April 27, 2024 Alphabet and Microsoft’s AI Investments Yield Strong Returns

April 26, 2024 Top 10 High Dividend Yield Stocks

Tesla Q1: Model 2 Could Be Their Model T

Tesla Is An AI Company That The Market Won’t Reward For Now

Amazon: The Margin Train Is Gaining Speed

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

SYK Stock News and Mentions of Stryker Corp. Stocktwits

SYK Stock News and Mentions of Stryker Corp. Stocktwits

Updated: April 28, 2024 (09:14)

Sector: Healthcare

Welcome to PandaPulse, innovative analytical stock market observer, where the latest news and stocktwits meets in-depth investor relations insights. Dive into our real-time sentiment analysis to gauge the mood of the markets and arm yourself with key information that resonates with both savvy investors and casual traders.

We meticulously analyze the sentiment trend in each article for the last 60 days where Stryker Company is mentioned. We assess its relevance and importance to carry out an overall sentiment valuation of Stryker Corp. (SYK).

You can view the trend designation for each individual article below. We use this data to compile indicators into one comprehensive sentiment value, which represents the current information agenda about the Stryker stocks.

News and Mentions of Stryker Corp. (SYK)

Analysts Estimate Agios Pharmaceuticals ( AGIO ) to Report a Decline in Earnings: What to Look Out for

Seeking Clues to Stryker ( SYK ) Q1 Earnings? A Peek Into Wall Street Projections for Key Metrics

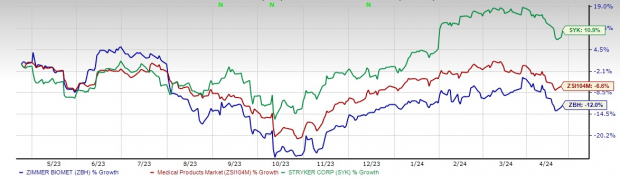

SYK vs ZBH: Which Stock Looks More Promising Ahead of Q1 Earnings?

Op-ed: Here are 6 health-care stocks to watch now, amid a bumpy recovery

Ongoing Procedural Growth May Aid Stryker's ( SYK ) Q1 Earnings

Stryker ( SYK ) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Endoscopy Devices Market size is set to grow by USD 14.24 billion from 2024-2028, advances in endoscopy ... - PR Newswire

Stryker Unusual Options Activity For April 19 - Stryker ( NYSE:SYK )

Here's Why You Should Retain Medtronic ( MDT ) Stock for Now

Here's How Much You Would Have Made Owning Stryker Stock In The Last 20 Years - Stryker ( NYSE:SYK )

Henry Schein ( HSIC ) Global Presence Aids, Macroeconomic Woes Stay

Here's Why You Should Retain Chemed ( CHE ) Stock for Now

Here's Why You Should Retain Charles River ( CRL ) Stock Now

Bio-Rad ( BIO ) Hurt by Softness in BioPharma and Competition

Hologic's ( HOLX ) New Launches Aid, Macroeconomic Issues Ail

Why You Should Add Haemonetics ( HAE ) to Your Portfolio Now

Smith+Nephew ( SNN ) Expands in Australia With New Alliance

Boston Scientific ( BSX ) Faces Rising Costs, Competition - Boston Scientific ( NYSE:BSX ) , Cardinal Health ( NYSE:CAH )

Align Technology ( ALGN ) Up 20.5% YTD: Will the Rally Continue?

Boston Scientific ( BSX ) Faces Rising Costs, Competition

Here's Why You Should Retain Myriad Genetics ( MYGN ) Stock Now

Labcorp's ( LH ) Strategic Alliances Aid Amid Macroeconomic Woes

Bruker ( BRKR ) Introduces Magnet Technology for NMR Adoption

Here's Why Investors Should Retain Integra ( IART ) Stock Now

Thermo Fisher ( TMO ) Launches TSX Universal Series ULT Freezers

Abbott ( ABT ) Faces Low Testing Demand, Currency Headwinds

IM Cannabis ( IMCC ) Expands Business in Germany With New Alliance

Here's Why You Should Retain Penumbra ( PEN ) Stock for Now

Labcorp ( LH ) Extends MRD Clinical Research With New Launch

Teleflex ( TFX ) Debuts the New Unified UroLift 2 System With ATC

Abbott ( ABT ) Receives FDA's Approval for the TriClip TEER System

Haemonetics' ( HAE ) New TEG 6s Cartridge Gets FDA Approval

Henry Schein ( HSIC ) Buys TriMed to Expand in Orthopedic Space

Globus Medical ( GMED ) Gains From New Launches Amid Macro Issues - DaVita ( NYSE:DVA ) , Cardinal Health ( NYSE:CAH )

QIAGEN ( QGEN ) Boosts Cancer Research Suite With New Launches

Reasons to Add Cardinal Health ( CAH ) to Your Portfolio Now

Globus Medical ( GMED ) Gains From New Launches Amid Macro Issues

Align ( ALGN ) Debuts Invisalign Palatal Expander in New Markets

Quest Diagnostics ( DGX ) Collaborates With Broad Clinical Labs

Exact Sciences' ( EXAS ) Oncoguard Esophagus Test Looks Promising

Here's Why Investors Should Buy Alcon ( ALC ) Stock Right Now

Here's Why Investors Should Retain Labcorp ( LH ) Stock for Now

Abbott's ( ABT ) i-STAT TBI Cartridge Receives FDA Approval

Prestige Consumer ( PBH ) Banks on its Portfolio Amid Cost Woes

Thermo Fisher ( TMO ) Debuts a New In-Line Metrology Solution

5 Medical Product Stocks to Buy Amid Industry Challenges

Here's Why You Should Invest in IDEXX ( IDXX ) Stock Right Now

Here's Why Investors Should Buy ResMed ( RMD ) Stock Now

Labcorp ( LH ) to Boost Clinical Diagnostics With New Deal

Tandem Diabetes ( TNDM ) Gains From Innovation Amid Macro Issues

Paragon 28 ( FNA ) Expands Syndesmotic Repair Line With New Launch

Medtronic's ( MDT ) Newest Evolut TAVR System Gets FDA Approval

Is Stryker ( SYK ) Stock Outpacing Its Medical Peers This Year?

Walgreens Boots ( WBA ) Q2 Earnings Top Estimates, EPS View Down

Here's Why Investors Should Retain STERIS ( STE ) Stock for Now

Here's Why You Should Add Lantheus ( LNTH ) to Your Portfolio

Shockwave Medical ( SWAV ) Up on Potential Acquisition Rumors

Boston Scientific ( BSX ) and Scivita Medical Expand Partnership

Here's Why Investors Should Retain Thermo Fisher ( TMO ) Stock

Price Over Earnings Overview: Stryker - Stryker ( NYSE:SYK )

Looking Into Stryker's Recent Short Interest - Stryker ( NYSE:SYK )

Abbott's ( ABT ) Assert-IQ Cardiac Monitor Receives CE Mark

Here's Why You Should Buy Zimmer Biomet ( ZBH ) Stock Now

Stryker's ( SYK ) Latest Launch to Streamline Procedural Workflows

Myriad Genetics ( MYGN ) Wins Foundational Patent for MRD Assay

Masimo ( MASI ) Plans Consumer Business Spin-Off to Drive Growth

Reasons to Retain Intuitive Surgical ( ISRG ) in Your Portfolio

QIAGEN ( QGEN ) Unveils QIAstat-Dx Analyzer With Remote Access

Charles River ( CRL ) Extends Gene Therapy Deal With NUS Medicine

Here's Why You Should Buy Align Technology ( ALGN ) Stock Now

$100 Invested In Stryker 20 Years Ago Would Be Worth This Much Today - Stryker ( NYSE:SYK )

Tandem Diabetes ( TNDM ) Gains From Innovation Amid Competition

Stryker ( SYK ) Acquires SERF SAS to Aid Its Orthopedic Segment

Bruker Corporation ( BRKR ) Hits 52-Week High: What's Driving It?

Phibro Stock ( PAHC ) Rises 7% YTD: Will the Run Continue?

The Zacks Analyst Blog Highlights Disney, Morgan Stanley, Stryker, Shopify and Delta Air Lines

Top Stock Reports for Disney, Morgan Stanley & Stryker

Reasons to Add Stryker ( SYK ) Stock in Your Portfolio Now

Here's Why You Should Retain National Vision ( EYE ) Stock Now

Stryker completes acquisition of SERF SAS

Walgreens' ( WBA ) AllianceRx Pharmacy Will Distribute VIVJOA

Here's Why Investors Should Buy Phibro ( PAHC ) Stock Now

Align Technology ( ALGN ) Gains From Innovation, Macro Issues Ail

Here's Why Investors Should Retain Abbott ( ABT ) Stock Now

Edwards Lifesciences ( EW ) Up 21.8% YTD: What's Driving It?

Inspira Technologies ( IINN ) Strives to Get AMAR Nod for ART100

Cartilage Repair Market Anticipates Rapid Growth, Projected To Reach $2.3 Billion In 2028 As Per The Business Research Company's Cartilage Repair Global Market Report 2024

Silvernail Elected International Paper Chief Executive Officer - PR Newswire

Here's Why You Should Retain Tandem Diabetes ( TNDM ) Now

Chemed ( CHE ) Reaches a New 52-Week High: What's Driving It?

Labcorp ( LH ) Presents New Research on Precision Diagnostics

Boston Scientific ( BSX ) Global Growth Robust, Macro Issues Ail

PetIQ ( PETQ ) Broadens Minties Line With Large Dogs Dental Treats

Here's Why You Should Buy Insulet ( PODD ) Stock Right Now

Exact Sciences' ( EXAS ) BLUE-C Study Results Published in NEJM

Monogram Orthopaedics ( NASDAQ: MGRM ) Aims To Overcome Robot Shortcomings With Its Advanced Solution - Monogram Orthopaedics ( NASDAQ:MGRM ) , Stryker ( NYSE:SYK )

Which Stocks Will Dominate The Future Of Tech? UBS Shares Its Top Picks In AI, Healthtech, Greentech, And Fintech - Air Liquide ( OTC:AIQUY ) , ASML Holding ( NASDAQ:ASML )

Stryker Unusual Options Activity - Stryker ( NYSE:SYK )

Edwards Lifesciences ( EW ) Hits 52-Week High: What's Driving It?

Charles River ( CRL ) Extends Gene Therapy Offering With New Pact

Labcorp ( LH ) Expands Strategic Alliances, Test Sales Fall

If You Invested $1000 In This Stock 20 Years Ago, You Would Have $8,100 Today - Stryker ( NYSE:SYK )

Envista ( NVST ) Faces Macroeconomic Challenges, FX Headwind

Inspira Technologies ( IINN ) Releases Favorable Data on VORTX

Here's Why You Should Retain Charles River ( CRL ) Stock Now

Bruker ( BRKR ) Up 20.7% Since Last Earnings: What's Driving It?

Chemed's ( CHE ) VITAS Segment Inks New Deal With Covenant Care

Here's Why You Should Retain Globus Medical ( GMED ) Stock Now

Edwards Lifesciences' ( EW ) SAPIEN TAVR Study Outcome Favorable

Alcon's ( ALC ) New Launch Strengthens IOL Innovation Leadership

FOOT LOCKER, INC. NAMES CINDY CARLISLE CHIEF HUMAN RESOURCES OFFICER

Integra LifeSciences ( IART ) Introduces MicroMatrix Flex

Bio-Rad ( BIO ) Suffers due to BioPharma Softness, Stiff Competition

KORU Medical ( KRMD ) Forms New Deal on Subcutaneous Infusion

Here's Why You Should Retain Medtronic ( MDT ) Stock for Now

Bruker ( BRKR ) Announces Advanced timsTOF Solutions at US HUPO

Thermo Fisher ( TMO ) Unveils CorEvitas Clinical Registry in GPP

Here's Why You Should Retain Teleflex ( TFX ) Stock for Now

Medtronic's ( MDT ) MiniMed 780G System Study Data Favorable

Zimmer Biomet ( ZBH ) Rides on ROSA Uptake, Favorable Trend

Global Hospital Beds Market Insights 2024: A $4.84 Billion Industry by 2029, Driven by a Large Pool of Target Patient Population, Increasing Elderly Population, and Chronic Disease Prevalence

Why Is Phibro ( PAHC ) Up 12.7% Since Last Earnings Report?

Why Is Phibro ( PAHC ) Up 12.7% Since Last Earnings Report?

Labcorp ( LH ) Introduces Weight Loss Management Portfolio

Neuronetics ( STIM ) Progresses in MRD and TRD With New Deal

Alcon's ( ALC ) Vivity EDOF IOL Achieves One Million Milestone

Here's Why You Should Retain Walgreens Boots ( WBA ) For Now

Abbott ( ABT ) to Reduce Childhood Malnutrition With New Pact

Phibro ( PAHC ) Appears Well Poised on Launches, Vaccine Sales

ResMed ( RMD ) Debuts the Smallest Full-Face CPAP Mask AirFit F40

Here's Why You Should Hold on to Neogen ( NEOG ) Stock Now

Hologic's ( HOLX ) BCI Genomic Test Study Outcome Favorable

Quanterix ( QTRX ) AD Offering Gets FDA's Breakthrough Device Tag

Edwards ( EW ) Gains From RESILIA's Global Adoption, TAVR Growth

Stryker ( SYK ) Completes First Arthroplasty Surgery in Europe

Haemonetics ( HAE ) Signs Agreement to Acquire Attune Medical

Reasons to Retain Prestige Consumer ( PBH ) Stock for Now

CVS Health ( CVS ) Expands In-Home Diagnostic Care With New Test

Penumbra ( PEN ) Gains From Innovation, Mounting Costs Ail

Here's Why Investors Should Retain Bruker ( BRKR ) Stock Now

QIAGEN ( QGEN ) Launches AI-Driven Biomedical Knowledge Base

Why Is Boston Scientific ( BSX ) Up 2.1% Since Last Earnings Report?

Peering Into Stryker's Recent Short Interest - Stryker ( NYSE:SYK )

Myriad Genetics ( MYGN ) to Evaluate MRD Testing With New Pact

Here's Why You Should Retain Omnicell ( OMCL ) Stock Now

Endoscopic Camera Market Size Is Expected To Grow At A Rate Of More Than 9% Through 2024-2028 As Per The Business Research Company's Endoscopic Camera Global Market Report 2024

Integra's ( IART ) Q4 Earnings Miss Estimates, Margins Down

National Vision ( EYE ) Q4 Earnings Top Estimates, Margins Fall