A.O. Smith: Great Company, Inferior Investment

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Plug Power (PLUG) Stock Forecast for 2024–2028. Sell or Buy?

Updated: May 19, 2024 (09:58)

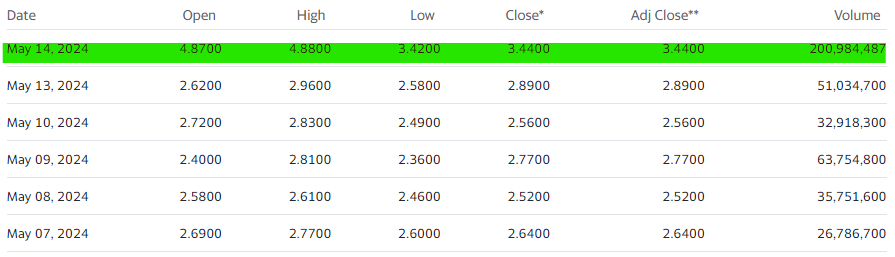

Sector: IndustrialsThe share price of Plug Power Inc. (PLUG) now

50/200 Day Moving Average: $3.028 / $5.1

This figure corresponds to the Average Price over the previous 50/200 days. For Plug Power stocks, the 50-day moving average is the support level today.

For Plug Power stocks, the 200-day moving average is the resistance level today.

Are you interested in Plug Power Inc. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Plug Power stock price in 2024, 2025, 2026, 2027, 2028. How much will one Plug Power share be worth in 2024 - 2028?

When should I take profit in Plug Power stock? When should I record a loss on Plug Power stock? What are analysts' forecasts for Plug Power stock? What is the future of Plug Power stock? We forecast Plug Power stock performance using neural networks based on historical data on Plug Power stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Plug Power stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Plug Power shares. This happens once a day.

Historical and forecast chart of Plug Power stock

The chart below shows the historical price of Plug Power stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Plug Power stock price can be found in the table below.

Long-term forecasts by years.

Navigating PLUG Stock: A High-Stakes Forecast Amidst Meme Mania and DOE Hurdles

The trajectory of Plug Power's stock (PLUG) is currently being shaped by a cocktail of influential factors, combining government backing, financial performance anxiety, and the whimsical waves of meme stock status. Understanding these elements is key for analysts aiming at crafting a precise PLUG stock forecast. The company's recent acquisition of a conditional loan guarantee from the Department of Energy (DOE) has sparked investor interest, potentially signaling a bullish future for PLUG stock. However, the caveat lies in the 'conditional' part, with stringent DOE requirements and political variability posing potential roadblocks to funding.

Interpreting the Market's Mixed Signals

Further complicating PLUG stock price predictions are the disappointing quarterly results the company has reported. A downturn exceeding 40% in sales, coupled with gross margins at all-time lows, paints a grim picture of operational challenges. These factors, paramount to PLUG's short-term outlook, suggest a cautious approach among investors.

Yet, in these turbulent waters, the meme stock frenzy offers a lifeline; increased market risk appetite can facilitate capital raises through stock offerings. Analysts looking to make the most accurate PLUG stock buy or sell decisions must weigh these dynamics carefully. The meme stock phenomenon, while potentially beneficial for raising funds, ultimately introduces volatility and dilution concerns.

- Conditional DOE Loan Guarantee's Double-edged Sword

- Impact of Quarterly Financial Performance on Sentiment

- The Meme Stock Frenzy's Role in Funding and Volatility

Considering these factors, the PLUG stock price target remains a complex puzzle. Analysts must navigate the interplay between policy, performance, and popularity, maintaining a vigilant eye on how these forces interact to shape Plug Power's valuation. Whether PLUG is a good stock to buy hinges on a nuanced analysis of these evolving dynamics.

Review the original Analysis

Unveiling PLUG Power's Future: Insights into Stock Performance

In the evolving landscape of renewable energy, Plug Power stands at a critical juncture, with its stock forecast (PLUG stock forecast) drawing attention from investors and analysts alike. The near future of PLUG stocks seems to be significantly influenced by various key factors, including the cost of ownership, profitability challenges, and the company's ambitious expansion strategy. Understanding and analyzing these elements might hold the key to decoding the direction of PLUG stock rates.

Deciphering the Impact on PLUG Stocks

At the forefront, the high cost of ownership and maintenance issues associated with Proton Exchange Membrane (PEM) technology are pivotal. These factors not only challenge the economic viability of Plug Power's products but also potentially deter investor confidence, affecting the PLUG stock price prediction. Meanwhile, the company's aggressive strategy to escalate its operations and build new hydrogen production plants, despite its profitability predicament, adds another layer of complexity to forecasting PLUG stock prices.

Further complicating the landscape are the subsidization of customers through unprofitable contracts and challenges in hydrogen production, both technical and competitive. These aspects are crucial for any PLUG stock forecast and could be used by analysts to craft nuanced predictions about the stock's trajectory. Additionally, liquidity issues and the prospect of capital raises, necessitating the issuance of more shares, could pressure the PLUG stock price target.

To conclude, by closely examining these factors, analysts can provide insights into whether PLUG is a good stock to buy or sell. As the company navigates its challenges and opportunities, the question of 'buy or sell Plug Power stock' remains a captivating dilemma for market watchers.

Review the original Analysis

Navigating the Turbulent Waters of PLUG Stock: A Detailed Forecast

As the investment community casts its gaze toward Plug Power, the recent disappointing Q1 2024 results have certainly thrown a spanner in the works for those predicting a smooth journey towards profitability. With revenues seeing a downturn and losses widening in comparison to the previous year, the stock forecast for PLUG seems laden with uncertainty. Analysts and investors alike are keenly scrutinizing these developments, understanding that the immediate future of PLUG stock rates hinges on several pivotal factors.

Key Dynamics Shaping PLUG's Financial Horizon

Firstly, the very crux of the matter lies in the aftermath of the Q1 2024 financial performance. This lackluster showing not only heightens skepticism regarding the viability of PLUG's turnaround strategy but also makes the task of forecasting PLUG's stock forecast more complex. Analysts parsing through PLUG's quarterly fallout find themselves at a crossroads, weighing the impact of declining revenues against future prospects.

Moreover, the company's ambitious pivot towards green hydrogen production emerges as a double-edged sword. Here lies a potential game-changer for PLUG's cost structure and margin improvement. Analysts armed with a keen eye for sustainability trends and operational efficiencies might find fertile ground in predicting how PLUG's green hydrogen venture aligns with broader market expectations, possibly illuminating a path for a PLUG stock price prediction that factors in a resurgence powered by green innovation.

The stability and management of PLUG's liquidity also loom large over stock forecasts. The ability to effectively steer through its cash reserves without triggering alarm signals could serve as a harbinger of stability, enticing analysts to adopt a cautiously optimistic posture for a PLUG stock buy or sell recommendation.

In descending order of impact, it becomes apparent that:

- Q1 2024 Financial Results

- Hydrogen Production

- Liquidity Management

are the pillars upon which any reasoned Plug Power stock forecast or PLUG stock price target must rest. For those pondering, "Is PLUG a good stock to buy?" these factors offer a compass by which to navigate the tempestuous seas of stock market predictions. With a conjuncture of meticulous analysis and a touch of foresight, one might yet chart a course through the volatile waves of PLUG's stock price prediction, searching for signs of calm or tumult on the horizon.

Review the original Analysis

Plug Power Inc. provides turnkey hydrogen fuel cell solutions for the electric mobility and stationary energy markets in North America and Europe. It focuses on proton exchange membrane (PEM) fuel cells and fuel reprocessing technologies, hybrid fuel cell / battery technologies and associated hydrogen storage and distribution infrastructure. The company offers GenDrive, a hydrogen-powered PAM fuel cell system that provides electrical power for material handling; GenFuel, a hydrogen refueling delivery, generation, storage and distribution system; GenCare, an ongoing repair and maintenance program for GenDrive and GenSure Fuel Cells, GenFuel Products, and Progen Engines; and GenSure, a stationary fuel solution that provides modular PEM fuel cells to support backup and grid-based power requirements for telecommunications, transportation, and utilities. It also provides GenKey, a turnkey fuel cell powered migration solution; and ProGen, a fuel cell stack and engine technology used in mobile and stationary fuel cell systems, and as engines in electric delivery vans. The company offers its products to the retail distribution and manufacturing business through direct product sales, original equipment manufacturers and dealer networks. Plug Power Inc. the company was founded in 1997 and is headquartered in Latham, New York.

Plug Power daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May 21 | 3.37 | 3.30 | 3.44 | 4.13 |

| May 22 | 3.40 | 3.30 | 3.50 | 6.02 |

| May 23 | 3.34 | 3.28 | 3.38 | 3.06 |

| May 24 | 3.26 | 3.21 | 3.30 | 2.72 |

| May 25 | 3.38 | 3.34 | 3.49 | 4.41 |

| May 26 | 3.32 | 3.26 | 3.43 | 5.18 |

| May 27 | 3.36 | 3.31 | 3.45 | 4.18 |

| May 28 | 3.41 | 3.37 | 3.52 | 4.62 |

| May 29 | 3.51 | 3.44 | 3.58 | 3.95 |

| May 30 | 3.40 | 3.29 | 3.50 | 6.24 |

| May 31 | 3.39 | 3.29 | 3.43 | 4.37 |

| Jun 01 | 3.39 | 3.31 | 3.43 | 3.73 |

| Jun 02 | 3.50 | 3.43 | 3.58 | 4.24 |

| Jun 03 | 3.56 | 3.48 | 3.60 | 3.31 |

| Jun 04 | 3.68 | 3.65 | 3.78 | 3.59 |

| Jun 05 | 3.80 | 3.71 | 3.87 | 4.30 |

| Jun 06 | 3.73 | 3.68 | 3.78 | 2.59 |

| Jun 07 | 3.86 | 3.80 | 3.93 | 3.54 |

| Jun 08 | 3.72 | 3.62 | 3.84 | 5.88 |

| Jun 09 | 3.71 | 3.66 | 3.76 | 2.63 |

| Jun 10 | 3.77 | 3.67 | 3.88 | 5.97 |

| Jun 11 | 3.69 | 3.64 | 3.79 | 4.13 |

| Jun 12 | 3.76 | 3.69 | 3.87 | 4.64 |

| Jun 13 | 3.71 | 3.65 | 3.83 | 4.88 |

| Jun 14 | 3.74 | 3.68 | 3.80 | 3.38 |

| Jun 15 | 3.70 | 3.66 | 3.76 | 2.55 |

| Jun 16 | 3.64 | 3.54 | 3.72 | 5.07 |

| Jun 17 | 3.64 | 3.59 | 3.71 | 3.28 |

| Jun 18 | 3.67 | 3.64 | 3.76 | 3.35 |

| Jun 19 | 3.56 | 3.48 | 3.60 | 3.44 |

Plug Power Daily Price Targets

Plug Power Stock Forecast 05-21-2024.

Forecast target price for 05-21-2024: $3.37.

Positive dynamics for Plug Power shares will prevail with possible volatility of 3.967%.

Pessimistic target level: 3.30

Optimistic target level: 3.44

Plug Power Stock Forecast 05-22-2024.

Forecast target price for 05-22-2024: $3.40.

Positive dynamics for Plug Power shares will prevail with possible volatility of 5.679%.

Pessimistic target level: 3.30

Optimistic target level: 3.50

Plug Power Stock Forecast 05-23-2024.

Forecast target price for 05-23-2024: $3.34.

Negative dynamics for Plug Power shares will prevail with possible volatility of 2.965%.

Pessimistic target level: 3.28

Optimistic target level: 3.38

Plug Power Stock Forecast 05-24-2024.

Forecast target price for 05-24-2024: $3.26.

Negative dynamics for Plug Power shares will prevail with possible volatility of 2.651%.

Pessimistic target level: 3.21

Optimistic target level: 3.30

Plug Power Stock Forecast 05-25-2024.

Forecast target price for 05-25-2024: $3.38.

Positive dynamics for Plug Power shares will prevail with possible volatility of 4.225%.

Pessimistic target level: 3.34

Optimistic target level: 3.49

Plug Power Stock Forecast 05-26-2024.

Forecast target price for 05-26-2024: $3.32.

Negative dynamics for Plug Power shares will prevail with possible volatility of 4.922%.

Pessimistic target level: 3.26

Optimistic target level: 3.43

PLUG (PLUG) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jun. | 3.44 | 3.32 | 3.68 | 9.82 |

| Jul. | 3.50 | 3.34 | 3.63 | 8.08 |

| Aug. | 3.37 | 3.01 | 3.57 | 15.59 |

| Sep. | 3.30 | 3.04 | 3.50 | 13.16 |

| Oct. | 2.96 | 2.83 | 3.07 | 7.53 |

| Nov. | 3.24 | 2.98 | 3.46 | 13.91 |

| Dec. | 3.33 | 3.00 | 3.58 | 16.30 |

Plug Power forecast for this year

Plug Power Stock Prediction for Jun 2024

An uptrend is forecast for this month with an optimal target price of $3.44012. Pessimistic: $3.32. Optimistic: $3.68

Plug Power Stock Prediction for Jul 2024

An uptrend is forecast for this month with an optimal target price of $3.49689. Pessimistic: $3.34. Optimistic: $3.63

Plug Power Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $3.371. Pessimistic: $3.01. Optimistic: $3.57

Plug Power Stock Prediction for Sep 2024

An downtrend is forecast for this month with an optimal target price of $3.30021. Pessimistic: $3.04. Optimistic: $3.50

Plug Power Stock Prediction for Oct 2024

An downtrend is forecast for this month with an optimal target price of $2.95864. Pessimistic: $2.83. Optimistic: $3.07

Plug Power Stock Prediction for Nov 2024

An uptrend is forecast for this month with an optimal target price of $3.24267. Pessimistic: $2.98. Optimistic: $3.46

Plug Power Stock Prediction for Dec 2024

An uptrend is forecast for this month with an optimal target price of $3.33022. Pessimistic: $3.00. Optimistic: $3.58

Plug Power (PLUG) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 3.35 | 3.23 | 3.71 | 12.86 |

| Feb | 3.56 | 3.20 | 3.91 | 18.02 |

| Mar | 3.88 | 3.66 | 4.15 | 11.91 |

| Apr | 3.47 | 3.17 | 3.84 | 17.49 |

| May | 3.12 | 2.99 | 3.42 | 12.47 |

| Jun | 3.41 | 3.18 | 3.67 | 13.50 |

| Jul | 3.66 | 3.48 | 3.85 | 9.69 |

| Aug | 3.75 | 3.53 | 4.16 | 15.16 |

| Sep | 4.05 | 3.71 | 4.39 | 15.64 |

| Oct | 4.41 | 3.98 | 4.94 | 19.45 |

| Nov | 4.35 | 4.08 | 4.67 | 12.45 |

| Dec | 4.42 | 4.16 | 4.74 | 12.19 |

Plug Power (PLUG) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 4.19 | 3.82 | 4.61 | 17.17 |

| Feb | 3.67 | 3.55 | 4.11 | 13.54 |

| Mar | 3.82 | 3.39 | 3.99 | 14.95 |

| Apr | 3.32 | 3.01 | 3.61 | 16.56 |

| May | 3.73 | 3.53 | 3.92 | 9.99 |

| Jun | 4.27 | 3.87 | 4.40 | 11.94 |

| Jul | 4.77 | 4.20 | 4.92 | 14.69 |

| Aug | 5.31 | 4.97 | 5.81 | 14.39 |

| Sep | 4.82 | 4.27 | 4.97 | 14.11 |

| Oct | 4.68 | 4.18 | 5.14 | 18.59 |

| Nov | 4.40 | 4.07 | 4.80 | 15.12 |

| Dec | 3.77 | 3.55 | 3.94 | 9.90 |

Plug Power (PLUG) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 4.07 | 3.60 | 4.26 | 15.46 |

| Feb | 3.95 | 3.69 | 4.15 | 11.13 |

| Mar | 4.36 | 4.00 | 4.54 | 12.07 |

| Apr | 4.13 | 3.95 | 4.54 | 12.85 |

| May | 4.60 | 4.18 | 4.90 | 14.77 |

| Jun | 4.59 | 4.40 | 4.78 | 8.06 |

| Jul | 5.01 | 4.81 | 5.36 | 10.24 |

| Aug | 4.86 | 4.68 | 5.27 | 11.21 |

| Sep | 5.10 | 4.71 | 5.68 | 17.10 |

| Oct | 4.85 | 4.55 | 5.00 | 9.02 |

| Nov | 4.55 | 4.08 | 5.07 | 19.52 |

| Dec | 4.22 | 3.73 | 4.59 | 18.77 |

Plug Power (PLUG) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 4.19 | 4.02 | 4.61 | 12.69 |

| Feb | 4.30 | 4.16 | 4.66 | 10.81 |

| Mar | 4.89 | 4.58 | 5.29 | 13.44 |

| Apr | 4.70 | 4.48 | 5.04 | 11.05 |

| May | 4.79 | 4.60 | 5.34 | 13.87 |

| Jun | 4.98 | 4.81 | 5.47 | 12.03 |

| Jul | 5.14 | 4.82 | 5.62 | 14.25 |

| Aug | 5.68 | 5.24 | 5.86 | 10.47 |

| Sep | 5.98 | 5.40 | 6.47 | 16.49 |

| Oct | 6.23 | 5.56 | 6.87 | 19.03 |

| Nov | 6.31 | 5.93 | 6.57 | 9.66 |

| Dec | 5.47 | 4.98 | 6.04 | 17.51 |

Plug Power information and performance

968 ALBANY-SHAKER ROAD, LATHAM, NY, US

Market capitalization of the Plug Power Inc. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of PLUG shares in the company outstanding by the market price of one share.

EBITDA of Plug Power is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.