April 27, 2024 Alphabet and Microsoft’s AI Investments Yield Strong Returns

April 26, 2024 Top 10 High Dividend Yield Stocks

Tesla Q1: Model 2 Could Be Their Model T

Tesla Is An AI Company That The Market Won’t Reward For Now

Amazon: The Margin Train Is Gaining Speed

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Bank of America (BAC) Stock Forecast for 2024–2028. Sell or Buy?

Updated: April 26, 2024 (17:22)

Sector: FinancialThe share price of Bank of America Corp. (BAC) now

50/200 Day Moving Average: $35.76 / $31.51

This figure corresponds to the Average Price over the previous 50/200 days. For Bank of America stocks, the 50-day moving average is the support level today.

For Bank of America stocks, the 200-day moving average is the support level today.

Are you interested in Bank of America Corp. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Bank of America stock price in 2024, 2025, 2026, 2027, 2028. How much will one Bank of America share be worth in 2024 - 2028?

When should I take profit in Bank of America stock? When should I record a loss on Bank of America stock? What are analysts' forecasts for Bank of America stock? What is the future of Bank of America stock? We forecast Bank of America stock performance using neural networks based on historical data on Bank of America stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Bank of America stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Bank of America shares. This happens once a day.

Historical and forecast chart of Bank of America stock

The chart below shows the historical price of Bank of America stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Bank of America stock price can be found in the table below.

Long-term forecasts by years.

Unlocking the Future Potential of BAC Stocks: A Precise Forecast

As investors keep a keen eye on the Bank of America's (BAC) stock forecast, understanding the myriad of factors that could influence its trajectory becomes vital. Among the myriad determinants, expansion plans, financial stability, interest rate fluctuations, and the broader industry outlook stand out as key predictors of BAC's stock rate changes. These elements not only offer a glimpse into BAC's future but also serve as a beacon for analysts aiming at crafting the most accurate BAC stock price predictions.

Navigating the Waters of BAC's Stock Forecast

Firstly, BAC's ambitious expansion plans, with the bank set to open 37 new financial centers across nine states by 2026, hint at a growth trajectory that could significantly boost its market presence and, consequently, its stock price. This move not only signals an aggressive push for market share but also the potential for increased revenue streams.

Secondly, the bank's financial stability, marked by robust cash reserves and a staunch market position, instills investor confidence. This serves as a critical foundation for any positive BAC stock buy or sell decision. Furthermore, the inevitable ebb and flow of interest rates, driven by Federal Reserve policies, can sway BAC's profitability, presenting a metric for keen analysts to monitor closely.

Lastly, the outlook of the US traditional banking sector alongside global investment banking, asset management, and wealth management spheres provide a backdrop against which BAC's stock forecast can be evaluated. Positive growth in these areas could spell a bullish signal for those pondering whether BAC is a good stock to buy.

By meticulously analyzing these factors, analysts can construct well-founded BAC stock price predictions and BAC stock price targets, guiding investors in making informed decisions on whether to buy or sell Bank of America stock.

- Expansion Plans

- Financial Stability

- Interest Rate Fluctuations

- Industry Outlook

In the ever-evolving financial markets, keeping a pulse on these crucial parameters can empower investors to navigate the complexities of BAC’s stock forecast, turning insights into action.

Review the original Analysis

Unlocking the Future of BAC Stock: A Guide to Navigating the Upswing

Investors and analysts closely monitoring Bank of America's (BAC) stock are on the edge of their seats as we head into the second half of the year, armed with insights that forecast a notable shift in the company's stock rates. Key events and factors poised to make the most impactful changes include Net Interest Income (NII) Growth, the behavior of the bank's Hold-To-Maturity (HTM) Securities Portfolio, and the company's overall Earnings Performance. These elements collectively sketch the potential trajectory of BAC stock prices, making them essential tools for any analyst aiming to make precise predictions.

Navigating BAC's Financial Seas: What to Watch

The anticipated growth in NII speaks volumes about BAC's financial resilience and future profitability. As the bank benefits from slower deposit repricing and the adjustment of lower-rate loans, the resulting increase in NII is expected to be a bullish signal for BAC stocks. Additionally, the stabilization of interest rates is forecasted to mitigate previous unrealized losses in BAC's HTM securities portfolio, easing investor concerns and potentially boosting stock optimism. Moreover, BAC's solid earnings performance, underscored by increased investment banking fee revenue and sales and trading revenue, hints at a strong, well-diversified business model primed for future growth.

For analysts aiming to forecast BAC's stock rates with precision, focusing on these key factors—NII growth, the HTM securities portfolio, and earnings performance—provides a robust framework. Such a comprehensive approach not only enhances the accuracy of BAC stock price predictions but also empowers investors to make informed decisions on whether BAC is a good stock to buy or sell, ultimately navigating the dynamic stock market landscape with confidence.

- Net Interest Income (NII) Growth

- Earnings Performance

- HTM Securities Portfolio

As we look towards the future, the Bank of America stock forecast suggests an opportune moment for investors. With the BAC stock price target adjusting in real-time to these financial indicators, determining the right moment to buy or sell Bank of America stock could be the key to unlocking significant investment opportunities.

Review the original Analysis

Unlocking the Potential: Bank of America's Stock Forecast Unveiled

When examining the future landscape of Bank of America's (BAC) stocks, it's clear that certain pivotal factors will play a significant role in shaping its trajectory. Analysts combing through the Bank of America stock forecast need to zero in on these elements to sketch the most accurate predictions possible. One cannot overlook the resilience provided by BAC's diversified business model, especially in a fluctuating economic environment. This diversification not only fortifies its standing against sector-specific downturns but also positions Bank of America as a stronger contender for a swift recovery, hinting at a potential upward nudge in BAC stock prices.

Key Predictors of BAC's Stock Movements

Further enriching this analysis, the widening of loan spreads emerges as a beacon indicating increased profitability, more so with potential interest rate drops on the horizon. This particular trend could entice analysts to tag BAC stock as a 'buy'. Additionally, the ongoing shift towards automation presents a double-edged sword; significant cost savings might be on the way, acting as a catalyst for higher stock values. However, the looming shadow of an economic downturn stirred by an inverted yield curve puts these optimistic projections to the test.

For anyone navigating the BAC stock forecast waters, integrating these factors—diversification, loan spreads, economic outlook, and technological shifts—into their analytical framework could provide valuable insights. Is BAC a good stock to buy? Well, blending these elements yields a nuanced perspective, leaning towards a positive BAC stock price prediction. Yet, as the financial tides turn, keeping a vigilant eye on these predictors will be crucial in steering clear of the rocks and towards prosperous waters.

- Diversification and resilience: A shield against sector-specific storms.

- Loan spreads: Widening margins signal profitability.

- Economic outlook: A balanced view could dilute recession concerns.

- Automation and cost savings: Efficiency could turbo-boost profits.

As we continue to monitor the pulse of Bank of America stock forecast, these key indicators will undoubtedly assist analysts and investors alike in making informed decisions on whether BAC stock is a buy or sell. Treading with insight and caution could reveal a promising BAC stock price target, crafting a roadmap to potentially lucrative investments.

Review the original Analysis

- Bank of America successfully adapted its business model by using some assets from the 2008 Federal Reserve aid package, which are now part of the bank’s subsidiaries.

- Mark-to-market valuations have negligible impacts on its operations as long as it holds on to securities until they mature and assumes constant operations. On the downside, “mark-to-market” symbolizes an opportunity cost that companies need to embrace for assured future gains.

- The bank principally focuses on managing incoming and outgoing cash flows to yield profits. It doesn’t excessively worry about unpredictable market conditions.

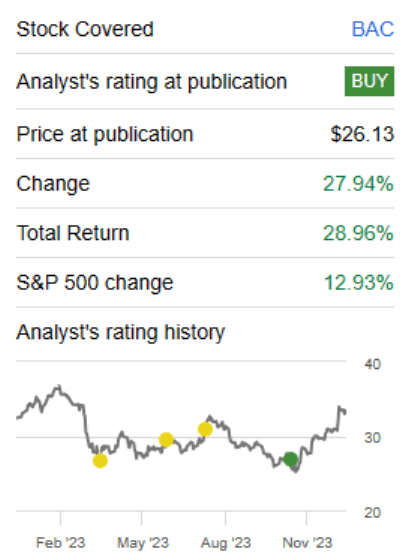

BAC is set to make significant financial gains as the ill-conceived, held-to-maturity securities that have been generating losses eventually roll off. The stock right now upgrades to a ‘Buy’ rating with an anticipated 7%-9% annual return over the long haul.

The stock has been performing admirably, even outpacing both the broader S&P 500 (SPY) and the illustrious “Magnificent 7”.

So what’s fueling these returns?

A whopping 29% total return over three months might lead you to believe that BAC has either reinvented some financial mechanism or tapped into the lucrative AI market. But far from it. The reality is that earnings estimates have seen a reluctant dip in the past month.

What’s really driving this is essentially market risk for a harsh recession being priced out. There are plenty of metrics you could consider for this, but Baa corporate bond yields (that teeter on investment-grade) and their spreads to US Treasuries have served as a terrific reverse indicator for BAC stock.

Given that yield is nearing its year-long low, you’d need to start questioning your future predictions for this and other risk factors.

About the Company

Bank of America is an international corporation operating in 35 countries. The company has 213,000 employees, 16,000 ATMs and 4,700 offices across America. It is engaged in three areas: lending to individuals and servicing their accounts; helping corporations manage assets; and trading on currency, stock, and commodity exchanges.

In 2015, Forbes ranked Bank of America as the twenty-third largest company in the world. In 2016, the bank became the largest in the United States in terms of assets. In 2016, the company earned $ 83.7 billion.

The company has been around since 1904, when Amadeo Giannini founded the Bank of Italy in San Francisco. Bank Giannini was different from other banks of the early 20th century: it had 100 branches, which served the middle class and immigrants – other banks in the city did not give them loans. After the 1906 earthquake, the Bank of Italy retained its building and money, unlike other banks. Giannini took advantage of the saved resources and began issuing recovery loans a few days after the disaster. In 1929 Bank of Italy merged with Los Angeles-based Bank of America. The United Bank received the name of the latter.

Bank of America daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Apr 28 | 37.62 | 37.07 | 37.91 | 2.25 |

| Apr 29 | 37.87 | 37.44 | 38.68 | 3.31 |

| Apr 30 | 37.52 | 37.06 | 38.11 | 2.82 |

| May 01 | 37.97 | 37.66 | 38.64 | 2.60 |

| May 02 | 37.94 | 37.58 | 38.54 | 2.54 |

| May 03 | 38.29 | 37.62 | 39.07 | 3.85 |

| May 04 | 38.42 | 38.02 | 39.29 | 3.33 |

| May 05 | 38.24 | 37.72 | 38.99 | 3.38 |

| May 06 | 37.15 | 36.33 | 37.42 | 3.01 |

| May 07 | 36.67 | 36.42 | 37.05 | 1.72 |

| May 08 | 35.57 | 35.24 | 36.06 | 2.33 |

| May 09 | 35.64 | 35.11 | 36.31 | 3.41 |

| May 10 | 36.40 | 36.10 | 36.94 | 2.33 |

| May 11 | 36.96 | 36.61 | 37.64 | 2.82 |

| May 12 | 36.54 | 36.19 | 37.32 | 3.12 |

| May 13 | 36.67 | 36.40 | 37.05 | 1.78 |

| May 14 | 36.71 | 36.40 | 37.16 | 2.09 |

| May 15 | 37.68 | 37.22 | 38.42 | 3.22 |

| May 16 | 38.08 | 37.58 | 38.44 | 2.28 |

| May 17 | 37.06 | 36.68 | 37.53 | 2.33 |

| May 18 | 36.93 | 36.17 | 37.62 | 4.01 |

| May 19 | 36.81 | 36.26 | 37.67 | 3.90 |

| May 20 | 37.04 | 36.15 | 37.53 | 3.81 |

| May 21 | 38.08 | 37.68 | 38.34 | 1.76 |

| May 22 | 38.68 | 38.10 | 39.20 | 2.89 |

| May 23 | 38.32 | 37.49 | 39.01 | 4.05 |

| May 24 | 38.84 | 38.22 | 39.60 | 3.60 |

| May 25 | 38.78 | 37.92 | 39.04 | 2.95 |

| May 26 | 37.65 | 37.23 | 37.88 | 1.73 |

| May 27 | 36.64 | 35.95 | 37.30 | 3.73 |

Bank of America Daily Price Targets

Bank of America Stock Forecast 04-28-2024.

Forecast target price for 04-28-2024: $37.62.

Negative dynamics for Bank of America shares will prevail with possible volatility of 2.204%.

Pessimistic target level: 37.07

Optimistic target level: 37.91

Bank of America Stock Forecast 04-29-2024.

Forecast target price for 04-29-2024: $37.87.

Positive dynamics for Bank of America shares will prevail with possible volatility of 3.202%.

Pessimistic target level: 37.44

Optimistic target level: 38.68

Bank of America Stock Forecast 04-30-2024.

Forecast target price for 04-30-2024: $37.52.

Negative dynamics for Bank of America shares will prevail with possible volatility of 2.747%.

Pessimistic target level: 37.06

Optimistic target level: 38.11

Bank of America Stock Forecast 05-01-2024.

Forecast target price for 05-01-2024: $37.97.

Positive dynamics for Bank of America shares will prevail with possible volatility of 2.535%.

Pessimistic target level: 37.66

Optimistic target level: 38.64

Bank of America Stock Forecast 05-02-2024.

Forecast target price for 05-02-2024: $37.94.

Negative dynamics for Bank of America shares will prevail with possible volatility of 2.481%.

Pessimistic target level: 37.58

Optimistic target level: 38.54

Bank of America Stock Forecast 05-03-2024.

Forecast target price for 05-03-2024: $38.29.

Positive dynamics for Bank of America shares will prevail with possible volatility of 3.704%.

Pessimistic target level: 37.62

Optimistic target level: 39.07

BAC (BAC) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May. | 37.97 | 35.92 | 38.66 | 7.08 |

| Jun. | 39.70 | 38.67 | 40.70 | 4.98 |

| Jul. | 40.89 | 38.69 | 42.27 | 8.47 |

| Aug. | 39.09 | 38.32 | 41.28 | 7.16 |

| Sep. | 38.11 | 36.85 | 38.72 | 4.82 |

| Oct. | 38.05 | 36.91 | 40.05 | 7.85 |

| Nov. | 38.40 | 36.30 | 39.69 | 8.53 |

| Dec. | 38.80 | 38.01 | 39.78 | 4.44 |

Bank of America forecast for this year

Bank of America Stock Prediction for May 2024

An uptrend is forecast for this month with an optimal target price of $37.9713. Pessimistic: $35.92. Optimistic: $38.66

Bank of America Stock Prediction for Jun 2024

An uptrend is forecast for this month with an optimal target price of $39.699. Pessimistic: $38.67. Optimistic: $40.70

Bank of America Stock Prediction for Jul 2024

An uptrend is forecast for this month with an optimal target price of $40.8939. Pessimistic: $38.69. Optimistic: $42.27

Bank of America Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $39.0905. Pessimistic: $38.32. Optimistic: $41.28

Bank of America Stock Prediction for Sep 2024

An downtrend is forecast for this month with an optimal target price of $38.1054. Pessimistic: $36.85. Optimistic: $38.72

Bank of America Stock Prediction for Oct 2024

An downtrend is forecast for this month with an optimal target price of $38.0521. Pessimistic: $36.91. Optimistic: $40.05

Bank of America Stock Prediction for Nov 2024

An uptrend is forecast for this month with an optimal target price of $38.3983. Pessimistic: $36.30. Optimistic: $39.69

Bank of America Stock Prediction for Dec 2024

An uptrend is forecast for this month with an optimal target price of $38.8015. Pessimistic: $38.01. Optimistic: $39.78

Bank of America (BAC) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 39.70 | 37.61 | 40.61 | 7.39 |

| Feb | 37.34 | 36.60 | 39.22 | 6.66 |

| Mar | 36.53 | 35.07 | 37.86 | 7.36 |

| Apr | 34.33 | 33.15 | 35.43 | 6.44 |

| May | 35.02 | 33.65 | 36.13 | 6.85 |

| Jun | 33.85 | 32.92 | 35.36 | 6.90 |

| Jul | 35.01 | 34.27 | 35.67 | 3.92 |

| Aug | 36.45 | 34.67 | 37.45 | 7.43 |

| Sep | 36.76 | 36.09 | 38.43 | 6.09 |

| Oct | 35.68 | 34.78 | 36.58 | 4.92 |

| Nov | 34.73 | 34.03 | 36.65 | 7.16 |

| Dec | 33.68 | 33.12 | 34.46 | 3.90 |

Bank of America (BAC) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 33.90 | 33.11 | 35.70 | 7.24 |

| Feb | 34.51 | 33.09 | 36.42 | 9.15 |

| Mar | 34.22 | 32.79 | 35.42 | 7.44 |

| Apr | 34.97 | 34.31 | 36.56 | 6.16 |

| May | 35.85 | 34.72 | 36.35 | 4.49 |

| Jun | 34.62 | 32.85 | 35.61 | 7.76 |

| Jul | 34.13 | 32.56 | 35.50 | 8.28 |

| Aug | 32.77 | 31.51 | 33.83 | 6.85 |

| Sep | 32.40 | 31.59 | 33.36 | 5.30 |

| Oct | 32.18 | 31.41 | 33.10 | 5.10 |

| Nov | 30.74 | 29.66 | 31.83 | 6.83 |

| Dec | 32.24 | 31.38 | 33.98 | 7.64 |

Bank of America (BAC) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 32.02 | 31.14 | 32.46 | 4.07 |

| Feb | 31.93 | 30.23 | 32.91 | 8.15 |

| Mar | 31.73 | 30.66 | 32.81 | 6.56 |

| Apr | 33.50 | 32.19 | 34.21 | 5.90 |

| May | 34.51 | 33.67 | 35.84 | 6.07 |

| Jun | 34.85 | 33.34 | 36.04 | 7.51 |

| Jul | 36.95 | 36.12 | 37.83 | 4.51 |

| Aug | 34.88 | 33.71 | 35.68 | 5.54 |

| Sep | 34.80 | 33.34 | 35.49 | 6.04 |

| Oct | 35.93 | 33.91 | 36.93 | 8.17 |

| Nov | 34.84 | 32.94 | 35.92 | 8.28 |

| Dec | 34.92 | 33.87 | 36.51 | 7.23 |

Bank of America (BAC) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 35.38 | 34.51 | 36.55 | 5.56 |

| Feb | 37.61 | 35.77 | 39.37 | 9.16 |

| Mar | 39.14 | 37.55 | 40.01 | 6.16 |

| Apr | 41.58 | 40.76 | 42.16 | 3.31 |

| May | 42.01 | 41.28 | 43.19 | 4.43 |

| Jun | 44.63 | 42.60 | 45.75 | 6.90 |

| Jul | 46.88 | 46.16 | 47.93 | 3.70 |

| Aug | 47.11 | 45.36 | 49.71 | 8.76 |

| Sep | 45.72 | 43.42 | 47.42 | 8.44 |

| Oct | 47.29 | 45.47 | 49.81 | 8.71 |

| Nov | 47.46 | 46.53 | 48.55 | 4.17 |

| Dec | 48.45 | 47.50 | 49.40 | 3.84 |

Bank of America information and performance

BANK OF AMERICA CORPORATE CENTER, 100 N TRYON ST, CHARLOTTE, NC, US

Market capitalization of the Bank of America Corp. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of BAC shares in the company outstanding by the market price of one share.

EBITDA of Bank of America is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.

Bank of America (BAC) stock dividend

Bank of America last paid dividends on 02/29/2024. The next scheduled payment will be on 03/29/2024. The amount of dividends is $0.94 per share. If the date of the next dividend payment has not been updated, it means that the issuer has not yet announced the exact payment. As soon as information becomes available, we will immediately update the data. Bookmark our portal to stay updated.

Last Split Date: 01/01/1970

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

For example, a 5: 1 ratio means that the value of one share will decrease 5 times, the total amount will increase 5 times. It is important to understand that this procedure does not change the capitalization of the company, as well as the total value of assets held in private hands.