July 14, 2024 This Week Top S&P 500 Gainers & Losers

Tesla Q2: The Bottom Is Likely In

Tesla: Time To Take Profits

Microsoft: The Q4 Results Should Surprise You

Tesla: Optimus And FSD Probably Won’t Save The Day

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

VALE Stock News and Mentions of Vale S.A. Stocktwits

VALE Stock News and Mentions of Vale S.A. Stocktwits

Updated: July 26, 2024 (09:13)

Sector: Basic materials

Welcome to PandaPulse, innovative analytical stock market observer, where the latest news and stocktwits meets in-depth investor relations insights. Dive into our real-time sentiment analysis to gauge the mood of the markets and arm yourself with key information that resonates with both savvy investors and casual traders.

We meticulously analyze the sentiment trend in each article for the last 60 days where Vale S.A. Company is mentioned. We assess its relevance and importance to carry out an overall sentiment valuation of Vale S.A. (VALE).

You can view the trend designation for each individual article below. We use this data to compile indicators into one comprehensive sentiment value, which represents the current information agenda about the Vale S.A. stocks.

News and Mentions of Vale S.A. (VALE)

VALE S.A. ( VALE ) Stock Moves -0.09%: What You Should Know

VALE S.A. ( VALE ) is Attracting Investor Attention: Here is What You Should Know

Here's What You Should Know Ahead of VALE's Q2 Earnings

VALE's Q2 Iron Ore Output Up 2% Y/Y, Copper and Nickel Lags

Do Options Traders Know Something About Vale ( VALE ) Stock We Don't?

VALE S.A. ( VALE ) Stock Moves -0.7%: What You Should Know

S&P Global To Rally More Than 13%? Here Are 10 Top Analyst Forecasts For Friday

Why VALE S.A. ( VALE ) Outpaced the Stock Market Today

VALE S.A. ( VALE ) Suffers a Larger Drop Than the General Market: Key Insights

VALE S.A. ( VALE ) Rises As Market Takes a Dip: Key Facts

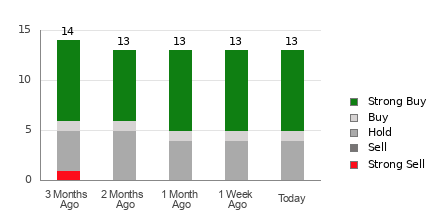

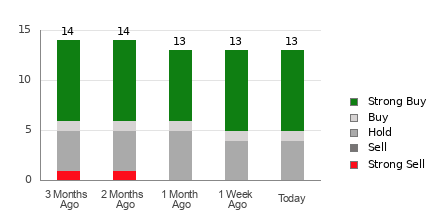

Brokers Suggest Investing in VALE ( VALE ) : Read This Before Placing a Bet

VALE S.A. ( VALE ) Laps the Stock Market: Here's Why

VALE S.A. ( VALE ) Gains As Market Dips: What You Should Know

VALE S.A. ( VALE ) Stock Sinks As Market Gains: Here's Why

Wall Street Bulls Look Optimistic About VALE ( VALE ) : Should You Buy?