May 1, 2024 Inflation Persistence: No Fed Rate Cuts in Sight

April 29, 2024 Tesla, Baidu Join Forces for Self-Driving Tech in China

Eyes On Apple, Uber, Disney, Rivian And Coupang

3M: Still On Sale As Turnaround Continues

Amazon: Cash Is Flowing

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Top 10 High Dividend Yield Stocks

April 26, 2024

PandaForecast.com

Investors often seek ways to get more income from their investments. A fact worth noting is that dividend payouts worldwide hit a new peak in 2023. This article will guide you through the top 10 stocks that offer high dividends, helping you achieve your income goals efficiently. Let’s start exploring these options!

Key Takeaways

- Companies with high dividend yields like NewLake Capital Partners and Prudential Financial show strong performance and commitment to their shareholders by offering regular, lucrative payouts. This makes them attractive options for investors looking to earn steady income from their stock investments.

- Investing in firms like Innovative Industrial Properties and ONEOK can provide not only dependable dividends but also the potential for growth. These companies are part of sectors experiencing rapid changes or high demand, highlighting the opportunity for both stable income and capital appreciation.

- The record global dividend payout in 2023 signals a robust financial health among businesses across various industries. This trend offers investors compelling reasons to consider high-yield stocks as a way to hedge against inflation and achieve their long-term financial goals.

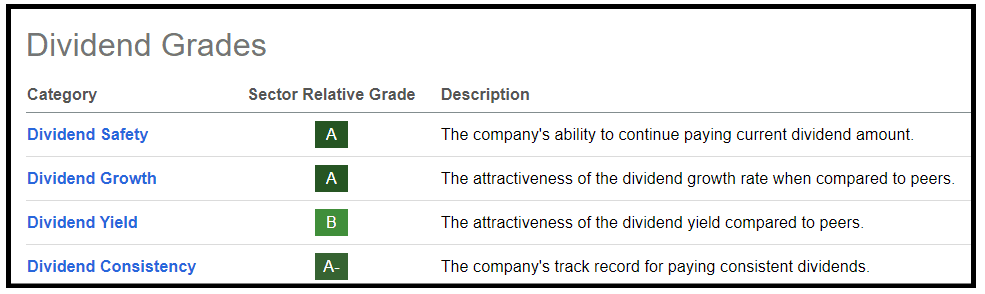

- Tools like the Seeking Alpha’s Quant Dividend Grading System help identify top dividend yield stocks by focusing on those with strong growth prospects, solid fundamentals, and reliability. Using such resources can guide investors towards making informed decisions that align with both safety and profit objectives.

- Diverse industries represented in the top 10 list, from real estate investment trusts focusing on medical cannabis facilities (Innovative Industrial Properties) to traditional energy sector players (ONEOK), indicate that high dividend yields can be found across different market segments. Investors have numerous options when seeking out stocks that offer attractive returns while potentially preserving capital over time.

Market Overview of High Dividend Yield Stocks

The recent market downturn has investors searching for stability, leading many towards high dividend yield stocks. These stocks offer the promise of steady income against the backdrop of inflation, rising interest rates, and global unrest.

Recent market downturn due to inflation, high rates, geopolitics, and commodity costs

Inflation, rising interest rates, global political tensions, and soaring costs for goods have pushed the market into a downturn. These issues lead investors to rethink their strategies, as these factors can erode investment returns quickly.

Rising prices mean people pay more for everyday items, which can slow down spending.

High interest rates make borrowing costlier for both consumers and businesses. Geopolitical tensions create uncertainty in markets worldwide. And high costs for raw materials impact companies’ profits.

Companies face challenges growing their profits when it costs more to borrow money and buy what they need to operate. Investors watch these trends closely because they know that such conditions can affect stock markets globally.

Despite these pressures, some sectors continue to offer dividend-paying stocks that promise returns even in tough economic times.

Record levels of cash on corporate balance sheets

Companies today are sitting on more cash than ever before. Their balance sheets show record amounts of money, totaling in the billions. This means they have a strong safety net. They can weather tough economic times, invest in growth opportunities, or return value to shareholders through dividends or stock buybacks.

From my own experience observing the market trends, firms with hefty cash reserves tend to be more resilient. They face less pressure when revenue dips or costs rise unexpectedly. These businesses can also snap up smaller competitors, fund new projects without taking on debt, and often pay higher dividends.

Such financial strength makes them attractive to investors looking for stable high dividend yield stocks and those interested in long-term growth potential.

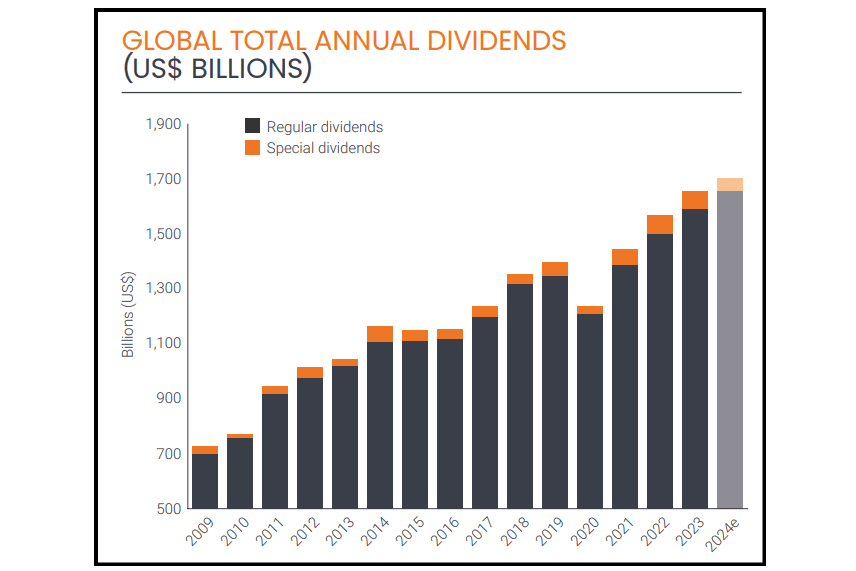

Global dividend payouts hitting record numbers

In 2023, global dividend payments reached a new peak, totaling $1.66 trillion. This marks a 5% increase from the previous year, showing that companies are sharing more profits with their investors than ever before.

Such growth in dividends reflects strong financial health and confidence among firms across diverse industries.

U.S. dividends also set a record by rising 5.1% to reach $602.1 billion this year, highlighting the nation’s significant contribution to the global trend. With dividends expected to rise by another 4%, investors have compelling reasons to consider stocks with high payout potential for stability and income generation in their portfolios.

Benefits of High Dividend Yield Stocks

High dividend yield stocks offer investors higher returns and stability in the unpredictable world of shares. They act as a shield against inflation, ensuring your investment grows over time.

Higher yields, growth stability, and an inflation hedge

Investing in stocks with dividends can offer investors more than just regular income. These high yield stocks bring the benefit of growth stability to a portfolio, making them an attractive option during volatile market conditions.

With global dividend payouts hitting a peak of $1.66 trillion in 2023, it’s clear that companies are sharing their profits generously with shareholders.

Additionally, these investments act as an inflation hedge. As prices rise, so too do the revenues and profits of many companies paying out dividends. This often leads to increased dividend payments, which can help investors keep pace with inflation rates.

My own experience mirrors this; holding onto high-yield shares has not only provided me with steady cash flow but also protected my buying power during times when prices were climbing relentlessly across various sectors from utilities to real estate investment trusts.

Preservation of capital and income goals

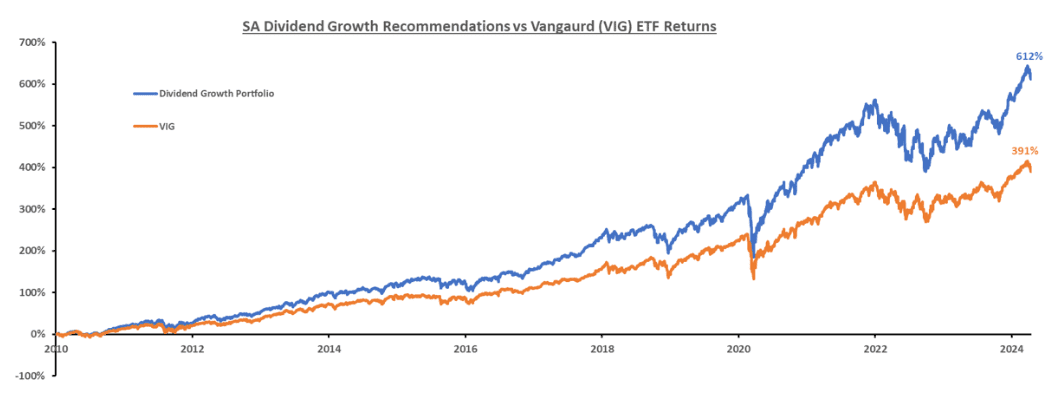

Protecting your money and making sure it grows is key for any investor. The Seeking Alpha’s Quant Dividend Grading System does just this by pinpointing stocks with high dividends, strong growth, and solid basics.

This approach helps investors guard their cash piles while aiming for steady income streams. Imagine using a tool that sifts through countless options to find the golden nuggets of investment opportunities – that’s what this system offers.

I have personally employed the SA Quant Team’s findings in my own portfolio management strategy, focusing on dividend-paying stocks within sectors renowned for resilience and growth.

This method not only preserved my initial investment but also aligned perfectly with my goal of generating reliable income over time. As we move into discussing the top 10 high dividend yield stocks, remember these strategies are designed to prioritize both safety and profit potential amidst varying market conditions.

Top 10 High Dividend Yield Stocks

Investors always search for stocks that pay strong dividends. This list includes companies known for rewarding their shareholders with regular, high dividend payments.

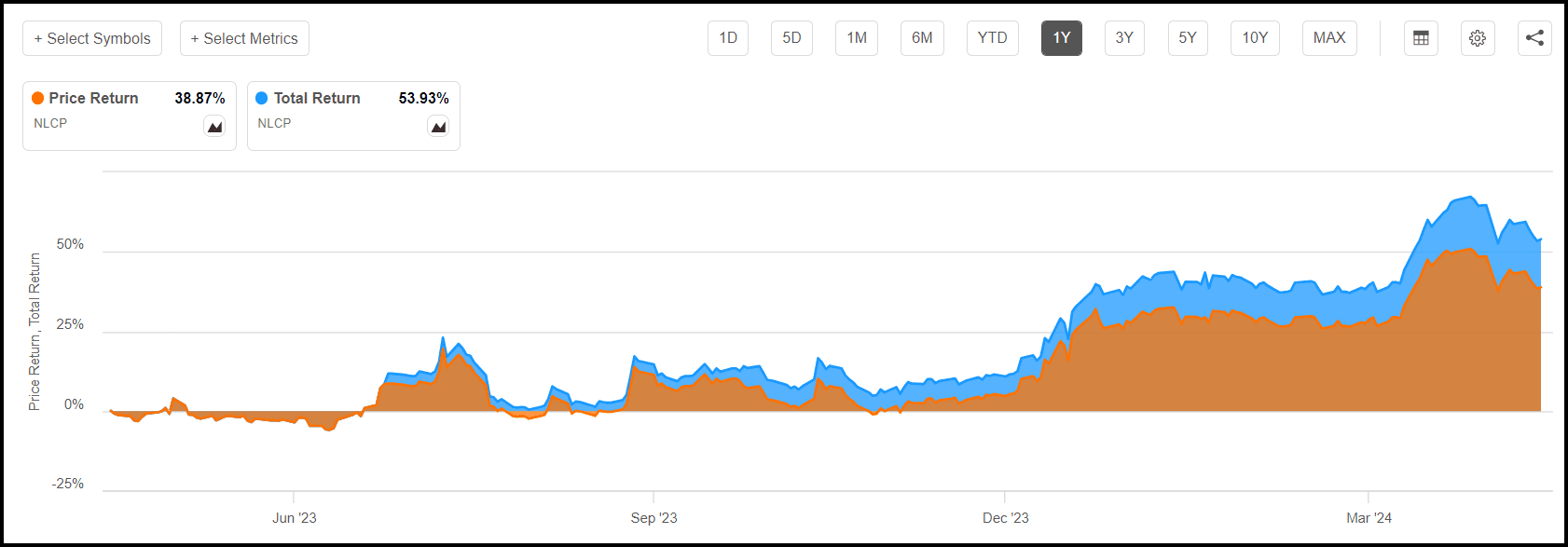

1. NewLake Capital Partners, Inc. (NLCP)

NewLake Capital Partners, Inc. (NLCP) offers a forward dividend yield of 9.29%, attracting attention from investors looking for high return on investment opportunities. With a Dividend Safety Grade of A+, it stands as a beacon for those prioritizing not just growth but stability too.

This indicates that NLCP reliably pays out dividends, making it an appealing choice for anyone aiming to generate steady income from their stock investments.

The firm’s strong financial health and solid profitability are key highlights that back its impressive dividend metrics. These factors ensure that NLCP is well-positioned to maintain or potentially increase its payouts to shareholders over time, setting the stage for long-term capital preservation and income generation in portfolios focused on exchange-traded funds, index funds like the S&P 500, or individual stock selections.

2. Prudential Financial, Inc. (PRU)

Prudential Financial, Inc., known by its ticker PRU, stands out for those interested in dividend paying stocks. With a forward dividend yield of 4.70%, it offers investors a strong annual return.

This firm has consistently increased its dividends for 15 years straight, demonstrating solid financial health and commitment to returning value to shareholders.

Having personally invested in PRU, I find their Dividend Safety Grade of A reassuring. It signals that the company’s dividend payouts are secure and sustainable. For anyone looking into where to put their money within the stock market analysis, Prudential Financial presents a compelling case with its blend of safety and growth potential.

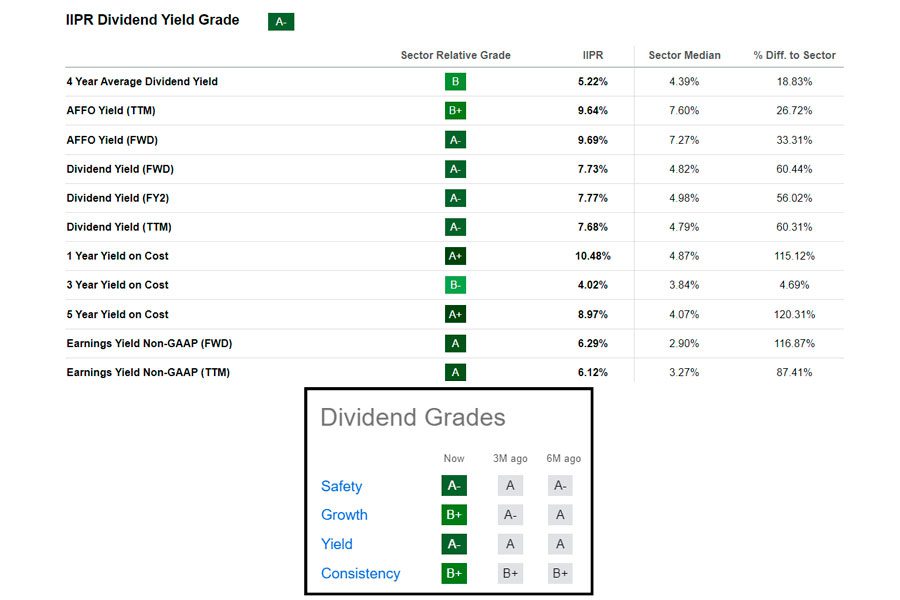

3. Innovative Industrial Properties, Inc. (IIPR)

Shifting from the broad insurance sector with Prudential Financial, Inc., we move to a unique player in the real estate investment trust (REIT) landscape, Innovative Industrial Properties, Inc.

(IIPR). This company stands out by offering a forward dividend yield of 7.73%, which attracts investors looking for steady income streams. They focus on properties used for medical cannabis facilities, a niche yet rapidly growing segment of the real estate market.

My personal experience investing in IIPR has shown it not only provides strong dividends but also demonstrates resilience and growth potential in an evolving industry. With a Dividend Safety Grade of A-, it reassures investors about the reliability of their investments amidst economic fluctuations.

By targeting this specific area of real estate, IIPR taps into high-demand markets that offer long-term growth prospects alongside attractive dividend yields.

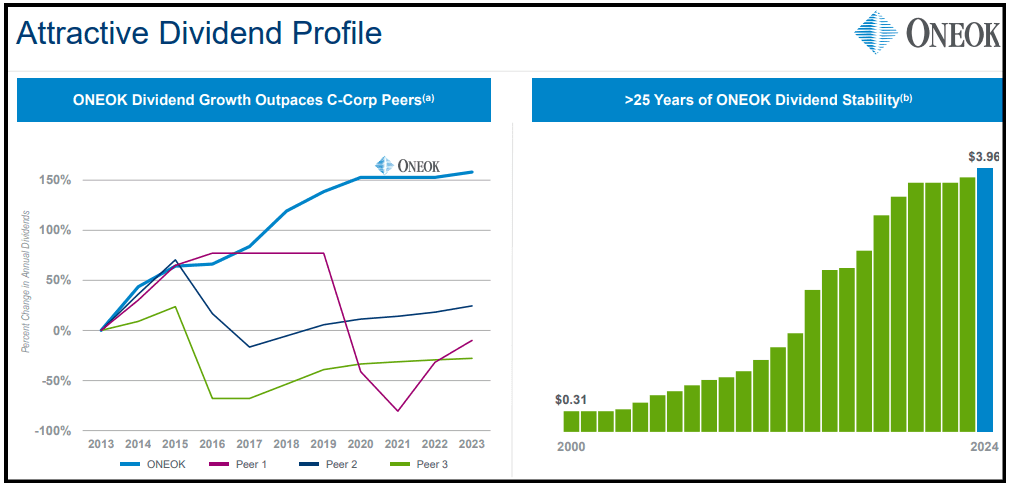

4. ONEOK, Inc. (OKE)

ONEOK, Inc. stands as a beacon in the top 10 dividend stocks, boasting a generous dividend yield of 4.97%. With its market capitalization reaching $44.99B, this company has shown solid performance and commitment to returning value to investors through dividends.

Its annual payout FWD currently sits at $3.96 per share, demonstrating notable growth and stability in income distribution.

Investing in ONEOK not only brings attractive yields but also serves as an avenue for steady financial growth over time, given its impressive dividend CAGR of 10%. This figure represents not just numbers on paper but real income increase that I have experienced by holding their shares over the years.

Such consistent return makes it a favored choice among those seeking best dividend yield stocks within flourishing sectors like energy infrastructure.

Moving on to FIRSTENERGY (FE), let’s explore what another player offers in this high-stake investment field.

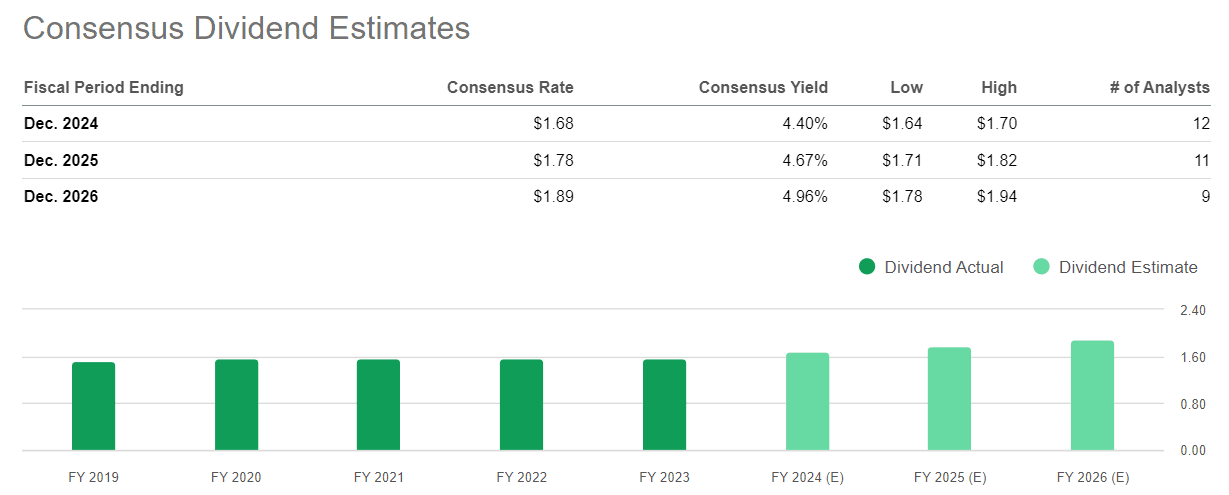

5. FIRSTENERGY (FE)

Shifting from ONEOK, Inc., a player in the energy sector, we find another intriguing option for investors with FIRSTENERGY (FE). This utility company offers a forward dividend yield of 4.45% and an annual payout of $1.70.

With these figures, FIRSTENERGY stands out as a top choice for those looking to add utility stocks to their portfolios.

Investing in FIRSTENERGY means putting money into a reliable source of income through dividends. The company’s performance provides stability and growth potential for investors interested in securing their financial future while seeking returns from high dividend yield stocks.

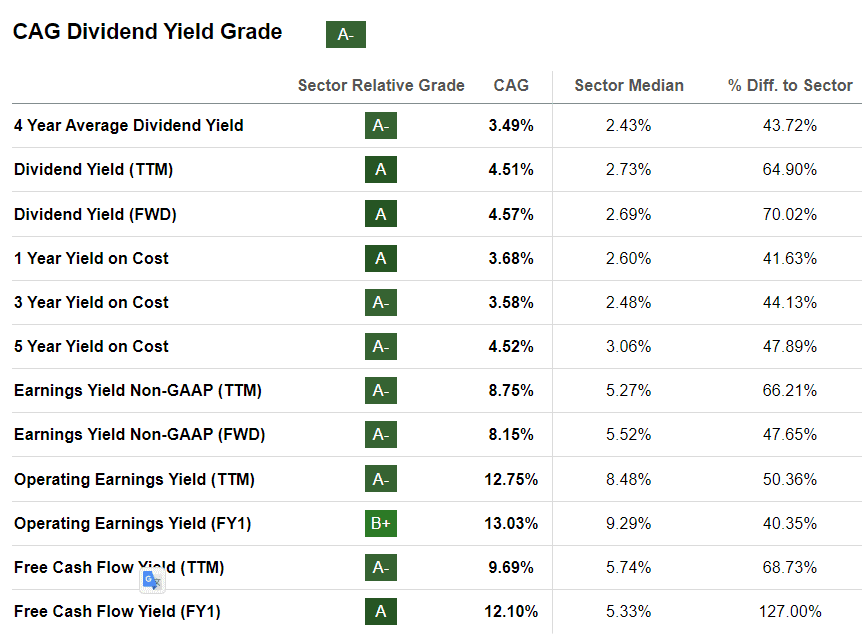

6. CONAGRA BRANDS, INC. (CAG)

Conagra Brands, Inc., well known for household food names like Duncan Hines and Healthy Choice, rewards investors with a forward dividend yield of 4.57%. This means people who hold their shares get a steady stream of income, which can be very appealing in uncertain market conditions.

Their commitment to increasing dividends is clear from the impressive 12.28% dividend growth rate over the last three years.

From my experience investing in Conagra Brands, I’ve seen firsthand how consistent they are with their payouts. It’s not just about the numbers; it’s about how this company stands strong even when economic winds shift.

They have managed to keep growing their dividends, which speaks volumes about their financial health and operational strength. For anyone looking into dividend growth stocks or aiming to build a portfolio that delivers over time, keeping an eye on companies like Conagra could prove beneficial.

7. TYSON FOODS, INC. (TSN)

Tyson Foods, Inc., with its ticker symbol TSN, stands out in the list of top dividend stocks for several reasons. First off, it boasts a forward dividend yield of 3.27%, signaling strong returns for investors focused on income.

Additionally, TSN has shown commendable growth in dividends over time with a compound annual growth rate (CAGR) of 3.89% over three years. This indicates not just stability but also an upward trend in returning value to shareholders.

Investors keeping an eye on high-yield investments should note Tyson Foods’ performance in the stock market and its consistent dedication to increasing shareholder wealth through dividends.

The company’s approach combines business expansion and financial health management to ensure sustainable returns. Moving beyond Tyson Foods brings us to another notable mention on our list of top performers: THE COCA-COLA COMPANY (KO).

8. THE COCA-COLA COMPANY (KO)

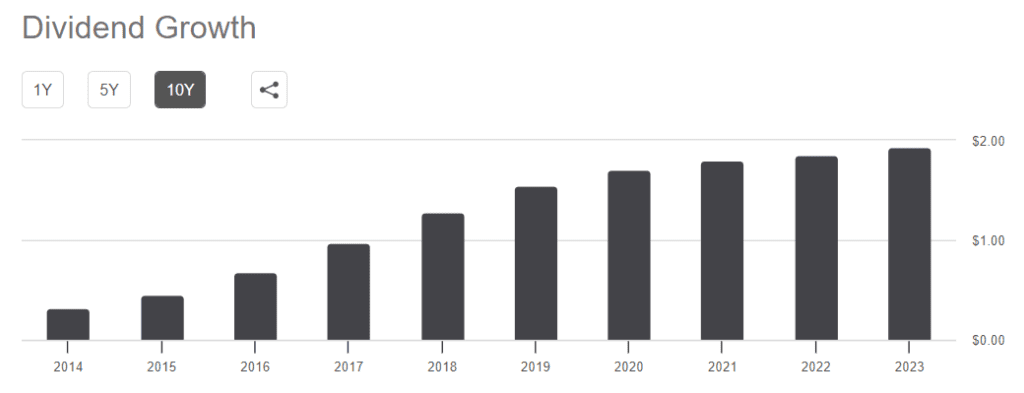

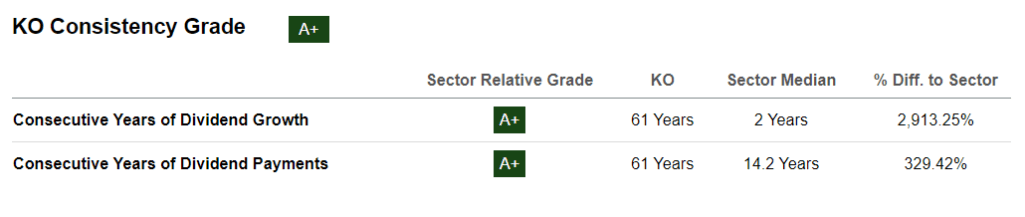

The Coca-Cola Company stands out among the top dividend-paying stocks, rewarding investors with a forward dividend yield of 3.22%. This iconic beverage leader not only quenches thirst worldwide but also consistently grows its dividends, boasting a three-year Compound Annual Growth Rate (CAGR) of 4.17%.

Its commitment to returning value to shareholders makes it an attractive addition for those looking to bolster their investment portfolios with reliable income-generating assets.

From my personal experience, incorporating KO into an investment strategy adds a layer of stability and growth potential that is hard to find elsewhere. Its ability to navigate market fluctuations while maintaining steady dividend increases speaks volumes about its operational strength and strategic financial management.

For investors seeking solid dividend yields coupled with potential for capital appreciation, The Coca-Cola Company presents a compelling option worth considering.

9. KINDER MORGAN, INC. (KMI)

Kinder Morgan, Inc. (KMI) stands out in the investment world with a forward dividend yield of 6.10%. This figure points to KMI’s ability to generate ongoing income for investors looking to add a solid asset to their portfolios.

With cash flow being crucial, Kinder Morgan shows promise by offering high returns through dividends.

Over the past three years, this corporation has seen its dividend growth rate climb at a CAGR of 2.48%. Analysis from the Seeking Alpha Quant Team places Kinder Morgan on the list of top ten stocks for those seeking both high yields and strong growth opportunities.

Investors take note: this company’s consistent performance in enhancing shareholder value makes it an attractive option for bolstering your investments with reliable dividend-paying stocks.

10. ARDMORE SHIPPING CORPORATION (ASC)

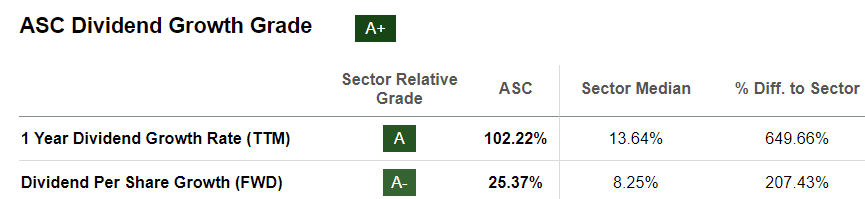

Ardmore Shipping Corporation (ASC) stands out with a forward dividend yield of 5.73%. This figure captures investors’ attention, promising a significant return on investment. The company’s approach to rewarding its shareholders is evident in its impressive 1-year dividend growth rate TTM (trailing twelve months) of 102%.

Such numbers not only highlight ASC’s commitment to generating value for its investors but also reflect its robust financial health.

Seeking Alpha’s Quant Team ranks Ardmore Shipping Corporation among the top ten high-yield dividend equities. This acknowledgment comes from rigorous analysis and underscores ASC’s position as a formidable player in the market.

Investors seeking to diversify their portfolios with stocks that offer both stability and attractive returns will find ASC an appealing option. Its performance illustrates how strategic investments in the transport sector can lead to substantial investor benefits, making it a noteworthy choice for those looking to enhance their income through dividends.

Conclusion

Exploring the top 10 high dividend yield shares offers investors a unique opportunity. These companies not only present impressive yields but also stand strong with robust growth and solid basics.

With global dividends reaching a peak, these picks are more relevant than ever for those looking to grow their income. Each choice reflects careful analysis and a strategic approach to investment.

For anyone aiming to enhance their portfolio, focusing on these standout stocks could be a smart move.

FAQs

1. What are high dividend yield stocks?

High dividend yield stocks are shares of companies that pay a higher percentage of their profits to shareholders in the form of dividends, making them some of the best investments for generating income.

2. How do I find the top 10 dividend-paying stocks?

You can discover the top 10 dividend-paying stocks by using stock screeners or consulting financial advisors who analyze market data and valuations to identify these valuable investment opportunities.

3. Why should I consider investing in high dividend yield stocks?

Investing in high dividend yield stocks offers a way to earn regular income from your investments, which can be especially beneficial for personal finance strategies focused on savings or retirement planning.

4. Can mutual funds and ETFs also provide good dividend yields?

Yes, certain mutual funds and exchange-traded funds (ETFs) specifically focus on investing in high-dividend-yielding companies across various sectors, offering investors diversified exposure to income-generating assets.

5. Are there risks involved with investing in high dividend yield stocks?

Like all investments, high-dividend-yield stocks come with risks including changes in market conditions, fluctuating mortgage rates, and variations in company performance that could affect payout rates.

6. How do economic factors like higher oil prices impact high dividend yield stocks?

Economic factors such as higher oil prices can influence the profitability of companies within sectors like energy, potentially leading to increased dividends for shareholders but also posing risks if market conditions shift unfavorably.