May 11, 2024 AppLovin Joins Elite 100% Return Club!

Nvidia Faces Macro Headwinds And Micro Tailwinds

Tesla: Challenges Remain Despite Improving Narrative

Amazon: Riding The AI Wave

Apple: Preparing For A Future-Defining WWDC

Microsoft: At The Forefront Of The AI Revolution

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Innovative Industrial Properties (IIPR) Stock Forecast for 2024–2028. Sell or Buy?

Updated: May 17, 2024 (08:42)

Sector: Real EstateThe share price of Innovative Industrial Properties, Inc. (IIPR) now

50/200 Day Moving Average: $100.57 / $89.05

This figure corresponds to the Average Price over the previous 50/200 days. For Innovative Industrial Properties stocks, the 50-day moving average is the support level today.

For Innovative Industrial Properties stocks, the 200-day moving average is the support level today.

Are you interested in Innovative Industrial Properties, Inc. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Innovative Industrial Properties stock price in 2024, 2025, 2026, 2027, 2028. How much will one Innovative Industrial Properties share be worth in 2024 - 2028?

When should I take profit in Innovative Industrial Properties stock? When should I record a loss on Innovative Industrial Properties stock? What are analysts' forecasts for Innovative Industrial Properties stock? What is the future of Innovative Industrial Properties stock? We forecast Innovative Industrial Properties stock performance using neural networks based on historical data on Innovative Industrial Properties stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Innovative Industrial Properties stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Innovative Industrial Properties shares. This happens once a day.

Historical and forecast chart of Innovative Industrial Properties stock

The chart below shows the historical price of Innovative Industrial Properties stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Innovative Industrial Properties stock price can be found in the table below.

Long-term forecasts by years.

The Future of IIPR Stocks: Understanding Key Influences

In the dynamic world of stock trading, forecasting the trajectory of Innovative Industrial Properties (IIPR) stock rates demands a nuanced understanding of the factors poised to shape its journey. Two pivotal events stand on the horizon, presenting both opportunities and challenges for IIPR stock forecasts.

Navigating the Winds of Change in Cannabis Legislation

Firstly, the potential rescheduling of cannabis to Schedule III is seen as a golden ray of hope for IIPR stock prices. This legislative change promises to bolster profitability and creditworthiness among cannabis operators by eliminating the burdensome Section 280E tax, saving operators an estimated 20% of their gross profit annually. This financial windfall could significantly enhance rent coverage for IIPR, marking a sizeable bullish catalyst for those contemplating whether IIPR is a good stock to buy.

On the flip side, the anticipated passage of the SAFER Banking Act could usher in fresh challenges. Should this act materialize, cannabis operators might find themselves swimming in more traditional financing options at lower costs. This threatens IIPR's sale-leaseback business model, potentially reducing rent and leading to defaults as operators seek escape from pricier leases. This scenario could depress the average rent for IIPR's properties, impacting its rental income and, by extension, rendering IIPR stock price prediction a more complex puzzle.

To accurately predict the future rates of IIPR stocks, analysts must keenly observe the unfolding of these legislative updates. By gauging their implications on IIPR's financial health and market position, investment decisions can be made with a higher confidence level. For those wrestling with the decision to buy or sell Innovative Industrial Properties stock, staying abreast of these developments will be crucial in navigating the undulating landscape of IIPR stock price targets.

- Rescheduling of cannabis to Schedule III

- The SAFER Banking Act

As the landscape for cannabis finance evolves, these factors will play critical roles in sculpting the IIPR stock forecast, guiding investors through a terrain ripe with both promise and peril.

Review the original Analysis

Predicting the Shifts: Navigating IIPR Stock's Future

When it comes to forecasting the IIPR stock rates, a keen analyst must consider key events and factors poised to significantly influence its trajectory. The rescheduling of marijuana as a Schedule III substance under federal law is a double-edged sword; it could enhance tenant cash flows, benefiting IIPR in the short term but also introduce fiercer competition in the industry. This potential increase in competition is a critical point for anyone involved in IIPR stock forecast activities and looking to buy or sell Innovative Industrial Properties stock.

Understanding IIPR's Challenges and Opportunities

In addition, the expected slowdown in IIPR's growth trajectory is a significant consideration. Analysts predicting the IIPR stock price prediction must weigh the impact of a decelerated expansion on the company's valuation. Investors eyeing the IIPR stock price target must remain cautious of management's past tendency towards share dilution, which has historically affected share value and could influence whether IIPR is a good stock to buy.

To craft the most accurate IIPR stock forecast, analysts should prioritize these factors:

- Anticipated slowdown in growth and its implications on stock valuation.

- The potential dilution of shares affecting investor sentiment.

- Impact of federal rescheduling of marijuana and its dual effects on the industry landscape.

By carefully evaluating these dynamics, financial professionals can offer more grounded IIPR stock buy or sell recommendations, navigating through the complexities to predict future stock price movements with greater precision.

Review the original Analysis

Unveiling IIPR's Future: Key Influences on Stock Movements

When predicting the trajectory of Innovative Industrial Properties' (IIPR) stock, a sharp look into the future reveals a couple of groundbreaking events poised to shift its rates. At the heart of this analysis are the DEA's rescheduling of marijuana to Schedule III and the lurking presence of the SAFER Banking Act. These events could revolutionize IIPR's operational landscape, hence influencing its stock forecast.

Predictive Insights: Navigating IIPR's Valuation Waters

The DEA's rescheduling symbolizes a brighter future for IIPR, enhancing tenant profitability through potential tax deductions. This pivotal move could potentially improve the Innovative Industrial Properties stock forecast, presenting buy signals for the eagle-eyed analyst. However, a storm brews on the horizon with the SAFER Banking Act. Should mainstream banking doors fling open for marijuana producers, IIPR's unique financing model could face unprecedented challenges, evoking a sell sentiment amid forecasting debates. This leads observers to ponder, is IIPR a good stock to buy?

Complicating matters further is IIPR's stretched valuation. The delicate balance between an IIPR stock price target buoyed by DEA optimism and pressures from potential banking reforms is a tightrope walk. Analysts aiming for the most accurate predictions must juggle these influential factors, deciphering their combined effects on IIPR stock price predictions.

The crux of forging a reliable IIPR stock forecast leans heavily on understanding these dynamics. As the industry treads changing tides, deciding whether to buy or sell Innovative Industrial Properties stock requires a nuanced, informed approach, factoring in the unpredictability of legislative impacts and market valuations.

Review the original Analysis

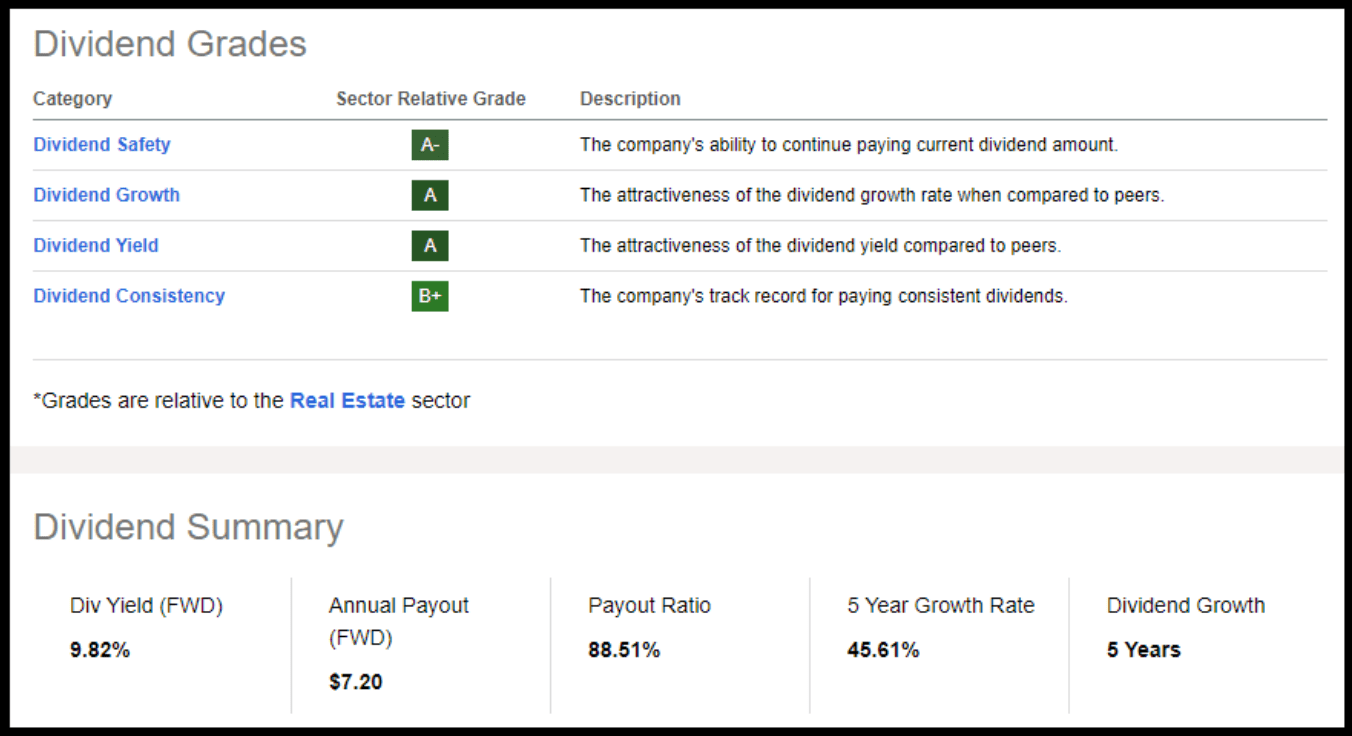

Innovative Industrial Properties Inc., an industrial REIT that caters to operators of regulated cannabis facilities with a valid state license, could be a smart pick if you’re in for buying when prices drop. This ‘strong buy’ recommendation holds its ground thanks to consistently paying dividends despite a decline in its stock price, solid financials, favorable valuations and an upward trend in earnings revision.

Changes in monetary policy have dealt harsh blows to a range of sectors and industries, including real estate. Despite these challenges which include rising interest rates, analyst downgrades and broader economic headwinds, Innovative Industrial Properties still stands strong as a quant-rated ‘buy’. The stock has taken a hit, falling 23% YTD. However, its impressive dividend growth coupled with an upcoming 9.82% dividend yield makes it extremely attractive as we expect REITs to recover.

Innovative Industrials (IIPR) really stands out due to its impressive cash flow, remarkable growth, and the ability to uphold its dividend scorecard from the solid profitability it maintains. What’s noteworthy is that it boasts a healthy revenue influx and an advance in Adjusted Funds from Operations (AFFO) Growth which are a whole 141.12% greater compared to other businesses in the same sector.

Thanks to its hefty cash reserves, IIPR can proudly sustain its dividend and report a nearly 30% Compound Annual Growth Rate (CAGR) in dividends over the past three years. Also, it’s interesting that the company’s stock is trading below its peak price from the past year. This makes Innovative Industrials quite an attractive option given its forward Price to AFFO ratio stands at 9.14x, which is a 31% lower rate compared to other companies in this industry.

The cherry on top? The company’s Total Debt-to-Capital ratio for the trailing 12 months is astoundingly lower by -73.23% than its industry peers! Meaning, it has very little debt on its shoulders. Plus, IIPR focuses mostly on industrial properties, which don’t have much overhead costs; hence it’s able to keep expenses low—a smart strategy indeed!

Innovative Industrial Properties daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May 19 | 113.93 | 112.68 | 114.87 | 1.94 |

| May 20 | 113.25 | 112.32 | 114.38 | 1.84 |

| May 21 | 113.68 | 112.86 | 114.54 | 1.49 |

| May 22 | 112.68 | 111.24 | 114.46 | 2.90 |

| May 23 | 114.26 | 113.30 | 115.69 | 2.12 |

| May 24 | 115.19 | 114.57 | 116.62 | 1.79 |

| May 25 | 114.71 | 113.35 | 116.45 | 2.73 |

| May 26 | 113.88 | 112.58 | 115.70 | 2.77 |

| May 27 | 114.63 | 113.24 | 116.19 | 2.61 |

| May 28 | 114.31 | 113.12 | 115.46 | 2.06 |

| May 29 | 115.09 | 114.45 | 115.55 | 0.97 |

| May 30 | 115.14 | 113.82 | 115.87 | 1.80 |

| May 31 | 115.97 | 114.48 | 116.43 | 1.70 |

| Jun 01 | 118.15 | 117.22 | 118.62 | 1.19 |

| Jun 02 | 116.99 | 116.22 | 118.67 | 2.11 |

| Jun 03 | 116.40 | 115.89 | 117.54 | 1.43 |

| Jun 04 | 117.10 | 115.51 | 117.73 | 1.93 |

| Jun 05 | 118.44 | 117.87 | 119.60 | 1.47 |

| Jun 06 | 118.79 | 117.94 | 120.48 | 2.16 |

| Jun 07 | 116.68 | 116.12 | 118.05 | 1.67 |

| Jun 08 | 117.33 | 115.85 | 118.95 | 2.67 |

| Jun 09 | 116.44 | 115.79 | 117.77 | 1.71 |

| Jun 10 | 116.93 | 115.85 | 117.49 | 1.41 |

| Jun 11 | 116.02 | 114.32 | 117.64 | 2.90 |

| Jun 12 | 116.46 | 115.55 | 117.39 | 1.59 |

| Jun 13 | 117.34 | 115.58 | 118.63 | 2.64 |

| Jun 14 | 116.45 | 115.94 | 117.96 | 1.75 |

| Jun 15 | 115.77 | 114.64 | 116.79 | 1.88 |

| Jun 16 | 113.46 | 111.89 | 114.98 | 2.76 |

| Jun 17 | 112.12 | 111.65 | 112.82 | 1.04 |

Innovative Industrial Properties Daily Price Targets

Innovative Industrial Properties Stock Forecast 05-19-2024.

Forecast target price for 05-19-2024: $113.93.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 1.905%.

Pessimistic target level: 112.68

Optimistic target level: 114.87

Innovative Industrial Properties Stock Forecast 05-20-2024.

Forecast target price for 05-20-2024: $113.25.

Negative dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 1.803%.

Pessimistic target level: 112.32

Optimistic target level: 114.38

Innovative Industrial Properties Stock Forecast 05-21-2024.

Forecast target price for 05-21-2024: $113.68.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 1.468%.

Pessimistic target level: 112.86

Optimistic target level: 114.54

Innovative Industrial Properties Stock Forecast 05-22-2024.

Forecast target price for 05-22-2024: $112.68.

Negative dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 2.815%.

Pessimistic target level: 111.24

Optimistic target level: 114.46

Innovative Industrial Properties Stock Forecast 05-23-2024.

Forecast target price for 05-23-2024: $114.26.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 2.074%.

Pessimistic target level: 113.30

Optimistic target level: 115.69

Innovative Industrial Properties Stock Forecast 05-24-2024.

Forecast target price for 05-24-2024: $115.19.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 1.759%.

Pessimistic target level: 114.57

Optimistic target level: 116.62

IIPR (IIPR) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jun. | 121.90 | 117.40 | 130.57 | 10.08 |

| Jul. | 125.96 | 121.09 | 128.23 | 5.57 |

| Aug. | 122.45 | 113.63 | 126.08 | 9.88 |

| Sep. | 121.57 | 117.52 | 126.16 | 6.85 |

| Oct. | 114.56 | 112.50 | 117.35 | 4.13 |

| Nov. | 115.59 | 110.60 | 121.73 | 9.14 |

| Dec. | 124.75 | 119.36 | 127.33 | 6.26 |

Innovative Industrial Properties forecast for this year

Innovative Industrial Properties Stock Prediction for Jun 2024

An uptrend is forecast for this month with an optimal target price of $121.902. Pessimistic: $117.40. Optimistic: $130.57

Innovative Industrial Properties Stock Prediction for Jul 2024

An uptrend is forecast for this month with an optimal target price of $125.961. Pessimistic: $121.09. Optimistic: $128.23

Innovative Industrial Properties Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $122.447. Pessimistic: $113.63. Optimistic: $126.08

Innovative Industrial Properties Stock Prediction for Sep 2024

An downtrend is forecast for this month with an optimal target price of $121.565. Pessimistic: $117.52. Optimistic: $126.16

Innovative Industrial Properties Stock Prediction for Oct 2024

An downtrend is forecast for this month with an optimal target price of $114.563. Pessimistic: $112.50. Optimistic: $117.35

Innovative Industrial Properties Stock Prediction for Nov 2024

An uptrend is forecast for this month with an optimal target price of $115.594. Pessimistic: $110.60. Optimistic: $121.73

Innovative Industrial Properties Stock Prediction for Dec 2024

An uptrend is forecast for this month with an optimal target price of $124.749. Pessimistic: $119.36. Optimistic: $127.33

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 126.55 | 122.45 | 134.18 | 8.74 |

| Feb | 124.84 | 117.53 | 132.25 | 11.13 |

| Mar | 133.15 | 128.84 | 140.46 | 8.28 |

| Apr | 135.91 | 133.46 | 142.51 | 6.35 |

| May | 133.46 | 125.17 | 140.79 | 11.09 |

| Jun | 140.43 | 131.33 | 145.23 | 9.57 |

| Jul | 134.99 | 130.86 | 139.85 | 6.43 |

| Aug | 138.52 | 131.41 | 143.75 | 8.59 |

| Sep | 150.61 | 145.05 | 153.59 | 5.56 |

| Oct | 164.16 | 155.74 | 168.89 | 7.79 |

| Nov | 160.32 | 155.42 | 167.83 | 7.39 |

| Dec | 160.03 | 150.82 | 171.56 | 12.09 |

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 160.47 | 156.86 | 164.65 | 4.74 |

| Feb | 150.36 | 144.94 | 157.12 | 7.75 |

| Mar | 154.01 | 147.22 | 158.86 | 7.33 |

| Apr | 155.12 | 145.77 | 164.89 | 11.60 |

| May | 160.01 | 151.65 | 169.80 | 10.69 |

| Jun | 165.62 | 154.74 | 175.61 | 11.88 |

| Jul | 164.43 | 160.43 | 167.69 | 4.32 |

| Aug | 167.83 | 161.64 | 178.10 | 9.24 |

| Sep | 163.15 | 156.40 | 173.72 | 9.97 |

| Oct | 148.91 | 138.19 | 152.12 | 9.16 |

| Nov | 137.11 | 130.45 | 140.08 | 6.87 |

| Dec | 127.37 | 119.91 | 135.96 | 11.80 |

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 125.53 | 123.05 | 132.20 | 6.92 |

| Feb | 132.88 | 124.98 | 136.58 | 8.49 |

| Mar | 135.75 | 127.19 | 141.37 | 10.03 |

| Apr | 133.55 | 129.58 | 140.64 | 7.86 |

| May | 140.40 | 137.24 | 148.48 | 7.57 |

| Jun | 149.75 | 140.58 | 155.81 | 9.77 |

| Jul | 159.32 | 151.72 | 166.77 | 9.03 |

| Aug | 152.86 | 146.54 | 158.09 | 7.31 |

| Sep | 154.51 | 151.32 | 163.28 | 7.32 |

| Oct | 141.16 | 138.12 | 144.34 | 4.31 |

| Nov | 141.55 | 137.47 | 144.99 | 5.18 |

| Dec | 139.38 | 133.99 | 142.89 | 6.23 |

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 133.23 | 127.60 | 140.19 | 8.98 |

| Feb | 144.98 | 140.55 | 150.07 | 6.35 |

| Mar | 149.55 | 143.90 | 158.97 | 9.48 |

| Apr | 143.23 | 134.33 | 149.28 | 10.02 |

| May | 142.84 | 134.61 | 146.70 | 8.24 |

| Jun | 144.90 | 135.51 | 153.63 | 11.80 |

| Jul | 148.03 | 142.96 | 154.95 | 7.74 |

| Aug | 150.82 | 140.37 | 158.83 | 11.62 |

| Sep | 140.24 | 135.69 | 148.31 | 8.51 |

| Oct | 146.42 | 141.41 | 150.64 | 6.12 |

| Nov | 137.72 | 129.05 | 144.54 | 10.72 |

| Dec | 132.14 | 125.96 | 135.71 | 7.19 |

Innovative Industrial Properties information and performance

1389 CENTER DRIVE, SUITE 200, PARK CITY, UT, US

Market capitalization of the Innovative Industrial Properties, Inc. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of IIPR shares in the company outstanding by the market price of one share.

EBITDA of Innovative Industrial Properties is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.

Innovative Industrial Properties (IIPR) stock dividend

Innovative Industrial Properties last paid dividends on 03/27/2024. The next scheduled payment will be on 04/15/2024. The amount of dividends is $7.24 per share. If the date of the next dividend payment has not been updated, it means that the issuer has not yet announced the exact payment. As soon as information becomes available, we will immediately update the data. Bookmark our portal to stay updated.

Last Split Date: 01/01/1970

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

For example, a 5: 1 ratio means that the value of one share will decrease 5 times, the total amount will increase 5 times. It is important to understand that this procedure does not change the capitalization of the company, as well as the total value of assets held in private hands.