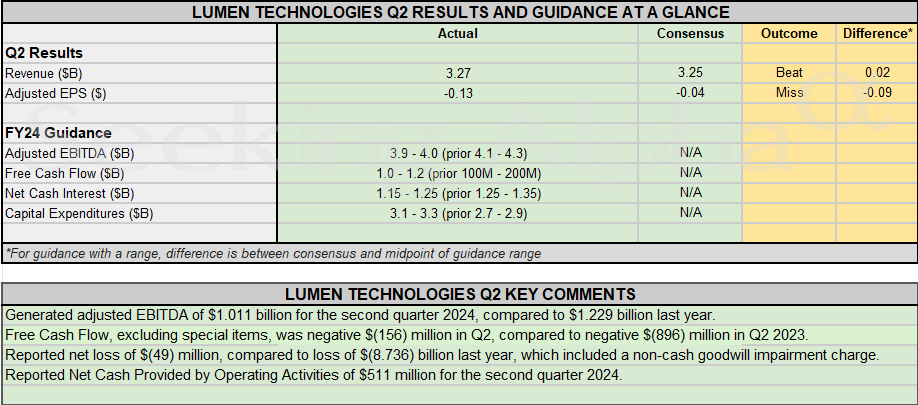

Lumen Faces Mixed Q2 Results, Slashes Guidance Yet Promises FCF Surge in 2024

Lumen Q2: EPS Misses While Revenue Surprises, Updated Outlook Revealed

Lumen Q2 Earnings: Expectations of Decline Amid High Debt and Revenue Drop

AI Boom Fuels $5B Business Surge for Lumen Technologies

Russell 2000 Soars in July: Lumen Technologies Leads with Astonishing 186% Rise

Lumen Technologies Soars 77% with Corning Agreement to Boost Network Capacity

Lumen Technologies is an American telecommunications company that provides a wide range of communications services. Provides local and long distance lines, multi-protocol label switching, data integration, managed hosting, localization, Ethernet, network access, wireless services, and more. The integrator serves many data centers in North America, Europe and Asia. The company also owns entertainment brands CenturyLink Prism TV and DIRECTV. Until 01/25/2021 it was named CenturyLink

Lumen Technologies daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Sep 22 | 6.88 | 6.83 | 6.99 | 2.32 |

| Sep 23 | 6.90 | 6.80 | 6.98 | 2.70 |

| Sep 24 | 6.89 | 6.81 | 6.95 | 2.15 |

| Sep 25 | 6.91 | 6.88 | 6.98 | 1.49 |

| Sep 26 | 7.04 | 6.96 | 7.08 | 1.76 |

| Sep 27 | 7.10 | 7.02 | 7.16 | 2.04 |

| Sep 28 | 7.08 | 7.05 | 7.18 | 1.87 |

| Sep 29 | 7.07 | 7.04 | 7.16 | 1.69 |

| Sep 30 | 6.96 | 6.91 | 6.99 | 1.15 |

| Oct 01 | 7.02 | 6.97 | 7.07 | 1.49 |

| Oct 02 | 7.01 | 6.90 | 7.06 | 2.30 |

| Oct 03 | 6.96 | 6.93 | 7.04 | 1.69 |

| Oct 04 | 7.07 | 7.01 | 7.15 | 2.04 |

| Oct 05 | 7.04 | 6.94 | 7.09 | 2.25 |

| Oct 06 | 7.08 | 7.02 | 7.17 | 2.14 |

| Oct 07 | 7.17 | 7.11 | 7.28 | 2.40 |

| Oct 08 | 7.18 | 7.07 | 7.23 | 2.25 |

| Oct 09 | 7.21 | 7.14 | 7.29 | 2.10 |

| Oct 10 | 7.12 | 7.03 | 7.16 | 1.84 |

| Oct 11 | 7.03 | 6.96 | 7.11 | 2.20 |

| Oct 12 | 6.97 | 6.91 | 7.02 | 1.55 |

| Oct 13 | 6.84 | 6.76 | 6.90 | 1.98 |

| Oct 14 | 6.85 | 6.77 | 6.90 | 1.96 |

| Oct 15 | 6.81 | 6.70 | 6.84 | 2.11 |

| Oct 16 | 6.79 | 6.75 | 6.83 | 1.27 |

| Oct 17 | 6.80 | 6.70 | 6.86 | 2.42 |

| Oct 18 | 6.72 | 6.62 | 6.75 | 2.07 |

| Oct 19 | 6.73 | 6.70 | 6.81 | 1.55 |

| Oct 20 | 6.78 | 6.70 | 6.87 | 2.63 |

| Oct 21 | 6.64 | 6.54 | 6.73 | 2.88 |

Lumen Technologies Daily Price Targets

Lumen Technologies Stock Forecast 09-22-2024.

Forecast target price for 09-22-2024: $6.88.

Positive dynamics for Lumen Technologies shares will prevail with possible volatility of 2.264%.

Pessimistic target level: 6.83

Optimistic target level: 6.99

Lumen Technologies Stock Forecast 09-23-2024.

Forecast target price for 09-23-2024: $6.90.

Positive dynamics for Lumen Technologies shares will prevail with possible volatility of 2.629%.

Pessimistic target level: 6.80

Optimistic target level: 6.98

Lumen Technologies Stock Forecast 09-24-2024.

Forecast target price for 09-24-2024: $6.89.

Negative dynamics for Lumen Technologies shares will prevail with possible volatility of 2.101%.

Pessimistic target level: 6.81

Optimistic target level: 6.95

Lumen Technologies Stock Forecast 09-25-2024.

Forecast target price for 09-25-2024: $6.91.

Positive dynamics for Lumen Technologies shares will prevail with possible volatility of 1.465%.

Pessimistic target level: 6.88

Optimistic target level: 6.98

Lumen Technologies Stock Forecast 09-26-2024.

Forecast target price for 09-26-2024: $7.04.

Positive dynamics for Lumen Technologies shares will prevail with possible volatility of 1.731%.

Pessimistic target level: 6.96

Optimistic target level: 7.08

Lumen Technologies Stock Forecast 09-27-2024.

Forecast target price for 09-27-2024: $7.10.

Positive dynamics for Lumen Technologies shares will prevail with possible volatility of 2.004%.

Pessimistic target level: 7.02

Optimistic target level: 7.16

LUMN (LUMN) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Oct. | 7.13 | 6.70 | 7.48 | 10.52 |

| Nov. | 7.56 | 7.36 | 7.89 | 6.74 |

| Dec. | 7.57 | 7.18 | 7.99 | 10.23 |

Lumen Technologies forecast for this year

Lumen Technologies Stock Prediction for Oct 2024

An uptrend is forecast for this month with an optimal target price of $7.1288. Pessimistic: $6.70. Optimistic: $7.48

Lumen Technologies Stock Prediction for Nov 2024

An uptrend is forecast for this month with an optimal target price of $7.55653. Pessimistic: $7.36. Optimistic: $7.89

Lumen Technologies Stock Prediction for Dec 2024

An uptrend is forecast for this month with an optimal target price of $7.56862. Pessimistic: $7.18. Optimistic: $7.99

Lumen Technologies (LUMN) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 7.32 | 7.08 | 7.67 | 7.71 |

| Feb | 7.25 | 6.85 | 7.60 | 9.92 |

| Mar | 7.48 | 7.34 | 7.86 | 6.63 |

| Apr | 7.93 | 7.65 | 8.29 | 7.80 |

| May | 7.72 | 7.54 | 7.88 | 4.39 |

| Jun | 7.83 | 7.60 | 8.07 | 5.90 |

| Jul | 7.81 | 7.45 | 8.23 | 9.49 |

| Aug | 8.01 | 7.50 | 8.50 | 11.69 |

| Sep | 8.21 | 7.81 | 8.44 | 7.54 |

| Oct | 8.01 | 7.60 | 8.18 | 7.05 |

| Nov | 8.25 | 7.94 | 8.52 | 6.89 |

| Dec | 7.98 | 7.68 | 8.39 | 8.45 |

Lumen Technologies (LUMN) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 7.68 | 7.53 | 8.10 | 7.06 |

| Feb | 7.92 | 7.49 | 8.29 | 9.71 |

| Mar | 8.28 | 7.97 | 8.58 | 7.11 |

| Apr | 8.16 | 7.65 | 8.52 | 10.20 |

| May | 7.82 | 7.52 | 8.16 | 7.89 |

| Jun | 7.76 | 7.59 | 8.16 | 6.93 |

| Jul | 7.50 | 7.30 | 7.92 | 7.73 |

| Aug | 7.33 | 6.94 | 7.69 | 9.69 |

| Sep | 7.13 | 6.76 | 7.27 | 7.06 |

| Oct | 6.94 | 6.75 | 7.16 | 5.74 |

| Nov | 6.70 | 6.56 | 6.90 | 4.90 |

| Dec | 7.05 | 6.76 | 7.42 | 8.97 |

Lumen Technologies information and performance

P O BOX 4065, 100 CENTURYTEL DR, MONROE, LA, US

Market capitalization of the Lumen Technologies, Inc. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of LUMN shares in the company outstanding by the market price of one share.

EBITDA of Lumen Technologies is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.

Lumen Technologies (LUMN) stock dividend

Lumen Technologies last paid dividends on 08/29/2022. The next scheduled payment will be on 09/09/2022. The amount of dividends is $None per share. If the date of the next dividend payment has not been updated, it means that the issuer has not yet announced the exact payment. As soon as information becomes available, we will immediately update the data. Bookmark our portal to stay updated.

Last Split Date: 01/01/1970

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

For example, a 5: 1 ratio means that the value of one share will decrease 5 times, the total amount will increase 5 times. It is important to understand that this procedure does not change the capitalization of the company, as well as the total value of assets held in private hands.

Commentary

Lumen Technologies is engaging in a strategic debt exchange, a crucial move to manage its maturing liabilities, albeit with an impending increase in interest expenses. The financial maneuver, which involves swapping existing notes for new secured notes due by 2032, allows Lumen to ease short-term liquidity concerns. However, the additional $30-$35 million in annual interest expenses will inevitably weigh on the company’s earnings, potentially impacting profitability if lucrative revenue streams fail to materialize. For investors, the immediate effects may appear subdued, with a relatively stable stock price expected as these financial nuances settle.

Despite these pressures, Lumen also finds itself seated near potential growth avenues, driven by an AI boom and ongoing sales opportunities that promise future revenue streams. These opportunities may offset some financial burdens, though their contributions are not yet guaranteed. Meanwhile, although the prominence of secured debt holders poses a risk to the shrinking batch of unsecured note holders, the lessened competition from a smaller unsecured debt class could provide some relief. On average, these factors collectively suggest the company's stock might maintain a 'Neutral' trend, balancing out as it navigates financial restructuring over the next month.