April 27, 2024 Alphabet and Microsoft’s AI Investments Yield Strong Returns

April 26, 2024 Top 10 High Dividend Yield Stocks

Tesla Q1: Model 2 Could Be Their Model T

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

HES Stock News and Mentions of Hess Corporation Stocktwits

HES Stock News and Mentions of Hess Corporation Stocktwits

Updated: April 28, 2024 (09:14)

Sector: Energy

Welcome to PandaPulse, innovative analytical stock market observer, where the latest news and stocktwits meets in-depth investor relations insights. Dive into our real-time sentiment analysis to gauge the mood of the markets and arm yourself with key information that resonates with both savvy investors and casual traders.

We meticulously analyze the sentiment trend in each article for the last 60 days where Hess Company is mentioned. We assess its relevance and importance to carry out an overall sentiment valuation of Hess Corporation (HES).

You can view the trend designation for each individual article below. We use this data to compile indicators into one comprehensive sentiment value, which represents the current information agenda about the Hess stocks.

News and Mentions of Hess Corporation (HES)

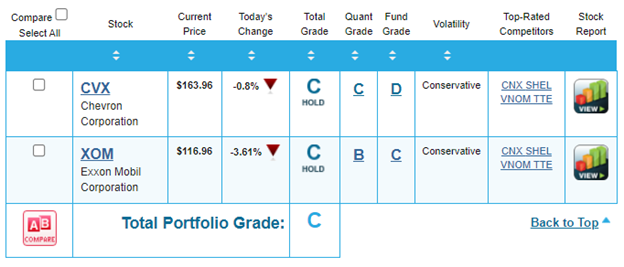

Chevron and Exxon Earnings Are in… Are they Good Buys?

RPC ( RES ) Lags on Q1 Earnings, Reiterates '24 Capex View

Phillips 66 ( PSX ) Q1 Earnings Miss, Revenues Increase Y/Y

Galp Energia ( GLPEY ) Taps Into Vast Hydrocarbon Reserves

Oceaneering ( OII ) Q1 Earnings and Revenues Miss Estimates

Helmerich & Payne ( HP ) Q2 Earnings and Revenues Top Estimates

Exxon stock falls as earnings miss on lower natural gas prices and squeezed refining margins

Chevron beats earnings estimates but profit falls on lower refining margins and natural gas prices

Meet the Industry-Leading Stock Billionaires Warren Buffett, Ken Griffin, Ken Fisher, and Steven Cohen Can't Stop Buying

Exxon, Chevron Earnings Are Coming. Giants Spar Over South America's Oil Jewel.

Eni ( E ) to Divest Its UK Upstream Assets to Ithaca Energy

Hess ( HES ) Q1 Earnings Beat on Higher Production Volumes

Transocean ( RIG ) Prolongs Its Stay With Hess and TotalEnergies

Antero Midstream ( AM ) Q1 Earnings Meet Estimates, Revenues Top

Hess ( HES ) Q1 Earnings and Revenues Beat Estimates

Hess ( NYSE:HES ) Now Covered by Analysts at StockNews.com

XOM vs CVX: Which Energy Stock Shows Promise Ahead of Q1 Earnings?

Phillips 66 ( PSX ) Gears Up for Q1 Earnings: What's in Store?

DT Midstream ( DTM ) Earnings Expected to Grow: Should You Buy?

Shell ( SHEL ) and Exxon ( XOM ) Bid Farewell to Groningen Field

4 Stocks Backed by High Efficiency to Increase Portfolio Returns

If You'd Invested $1,000 in Chevron 5 Years Ago, Here's How Much You'd Have Today

The Zacks Analyst Blog Highlights Meta Platforms, General Motors, United Rentals, Hess and Valero Energy

New Fortress ( NFE ) Advances Construction of 1.6GW Power Plant

Time to Buy Chevron's ( CVX ) Stock as Q1 Earnings Approach?

ExxonMobil and Chevron Stock Have 22%-30% Upside, According to 1 Wall Street Analyst

SHAREHOLDER INVESTIGATION: Halper Sadeh LLC Investigates MCBC, HES, MGRC, ANSS - Ansys ( NASDAQ:ANSS ) , Hess ( NYSE:HES )

Kuehn Law Encourages MCBC, HES, MGRC, and ANSS Investors to Contact Law Firm

SilverBow's ( SBOW ) Buyout Proposal Withdrawn by Kimmeridge

Top 5 S&P 500 Giants Set to Beat on Q1 Earnings Next Week

Is a Beat in Store for Hess ( HES ) This Earnings Season?

Petrobras' ( PBR ) Buzios Field Achieves Production Milestone

Why Hess ( HES ) is Poised to Beat Earnings Estimates Again

Hess ( HES ) Earnings Expected to Grow: Should You Buy?

$1000 Invested In This Stock 5 Years Ago Would Be Worth $2,200 Today - Hess ( NYSE:HES )

Why I Just Bought More of This Top Oil Stock

Hess ( NYSE:HES ) Now Covered by StockNews.com

3 Reasons Why Growth Investors Shouldn't Overlook Hess ( HES )

Shell ( SHEL ) Collaborates With Seatrium to Enhance FPS Technology

Subsea7 ( SUBCY ) Secures Talos' Sunspear Development Contract

Guyana's Oil Spigot Wide Open: Exxon, Hess Sanction Massive $12.7B Oil Project - Hess ( NYSE:HES ) , Exxon Mobil ( NYSE:XOM )

Behind The Numbers: Chevron CEO's Pay Soars To $26.5M - Chevron ( NYSE:CVX )

Hess ( NYSE:HES ) Now Covered by StockNews.com

Why This 1 Momentum Stock Could Be a Great Addition to Your Portfolio

Oil Is Up, These 3 Energy Stocks Are Set to Reward Investors

Here's Why You Should Retain Chevron ( CVX ) Stock for Now

The Zacks Analyst Blog Highlights Berkshire Hathaway, NVIDIA, Bank of America, Occidental Petroleum and Chevron

$1000 Invested In This Stock 5 Years Ago Would Be Worth $2,500 Today - Hess ( NYSE:HES )

Oil Prices Holds Above $85 As Israel Braces For Iran Response

2 Beloved Warren Buffett Stocks to Watch on Rise in Oil Prices

Peering Into Hess's Recent Short Interest - Hess ( NYSE:HES )

Warren Buffett's Favorite Stock Nears Buy Point As Oil Eyes $90

Top Analyst Reports for Alphabet, Oracle & Chevron

ExxonMobil ( XOM ) & CNOOC Challenge Chevron's Guyana Acquisition

4 Top Dividend Stocks Yielding 4% to Buy in April

Hess ( NYSE:HES ) Coverage Initiated at StockNews.com

2 Energy Stocks You Can Buy Right Now Before They Surge Even Higher

StockNews.com Initiates Coverage on Hess ( NYSE:HES )

's 'Stock Whisper' Index: 5 Stocks Investors Secretly Monitor But Don't Talk About Yet - Bank of America ( NYSE:BAC ) , Boston Scientific ( NYSE:BSX )

Insider Unloading: Andrew P Slentz Sells $3.06M Worth Of Hess Shares - Hess ( NYSE:HES )

Hess Senior Vice President Trades Company's Stock - Hess ( NYSE:HES )

U.S. energy secretary tells skeptical executives natural gas export pause will be short-lived

The Zacks Analyst Blog Highlights Diamondback Energy, Exxon Mobil, Chevron, Pioneer Natural Resources and Hess

Chevron Stock Has 29% Upside, According to 1 Wall Street Analyst

3 Stocks to Watch on Oil Companies' Rush to Drill Land

Chevron, JX Nippon Set Sail on CO2 Storage Voyage Across Asia Pacific - Chevron ( NYSE:CVX )

ExxonMobil Continues to Find Oil in a Place Chevron Really Wants to Be

Exxon CEO Denies Interest in Buying Hess, Focuses on Preemption Rights In Dispute with Chevron: Report - Exxon Mobil ( NYSE:XOM )

2 Warren Buffett Stocks to Buy Hand Over Fist in March

StockNews.com Initiates Coverage on Hess ( NYSE:HES )

Here's How Much $100 Invested In Hess 5 Years Ago Would Be Worth Today - Hess ( NYSE:HES )

Why Is Occidental ( OXY ) Up 4.1% Since Last Earnings Report?

Unpacking the Latest Options Trading Trends in Hess - Hess ( NYSE:HES )

Oil & Gas Stock Roundup: CVX & HES Take Center Stage

Kuehn Law Encourages VIVK, HES, SDPI, and AKTX Investors to Contact Law Firm - Akari Therapeutics ( NASDAQ:AKTX ) , Hess ( NYSE:HES )

Is Invesco S&P 500 Equal Weight Energy ETF ( RSPG ) a Strong ETF Right Now?

StockNews.com Initiates Coverage on Hess ( NYSE:HES )

Hess reviews timeline for Chevron deal closing after Exxon escalates Guyana dispute

Hess' ( HES ) Guyana Oil Assets Spark Major Energy Sector Dispute

A Closer Look at Hess's Options Market Dynamics - Hess ( NYSE:HES )

Should You Invest in the Invesco S&P 500 Equal Weight Energy ETF ( RSPG ) ?

Got $1000? Buy These 3 Stocks That Yield 4% or Higher

Why Is Hess ( HES ) Up 3% Since Last Earnings Report?

Hess Insider Trades Send A Signal - Hess ( NYSE:HES )

Behind the Scenes of Hess's Latest Options Trends - Hess ( NYSE:HES )

Ovintiv Getting Closer To Key Technical Benchmark