May 1, 2024 Inflation Persistence: No Fed Rate Cuts in Sight

April 29, 2024 Tesla, Baidu Join Forces for Self-Driving Tech in China

April 27, 2024 Alphabet and Microsoft’s AI Investments Yield Strong Returns

April 26, 2024 Top 10 High Dividend Yield Stocks

Amazon Q1 Review: Best Of Big Tech Bunch

Tesla: The Thesis Is Stronger Than Ever

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

OXY Stock News and Mentions of Occidental Petroleum Corp. Stocktwits

OXY Stock News and Mentions of Occidental Petroleum Corp. Stocktwits

Updated: May 1, 2024 (09:15)

Sector: Energy

Welcome to PandaPulse, innovative analytical stock market observer, where the latest news and stocktwits meets in-depth investor relations insights. Dive into our real-time sentiment analysis to gauge the mood of the markets and arm yourself with key information that resonates with both savvy investors and casual traders.

We meticulously analyze the sentiment trend in each article for the last 60 days where Occidental Petroleum Company is mentioned. We assess its relevance and importance to carry out an overall sentiment valuation of Occidental Petroleum Corp. (OXY).

You can view the trend designation for each individual article below. We use this data to compile indicators into one comprehensive sentiment value, which represents the current information agenda about the Occidental Petroleum stocks.

News and Mentions of Occidental Petroleum Corp. (OXY)

Occidental Petroleum's Options Frenzy: What You Need to Know - Occidental Petroleum ( NYSE:OXY )

Earnings Preview: PHX Minerals ( PHX ) Q1 Earnings Expected to Decline

Berry Petroleum ( BRY ) Lags Q1 Earnings Estimates

ONEOK ( OKE ) Q1 Earnings & Revenues Fall Shy of Estimates

Diamondback Energy, Top Permian Basin Producer, Reports 16% Revenue Growth Amid 30% Run

Analysts Estimate Occidental Petroleum ( OXY ) to Report a Decline in Earnings: What to Look Out for

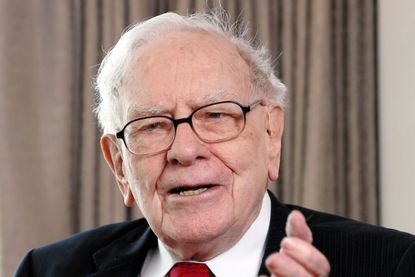

3 Reasons to Buy Occidental Petroleum ( and Warren Buffett Isn't 1 of Them )

Jim Cramer Says Tesla Stock Will 'Keep Running Until All Shorts Are Crushed,' Praises Elon Musk's China FSD Deal As 'Perfect Example Of Redefining Narrative' - Tesla ( NASDAQ:TSLA )

Are You a Momentum Investor? This 1 Stock Could Be the Perfect Pick

Meta's Chief AI Scientist Reveals Mark Zuckerberg Was 'Snubbed' From Biden's AI Safety Institute; Elon Musk Also Missing From The List - Meta Platforms ( NASDAQ:META )

3 BNY Mellon Mutual Funds for Reliable Returns

This Billionaire Is Pounding the Table For These Ultra-High-Yield Dividend Stocks

Prediction: This Will Be Warren Buffett's Second Biggest Holding After Apple by 2027

Meet the 8 Phenomenal Stocks Warren Buffett Plans to Hold Forever

If You'd Invested $250 in Occidental Petroleum 4 Years Ago, Here's How Much You'd Have Today

ExxonMobil: Buy, Sell, or Hold?

More Than a Quarter of Billionaire Carl Icahn's Portfolio Is In These 3 Energy Stocks

Is It Too Late to Buy Berkshire Hathaway Stock?

Biden's Homeland Security team taps tech elite for AI defense board

Tech CEOs Altman, Nadella, Pichai and others join government AI safety board led by DHS' Mayorkas

TotalEnergies ( TTE ) Q1 Earnings Beat Estimates, Sales Down Y/Y

Occidental Petroleum ( OXY ) Gains As Market Dips: What You Should Know

Occidental Petroleum ( OXY ) Stock Dips While Market Gains: Key Facts

Spotlight on Occidental Petroleum: Analyzing the Surge in Options Activity - Occidental Petroleum ( NYSE:OXY )

What's in Berkshire Hathaway's Portfolio? Here's a Quick Rundown.

Best Energy Stocks To Invest In Now? 3 To Know

What the Options Market Tells Us About Occidental Petroleum - Occidental Petroleum ( NYSE:OXY )

3 Energy Stocks to Buy Pre Earnings

Alphabet To Rally Around 14%? Here Are 10 Top Analyst Forecasts For Monday - Alcoa ( NYSE:AA ) , Accolade ( NASDAQ:ACCD )

3 Energy Stocks to Sell Before Oil Prices Stall

Looking for Once-in-a-Generation Investment Opportunities? Here Are 3 Magnificent Stocks to Buy Right Now

Meet the Surprising Oil Stock Lawmakers Couldn't Stop Buying in 2023 ( Hint: It's Not Chevron or ExxonMobil )

Chevron the Venture Capitalist: The Oil Giant Is Pumping $500 Million Into the Future of Energy

Warren Buffett Has Over $10 Billion Invested in 7 Stocks. Here's the Best Stock to Buy Right Now, According to Wall Street.

Why the Market Dipped But Occidental Petroleum ( OXY ) Gained Today

Is Most-Watched Stock Occidental Petroleum Corporation ( OXY ) Worth Betting on Now?

Looking At Occidental Petroleum's Recent Unusual Options Activity - Occidental Petroleum ( NYSE:OXY )

Bank of America Just Predicted $95 Oil. 3 Oil Stocks to Buy Now

3 Warren Buffett Stocks to Buy Hand Over Fist

How Iran's Attack Against Israel Will Impact Gas Prices You Pay At The Pump - Occidental Petroleum ( NYSE:OXY ) , Chevron ( NYSE:CVX )

Warren Buffett Could Have Bought Any of 378 S&P 500 Companies With $74 Billion. Instead, He Piled It All Into 1 Beloved Stock

Want $1 Million in Retirement? 3 Stocks to Buy Now and Hold for Decades.

Occidental Petroleum ( OXY ) Stock Moves -0.36%: What You Should Know

Intel, JPMorgan Take Heat In Dow Jones; Oil Spikes, Here's Why

Oil Price Forecast: Production Cuts and Geopolitical Tensions

Will This Technical Hurdle End Exxon Mobil's Longest Advance In 17 Years?

Energy stocks are hot again. The rally could have more fuel to burn | Business

Here Are All 27 of Warren Buffett's Billion-Dollar Bets in Berkshire Hathaway's $370 Billion Portfolio

Berkshire Hathaway Is Great. Here's Why You Shouldn't Buy It.

Pipeline Company Offers 6.5% Yield And Rising Profit Estimates

Warren Buffett Is Making a Once-in-a-Generation Bet on 2 Stocks. Should You?

Occidental Petroleum Sees RS Rating Improve To 74

Smart Money Is Betting Big In OXY Options - Occidental Petroleum ( NYSE:OXY )

Why Billionaire Bill Gross Loves These 3 High-Yield Dividend Stocks

Occidental Petroleum ( OXY ) Stock Drops Despite Market Gains: Important Facts to Note

This Vanguard ETF Is a No-Brainer Buy Right Now

Occidental Petroleum Sees IBD RS Rating Climb To 72

What To Watch As First-Quarter 2024 Earnings Season Begins

If You Like Vanguard's Largest Value Fund, Then You'll Love These 2 ETFs

Murphy USA and Capri have been highlighted as Zacks Bull and Bear of the Day

The Zacks Analyst Blog Highlights Berkshire Hathaway, NVIDIA, Bank of America, Occidental Petroleum and Chevron

3 Stocks Poised to Benefit From US Clean Energy Transition

Oil Prices Holds Above $85 As Israel Braces For Iran Response

Joe Biden's Election Odds At Risk From Rising Oil Prices, Scolds Ukraine For Attacking Russian Oil While US Supply Set To Dip - Occidental Petroleum ( NYSE:OXY ) , JPMorgan Chase ( NYSE:JPM )

2 Beloved Warren Buffett Stocks to Watch on Rise in Oil Prices

3 Warren Buffett Stocks to Buy Hand Over Fist in April

Warren Buffett Owns 21,000 Miles of Energy Pipelines. Want to Invest Like Him? Buy This High-Yield Midstream Stock

Occidental Petroleum ( OXY ) Outpaces Stock Market Gains: What You Should Know

The Best Warren Buffett Stocks to Buy With $100 Right Now

Warren Buffett's Favorite Stock Nears Buy Point As Oil Eyes $90

This Warren Buffett Stock Just Got a Vote of Confidence From a Key Rival. Is It a Buy?

A Closer Look at Occidental Petroleum's Options Market Dynamics - Occidental Petroleum ( NYSE:OXY )

Occidental Petroleum Corporation ( OXY ) is Attracting Investor Attention: Here is What You Should Know

3 Stocks Warren Buffett Plans to Hold Forever That Still Look Like Great Buys Today

Interested in Occidental Petroleum? Check Out This Oil Stock First.

1 Stock That Could Outperform the S&P 500 With Less Risk, According to Warren Buffett

Is It Safe to Buy Stocks With the S&P 500 at a Record High? Warren Buffett's Advice Could Save Investors From Costly Mistakes

Buying These 3 Beaten-Down High-Yield, Dividend Stocks Could Be a Genius Move to Boost Your Passive Income

The Best Warren Buffett Stocks to Buy With $300 Right Now

Warren Buffett Is Raking In $4.36 Billion in Annual Dividend Income From These 5 Stocks

These 2 Oils and Energy Stocks Could Beat Earnings: Why They Should Be on Your Radar

Vast Renewables Limited Announces Operational and Financial Results for First Half of Fiscal 2024

Occidental Petroleum ( OXY ) Surpasses Market Returns: Some Facts Worth Knowing

SAP BrandVoice: Oil & Gas Trends 2024: Making Sustainable Business More Sustainable

This Famous Billionaire Investor Likes This Relatively Unknown Ultra-High-Yield Dividend Stock

What the Options Market Tells Us About Occidental Petroleum - Occidental Petroleum ( NYSE:OXY )

Why Bill Gates Reckons Houston May Become The 'Silicon Valley Of Energy'

Three Dividends Up To 7% With Big Insider Buying

Warren Buffett's Berkshire Hathaway Owns Over 25% of These 4 Companies ( Hint: Apple Isn't One of Them )

Berkshire Hathaway's Beating the Market, But Its Biggest Holdings Aren't. What Gives?

Marathon Oil ( MRO ) Up 13.4% Since Last Earnings Report: Can It Continue?

The Oil Market's Massive M&A Wave Has Devon Energy on the Outside Still Looking for a Deal

Occidental Petroleum ( OXY ) Stock Sinks As Market Gains: What You Should Know

CTO Realty ( CTO ) Sells Mixed-Use Asset to Boost Core Properties

Chevron Is Following Leaders ExxonMobil and Occidental Petroleum to Capture This $5 Trillion Potential Opportunity

Warren Buffett Is Loading Up on This High-Yield Dividend Stock. Here's Why I Am Too.

Texas pulls $8.5B from BlackRock in stunning blow to ESG movement

Occidental Petroleum Corporation ( OXY ) is Attracting Investor Attention: Here is What You Should Know

What the Options Market Tells Us About Occidental Petroleum - Occidental Petroleum ( NYSE:OXY )

2 Warren Buffett Stocks to Buy Hand Over Fist in March

New Clues Strongly Suggest This Is the "Confidential Stock" Warren Buffett Has Been Buying

Carbon Capture and Storage market size to increase by 104.5 million T between 2022 to 2027, Air Products and ... - PR Newswire

This High-Yield Dividend Stock Has Big Plans for Rewarding Its Shareholders

U.S. Oil Companies Produced More Oil Than any Country in History Last Year. Here Are 3 Top Oil Stocks to Buy Now

Why I Just Bought This High-Yield Dividend Stock ( Hint: The $4 Trillion Market It's Targeting Is a Big Factor )

Occidental Petroleum ( NYSE:OXY ) Upgraded to Hold at StockNews.com

Why Is Occidental ( OXY ) Up 4.1% Since Last Earnings Report?

Is Chevron Stock Going to $180? 1 Wall Street Analyst Thinks So.

Occidental Petroleum's Options Frenzy: What You Need to Know - Occidental Petroleum ( NYSE:OXY )

CTO Realty ( CTO ) Sees Healthy Leasing Activity Year to Date

CTO Realty Growth Provides Year-To-Date Leasing Update

CTO Realty Growth Provides Year-To-Date Leasing Update - Alpine Income Prop Trust ( NYSE:PINE ) , CTO Realty Growth ( NYSE:CTO )

Warren Buffett Has Bought Shares of This Stock for 22 Consecutive Quarters -- and It's Not Apple or Occidental

Permian M&A Has Plenty of Room to Run. Expect More Oil Consolidation.

6 Dividend Stocks Make Up 78.4% of Warren Buffett's $370 Billion Portfolio, and They Are All Cheaper Than the S&P 500

Prediction: This Warren Buffett Stock Will Be the Next Trillion-Dollar Company

Forget Occidental Petroleum: 2 Better Oil Stocks to Buy Now

Berkshire Hathaway's Latest

Warren Buffett's Main Investing Focus Right Now -- and How It Could Make Him Billions

Warren Buffett owns 2 ETFs-this one is better for everyday investors, experts say

78% of Warren Buffett's $369 Billion Portfolio Is Invested in Just 6 Stocks

Warren Buffett Stocks: Analyzing The Berkshire Hathaway Portfolio

Best Warren Buffett Stocks To Buy And Hold In 2024

Occidental Petroleum Corporation ( OXY ) Is a Trending Stock: Facts to Know Before Betting on It

A Closer Look at Occidental Petroleum's Options Market Dynamics - Occidental Petroleum ( NYSE:OXY )

Here's Why Warren Buffett-Led Berkshire Hathaway Has Held These 2 Dow Dividend Stocks for Over 30 Years

Here's Why Warren Buffett-Led Berkshire Hathaway Doesn't Want to Own 100% of Occidental Petroleum Stock

Warren Buffett's Latest $2.1 Billion Buy Brings His Total Investment in This Stock to More Than $74 Billion in Under 6 Years

Warren Buffett Loves Occidental Petroleum for a Reason That's Not Showing Up in the Numbers -- Yet