April 27, 2024 Alphabet and Microsoft’s AI Investments Yield Strong Returns

April 26, 2024 Top 10 High Dividend Yield Stocks

Tesla Q1: Model 2 Could Be Their Model T

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Comcast (CMCSA) Stock Forecast for 2024–2028. Sell or Buy?

Updated: April 29, 2024 (10:11)

Sector: Communication servicesThe share price of Comcast Corp. (CMCSA) now

50/200 Day Moving Average: $41.78 / $43.33

This figure corresponds to the Average Price over the previous 50/200 days. For Comcast stocks, the 50-day moving average is the resistance level today.

For Comcast stocks, the 200-day moving average is the resistance level today.

Are you interested in Comcast Corp. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Comcast stock price in 2024, 2025, 2026, 2027, 2028. How much will one Comcast share be worth in 2024 - 2028?

When should I take profit in Comcast stock? When should I record a loss on Comcast stock? What are analysts' forecasts for Comcast stock? What is the future of Comcast stock? We forecast Comcast stock performance using neural networks based on historical data on Comcast stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Comcast stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Comcast shares. This happens once a day.

Historical and forecast chart of Comcast stock

The chart below shows the historical price of Comcast stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Comcast stock price can be found in the table below.

Long-term forecasts by years.

Decoding the Future: Navigating CMCSA Stock's Ups and Downs

Peering into the kaleidoscope of financial analytics, the CMCSA stock forecast presents an intriguing vista shaped by a number of pivotal events and factors. Amid the shifting sands of the Comcast name stock forecast, discerning investors and analysts are keenly watching two major influences: the ongoing decline in cable subscribers and the financial viability of Peacock, Comcast's streaming service. These elements are crucial in shaping strategies for those pondering if CMCSA is a good stock to buy.

Strategic Analysis: Mapping CMCSA's Trajectory

For analysts focused on delivering an accurate CMCSA stock price prediction, understanding the dual impact of subscriber trends and Peacock's performance becomes paramount. The dwindling number of cable subscribers, once seen as a dire threat to Comcast, is now counterbalanced by the company's robust broadband footprint. This reality serves as a litmus test, challenging analysts to weigh the company's broadband moat against the backdrop of changing consumer preferences. Meanwhile, Peacock's adjusted EBITDA loss spells a cautionary tale of growth versus profitability, becoming a critical lever in any CMCSA stock price target deliberation.

To navigate these waters, analysts amalgamate these insights to guide their recommendations on whether to buy or sell Comcast stock. The intricacies of CMCSA's evolving landscape thus offer a fertile ground for crafting investment strategies that reflect not just current realities but forecasted trends. Answering whether CMCSA stock is a buy or sell hinges on the delicate balance of its broadband crown jewel against the uncertainties clouding Peacock's horizon.

Review the original Analysis

Unlocking Comcast's Potential: A Sneak Peek into CMCSA's Stock Forecast

Comcast Corporation (CMCSA) stands at the precipice of exciting times with several upcoming events poised to significantly influence its stock rates. Analysts keen on making an accurate CMCSA stock price prediction should closely monitor a trio of powerhouse catalysts. Firstly, the broadcasting of the Summer Olympics is anticipated to be a major revenue booster through advertising. Additionally, the political windfall from the U.S. presidential election could potentially pump up campaign-related spending. Last but not least, the much-awaited debut of Orlando's Epic Universe amusement park in 2025 is set to infuse CMCSA with a fresh stream of earnings.

Strategizing Investment Moves with CMCSA

Analyzing these factors, it's clear how they can be leveraged for making the most accurate CMCSA stock forecast. The company's valuation, currently an attractive facet at 7x EBT, hints at an undervalued asset ripe for the picking. This valuation, coupled with a robust growth outlook projecting an 8.1% EPS CAGR over the next five years, anchors CMCSA as a promising investment.

For anyone pondering, "Is CMCSA a good stock to buy?" the answer leans towards a strong affirmative. Given its solid growth trajectory supported by high ROCE and attractive reinvestment rates, along with immediate, impactful events on the horizon, Comcast appears as a compelling candidate for those looking to diversify their portfolio.

Summing it up, to navigate the question of "buy or sell Comcast stock?", potential and current investors should weigh these influencing events and factors. By doing so, they can harness this pivotal moment to optimize their investment strategy, potentially marking CMCSA stock as a buy.

Review the original Analysis

CMCSA Stock: Navigating the Winds of Change

With the ever-evolving landscape of the stock market, CMCSA stocks are poised at a significant juncture, influenced by a blend of pivotal events and underlying factors. Analysts pondering whether CMCSA is a good stock to buy or sell are keenly observing several critical dynamics. Foremost among these is the company's pronounced undervaluation, which frames a compelling narrative for potential stock price appreciation. The spotlight shines bright on CMCSA's valuation and undervaluation metrics, offering a convincing argument for a soon-to-arrive catch-up trade.

Key Catalysts Shaping CMCSA's Future

As we peer into the crystal ball for a CMCSA stock price prediction, the recent triumphs in Q4 2023, particularly Universal's box office dominance and expanded internet connectivity, emerge as significant harbingers. These achievements not only bolster the Comcast stock forecast but also paint a robust picture of future growth. Coupled with favorable earnings estimates and a solid balance sheet, these elements form the bedrock of positive momentum for CMCSA stock price target adjustments.

Dividend continuity and growth also play a vital role, attracting a broader investor base seeking consistent returns. This factor, combined with a detailed comparison to industry counterparts like Disney, showcases CMCSA as an undervalued gem with a promising outlook. Such analysis is crucial for those in the market wondering, "Is CMCSA a good stock to buy?" By factoring in these elements, analysts are better positioned to make accurate forecasts on the buy or sell Comcast stock dilemma, navigating through the myriad of influences with a sharper lens.

Understanding the interplay of these key drivers—valuation, Q4 highlights, financial strength, dividend attractiveness, and competitive positioning—provides the insight needed for a well-rounded Comcast name stock forecast. As CMCSA continues to capitalize on its strategic advantages, its stock rates are expected to reflect the positive trajectory dictated by these influential factors.

Review the original Analysis

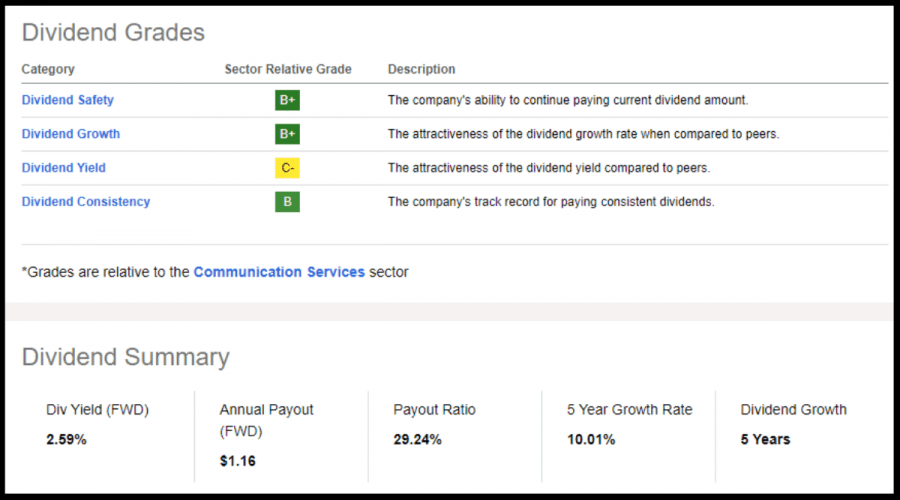

Comcast Corporation, a prominent cable and satellite provider, has been enjoying a rising trend in 2023. This momentum is due to healthy cash flows and impressive broadband metrics that consecutively exceeded both top and bottom line earnings expectations, along with smart technology investments. The company managed to outdo its rivals AT&T and Verizon by increasing its broadband market share. Additionally, Comcast boasts 13 successive years of dividend payments and five years of dividend growth. It also has a payout ratio close to 30%, signifying immense profitability.

Despite its success, Comcast’s stock is surprisingly affordable as it carries a C- grade valuation. The forward Non-GAAP P/E ratio stands at just 11.85x, notably lower than the sector average of 14.60x. Likewise, its forward PEG ratio is down by 32%. Over the past three months, as many as 22 Wall Street analysts have tweaked their forecasts upwards. Furthermore, Comcast’s sturdy balance sheet which ranks among the best amid its primary competitors backs up its stable dividend safety grade. In light of these factors, investing in Comcast might be considered an effortless and straightforward option.

Comcast daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May 01 | 40.43 | 39.91 | 41.27 | 3.40 |

| May 02 | 40.82 | 40.21 | 41.58 | 3.41 |

| May 03 | 41.09 | 40.74 | 41.74 | 2.46 |

| May 04 | 40.13 | 39.74 | 40.46 | 1.81 |

| May 05 | 40.18 | 39.38 | 40.73 | 3.43 |

| May 06 | 40.26 | 39.74 | 40.95 | 3.06 |

| May 07 | 39.96 | 39.59 | 40.23 | 1.61 |

| May 08 | 39.67 | 39.18 | 40.34 | 2.95 |

| May 09 | 39.39 | 38.93 | 39.70 | 1.98 |

| May 10 | 38.50 | 38.10 | 38.77 | 1.75 |

| May 11 | 38.51 | 38.24 | 39.27 | 2.68 |

| May 12 | 38.20 | 37.41 | 38.81 | 3.75 |

| May 13 | 38.33 | 37.53 | 38.86 | 3.55 |

| May 14 | 38.85 | 38.03 | 39.40 | 3.60 |

| May 15 | 38.56 | 38.07 | 39.40 | 3.49 |

| May 16 | 39.54 | 39.04 | 39.88 | 2.16 |

| May 17 | 40.56 | 40.29 | 41.43 | 2.85 |

| May 18 | 41.62 | 41.22 | 42.22 | 2.43 |

| May 19 | 40.57 | 39.85 | 41.15 | 3.25 |

| May 20 | 39.92 | 39.18 | 40.37 | 3.02 |

| May 21 | 40.02 | 39.20 | 40.86 | 4.23 |

| May 22 | 39.44 | 38.84 | 39.75 | 2.33 |

| May 23 | 39.38 | 38.61 | 39.74 | 2.91 |

| May 24 | 39.69 | 39.41 | 40.54 | 2.85 |

| May 25 | 40.77 | 40.45 | 41.39 | 2.31 |

| May 26 | 40.99 | 40.70 | 41.40 | 1.72 |

| May 27 | 40.21 | 39.69 | 41.04 | 3.40 |

| May 28 | 40.50 | 40.02 | 41.34 | 3.29 |

| May 29 | 40.22 | 39.43 | 40.56 | 2.88 |

| May 30 | 40.72 | 39.89 | 41.46 | 3.94 |

Comcast Daily Price Targets

Comcast Stock Forecast 05-01-2024.

Forecast target price for 05-01-2024: $40.43.

Positive dynamics for Comcast shares will prevail with possible volatility of 3.292%.

Pessimistic target level: 39.91

Optimistic target level: 41.27

Comcast Stock Forecast 05-02-2024.

Forecast target price for 05-02-2024: $40.82.

Positive dynamics for Comcast shares will prevail with possible volatility of 3.299%.

Pessimistic target level: 40.21

Optimistic target level: 41.58

Comcast Stock Forecast 05-03-2024.

Forecast target price for 05-03-2024: $41.09.

Positive dynamics for Comcast shares will prevail with possible volatility of 2.398%.

Pessimistic target level: 40.74

Optimistic target level: 41.74

Comcast Stock Forecast 05-04-2024.

Forecast target price for 05-04-2024: $40.13.

Negative dynamics for Comcast shares will prevail with possible volatility of 1.777%.

Pessimistic target level: 39.74

Optimistic target level: 40.46

Comcast Stock Forecast 05-05-2024.

Forecast target price for 05-05-2024: $40.18.

Positive dynamics for Comcast shares will prevail with possible volatility of 3.314%.

Pessimistic target level: 39.38

Optimistic target level: 40.73

Comcast Stock Forecast 05-06-2024.

Forecast target price for 05-06-2024: $40.26.

Positive dynamics for Comcast shares will prevail with possible volatility of 2.973%.

Pessimistic target level: 39.74

Optimistic target level: 40.95

CMCSA (CMCSA) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May. | 40.49 | 39.26 | 41.27 | 4.87 |

| Jun. | 40.33 | 39.33 | 41.00 | 4.09 |

| Jul. | 41.33 | 40.30 | 43.41 | 7.16 |

| Aug. | 40.17 | 38.18 | 42.03 | 9.17 |

| Sep. | 39.53 | 37.28 | 40.67 | 8.32 |

| Oct. | 40.95 | 38.53 | 42.36 | 9.05 |

| Nov. | 40.62 | 38.32 | 42.31 | 9.45 |

| Dec. | 41.50 | 40.11 | 43.33 | 7.43 |

Comcast forecast for this year

Comcast Stock Prediction for May 2024

An uptrend is forecast for this month with an optimal target price of $40.4892. Pessimistic: $39.26. Optimistic: $41.27

Comcast Stock Prediction for Jun 2024

An downtrend is forecast for this month with an optimal target price of $40.3272. Pessimistic: $39.33. Optimistic: $41.00

Comcast Stock Prediction for Jul 2024

An uptrend is forecast for this month with an optimal target price of $41.3273. Pessimistic: $40.30. Optimistic: $43.41

Comcast Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $40.1701. Pessimistic: $38.18. Optimistic: $42.03

Comcast Stock Prediction for Sep 2024

An downtrend is forecast for this month with an optimal target price of $39.5274. Pessimistic: $37.28. Optimistic: $40.67

Comcast Stock Prediction for Oct 2024

An uptrend is forecast for this month with an optimal target price of $40.9504. Pessimistic: $38.53. Optimistic: $42.36

Comcast Stock Prediction for Nov 2024

An downtrend is forecast for this month with an optimal target price of $40.6228. Pessimistic: $38.32. Optimistic: $42.31

Comcast Stock Prediction for Dec 2024

An uptrend is forecast for this month with an optimal target price of $41.5003. Pessimistic: $40.11. Optimistic: $43.33

Comcast (CMCSA) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 42.53 | 39.91 | 44.26 | 9.84 |

| Feb | 44.74 | 42.70 | 45.71 | 6.58 |

| Mar | 43.77 | 41.08 | 45.70 | 10.11 |

| Apr | 40.38 | 38.15 | 41.93 | 9.01 |

| May | 40.25 | 37.74 | 40.96 | 7.86 |

| Jun | 40.99 | 38.56 | 43.35 | 11.04 |

| Jul | 42.99 | 40.93 | 45.74 | 10.53 |

| Aug | 44.54 | 43.40 | 46.50 | 6.67 |

| Sep | 47.67 | 46.07 | 48.82 | 5.63 |

| Oct | 50.00 | 47.68 | 50.96 | 6.44 |

| Nov | 50.68 | 49.71 | 51.94 | 4.29 |

| Dec | 49.54 | 47.52 | 50.49 | 5.89 |

Comcast (CMCSA) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 50.57 | 48.55 | 51.59 | 5.88 |

| Feb | 50.13 | 48.16 | 51.29 | 6.10 |

| Mar | 47.92 | 46.27 | 50.61 | 8.56 |

| Apr | 46.58 | 45.58 | 48.74 | 6.50 |

| May | 45.31 | 43.68 | 46.40 | 5.86 |

| Jun | 46.47 | 43.54 | 48.89 | 10.95 |

| Jul | 49.67 | 47.57 | 50.78 | 6.34 |

| Aug | 47.53 | 46.20 | 50.30 | 8.16 |

| Sep | 45.05 | 42.89 | 47.40 | 9.51 |

| Oct | 42.71 | 41.04 | 44.15 | 7.04 |

| Nov | 40.08 | 38.96 | 41.59 | 6.32 |

| Dec | 39.41 | 37.96 | 40.07 | 5.27 |

Comcast (CMCSA) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 38.34 | 36.46 | 39.26 | 7.11 |

| Feb | 38.98 | 37.70 | 41.32 | 8.75 |

| Mar | 40.10 | 38.21 | 42.41 | 9.91 |

| Apr | 38.92 | 38.14 | 40.69 | 6.27 |

| May | 41.19 | 38.55 | 42.67 | 9.65 |

| Jun | 40.92 | 39.22 | 42.82 | 8.41 |

| Jul | 39.29 | 37.59 | 40.23 | 6.56 |

| Aug | 36.40 | 35.70 | 38.29 | 6.77 |

| Sep | 36.10 | 34.05 | 38.42 | 11.35 |

| Oct | 34.72 | 32.61 | 36.36 | 10.31 |

| Nov | 35.69 | 34.09 | 36.63 | 6.94 |

| Dec | 37.83 | 36.41 | 39.19 | 7.10 |

Comcast (CMCSA) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 40.86 | 39.03 | 42.04 | 7.15 |

| Feb | 42.53 | 41.64 | 44.09 | 5.56 |

| Mar | 42.19 | 39.52 | 43.06 | 8.23 |

| Apr | 44.51 | 42.56 | 45.26 | 5.98 |

| May | 43.52 | 42.58 | 44.25 | 3.78 |

| Jun | 41.98 | 39.97 | 44.47 | 10.12 |

| Jul | 43.83 | 43.10 | 45.87 | 6.04 |

| Aug | 45.30 | 42.95 | 46.21 | 7.06 |

| Sep | 45.27 | 42.95 | 46.68 | 7.99 |

| Oct | 45.78 | 44.60 | 47.02 | 5.14 |

| Nov | 43.21 | 40.86 | 45.01 | 9.22 |

| Dec | 44.77 | 43.91 | 45.88 | 4.29 |

Comcast information and performance

ONE COMCAST CENTER, PHILADELPHIA, PA, US

Market capitalization of the Comcast Corp. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of CMCSA shares in the company outstanding by the market price of one share.

EBITDA of Comcast is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.

Comcast (CMCSA) stock dividend

Comcast last paid dividends on 04/02/2024. The next scheduled payment will be on 04/24/2024. The amount of dividends is $1.16 per share. If the date of the next dividend payment has not been updated, it means that the issuer has not yet announced the exact payment. As soon as information becomes available, we will immediately update the data. Bookmark our portal to stay updated.

Last Split Date: 01/01/1970

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

For example, a 5: 1 ratio means that the value of one share will decrease 5 times, the total amount will increase 5 times. It is important to understand that this procedure does not change the capitalization of the company, as well as the total value of assets held in private hands.