May 11, 2024 AppLovin Joins Elite 100% Return Club!

Microsoft: At The Forefront Of The AI Revolution

Amazon: Price Still Not Fully Justified

Amazon: Q1, 3 Major Implications For 2024

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

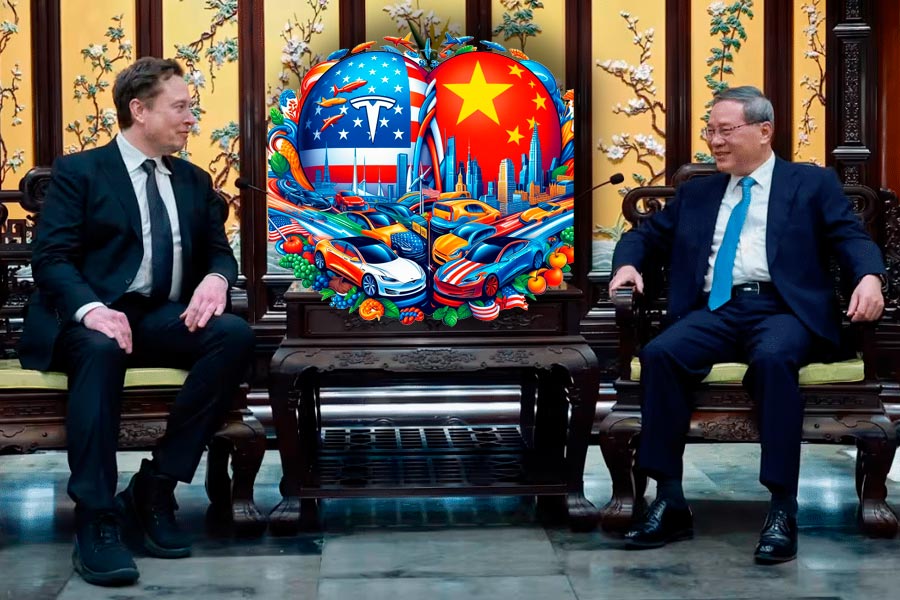

Tesla, Baidu Join Forces for Self-Driving Tech in China

April 29, 2024

Tesla is charging full steam ahead with its ambitious plan to roll out self-driving technology in China, securing a significant partnership with Baidu. As part of the agreement, Tesla will tap into Baidu’s coveted mapping license—essential for data collection on Chinese roads. Moreover, Baidu’s high-precision navigation expertise will strengthen Tesla’s self-driving endeavors in the area.

The stock market has responded positively to this news, with Tesla’s shares enjoying an approximate 8% boost in pre-market trading. Similarly, Baidu’s American Depositary Receipts (ADRs) saw a healthy rise, jumping about 6%. It’s interesting to note that Baidu’s navigation system has already been integrated into Tesla’s Chinese fleet.

Elon Musk Champions Tesla’s Entry into the Chinese Market

Elon Musk, the ever-driven CEO of Tesla, has been engaging with top Chinese officials, including Premier Li Qiang. This comes as Musk had to postpone a planned trip to India, opting instead to focus on Tesla’s priorities.

During his visit to China, Musk lobbied for approval to launch Tesla’s Full Self Driving (FSD) system and discussed the intricacies of transferring data gathered in China. This cross-border data flow is essential for perfecting Tesla’s self-driving software.

Keeping in line with China’s stringent data regulations, Tesla has been keeping all data collected in China within its borders since 2021, avoiding any transfer to its U.S. headquarters.

Navigating China’s Regulatory Maze for Data and Driving

China’s regulatory framework requires any driver assistance technology to secure a mapping service license before hitting the public roads—a rule that foreign companies like Tesla must comply with by partnering with a licensed local firm, such as Baidu. Getting this license is a crucial legal hurdle that will allow Tesla to activate its FSD technology in China, paving the way for vital data collection on road layouts and nearby structures. The nitty-gritty of who will own the amassed data—Tesla or Baidu—is still up in the air.

Outlook for Tesla’s Self-Driving Ambitions Amid China’s Evolving Market

Tesla is navigating a complex market environment in China, faced with cooling consumer interest and fierce competition from domestic electric vehicle brands.

Reacting to these market forces, Tesla recently slashed the cost of its Full Self Driving suite by a third, down to $8,000, in the U.S. Unleashing FSD in China is a bold strategic step for Tesla as it vies for dominance against local EV makers that are rapidly chipping away at its market dominance. Musk has alluded to a potential near-future release of FSD in China.

Industry commentators, like The Value Portfolio of Investing Group, suggest that while Tesla’s achievements have yet to align with its lofty market valuation, a successful FSD launch or a significant breakthrough elsewhere could prompt a major uptick in the company’s prospects.