October 1, 2024 Investor Beware: Port Strike Puts Key Stocks And Sectors At Risk

September 30, 2024 Market Movers: Jobs Report and Key Earnings in Focus

September 19, 2024 Federal Reserve’s Aggressive Move Hints At Bold Economic Strategy

Amazon: Cheaper Than You Think

Tesla Stock: Robotaxi Was A Poor Catalyst

Microsoft: It’s Time To Look Elsewhere (Rating Downgrade)

Apple’s Q4 2024 Earnings May Disappoint You

October 3, 2024 Your Path to Profits: The Best Trading Platforms for New Traders

October 3, 2024 Mastering Trading Indicators: Your Essential Toolkit For Success

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

Australian Dollar to US Dollar (AUD/USD) Forecast for 2024, 2025, 2026. Sell or Buy?

Updated: October 18, 2024 (2:49)

Reverse forecast: USD to AUD

Australian Dollar / US Dollar price online today

| Now | Tomorrow | 7 Days | 30 Days | |

|---|---|---|---|---|

| 100 Australian Dollar (AUD) to US Dollar (USD) | 67.1 | 67.8 | 68.2 | |

| 200 Australian Dollar (AUD) to US Dollar (USD) | 134.2 | 135.5 | 136.4 | |

| 500 Australian Dollar (AUD) to US Dollar (USD) | 335.6 | 338.8 | 340.9 | |

| 1000 Australian Dollar (AUD) to US Dollar (USD) | 671.1 | 677.6 | 681.8 | |

| 3000 Australian Dollar (AUD) to US Dollar (USD) | 2013.4 | 2032.9 | 2045.3 |

How much will the AUD/USD currency pair cost in 2024, 2025 and 2026? What is the forecast for the AUD/USD currency pair? What is the target price of the Australian Dollar / US Dollar currency pair for 2024-2026?

We continuously scrutinize the key events in the news flow to assist you in tackling the essential question: Will the Australian Dollar rise or fall against the US Dollar?

Identifying the trend of the AUD/USD currency pair

Recent news articles provide valuable insights into potential trends affecting the AUDUSD exchange rates. The increasing inclination towards cryptocurrencies, particularly with Bitcoin’s potential to skyrocket as noted by Michael Saylor, suggests a possible shift of capital from the USD to digital assets. This may result in USD weakness, impacting the AUDUSD pair.

A mixed sentiment is observed in the global markets. While the Dow reaches record highs, the performance divide in mega-cap tech and financial stocks, coupled with ongoing Middle East uncertainties, could weigh on the USD, fostering relative strength in the AUD.

The emerging use of stablecoins backed by the USD on a global scale is noteworthy, indicating a slight bullish trend for the USD’s utility, yet the domestic regulatory ambiguity may temper its broader influence. Simultaneously, a strengthening USD, illustrated by its three-month highs, reflects a demand for safe-haven fiat currencies, contrasting the bullish crypto sentiment.

In conclusion, investors might anticipate moderate volatility in the AUDUSD pair with a potential tilt towards Australian dollar stability, as global economic narratives unfold and investor confidence ebbs and flows across different asset classes.

AUD Trend Prediction

As of now, Panda has analyzed 6 news pieces concerning the AUD currency. The average relevance score for these news items is 0.29 (with the closer to 1 being more relevant).|

2024-10-01

|

Bullish | Impact: 0.23 | News: 1 (1/0/0) |

|

2024-09-30

|

Bullish | Impact: 0.27 | News: 2 (2/0/0) |

|

2024-09-24

|

Neutral | Impact: -0.05 | News: 1 (0/1/0) |

|

2024-09-20

|

Neutral | Impact: 0.15 | News: 1 (0/1/0) |

|

2024-09-03

|

Neutral | Impact: -0.1 | News: 1 (0/1/0) |

MHC Digital and Circle Partner to Enhance USDC Availability in Asia-Pacific

ANZ Bank Collaborates with Project Guardian on RWA Tokenization

USD Trend Forecasting

Regarding the USD currency, 292 news pieces were analyzed. The average relevance of these news items is 0.31 (the closer to 1, the higher).|

2024-10-17

|

Bullish | Impact: 0.04 | News: 4 (2/0/2) |

|

2024-10-16

|

Bullish | Impact: 0.22 | News: 2 (2/0/0) |

|

2024-10-15

|

Bullish | Impact: 0.35 | News: 6 (5/1/0) |

|

2024-10-14

|

Neutral | Impact: 0.11 | News: 4 (1/3/0) |

|

2024-10-12

|

Bullish | Impact: 0.17 | News: 1 (1/0/0) |

|

2024-10-11

|

Neutral | Impact: -0.06 | News: 5 (1/2/2) |

|

2024-10-08

|

Neutral | Impact: 0.03 | News: 6 (0/6/0) |

Michael Saylor's Prediction: Bitcoin's Potential to Skyrocket 20,000%

Global Markets Fluctuate Amid Middle East Focus; Dow's Record and Oil's Steady Course Highlighted

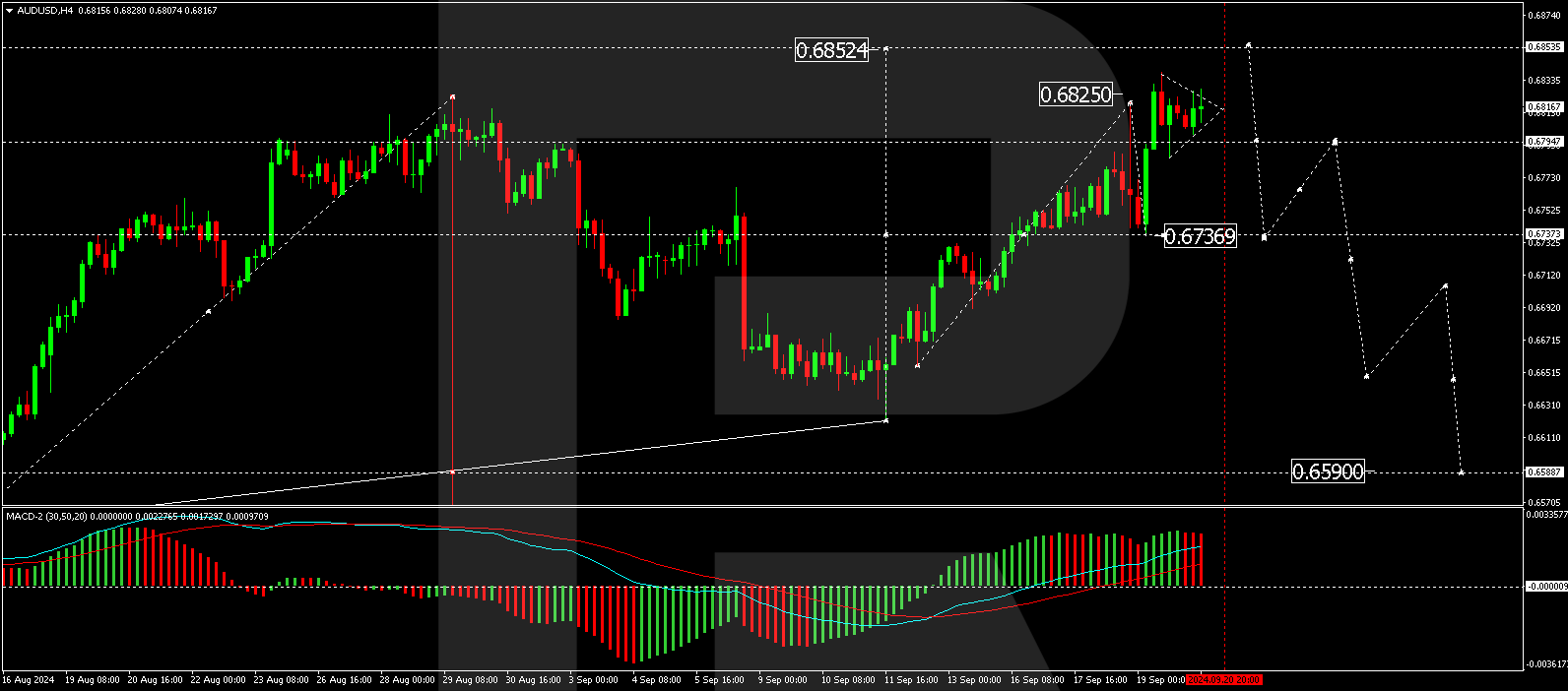

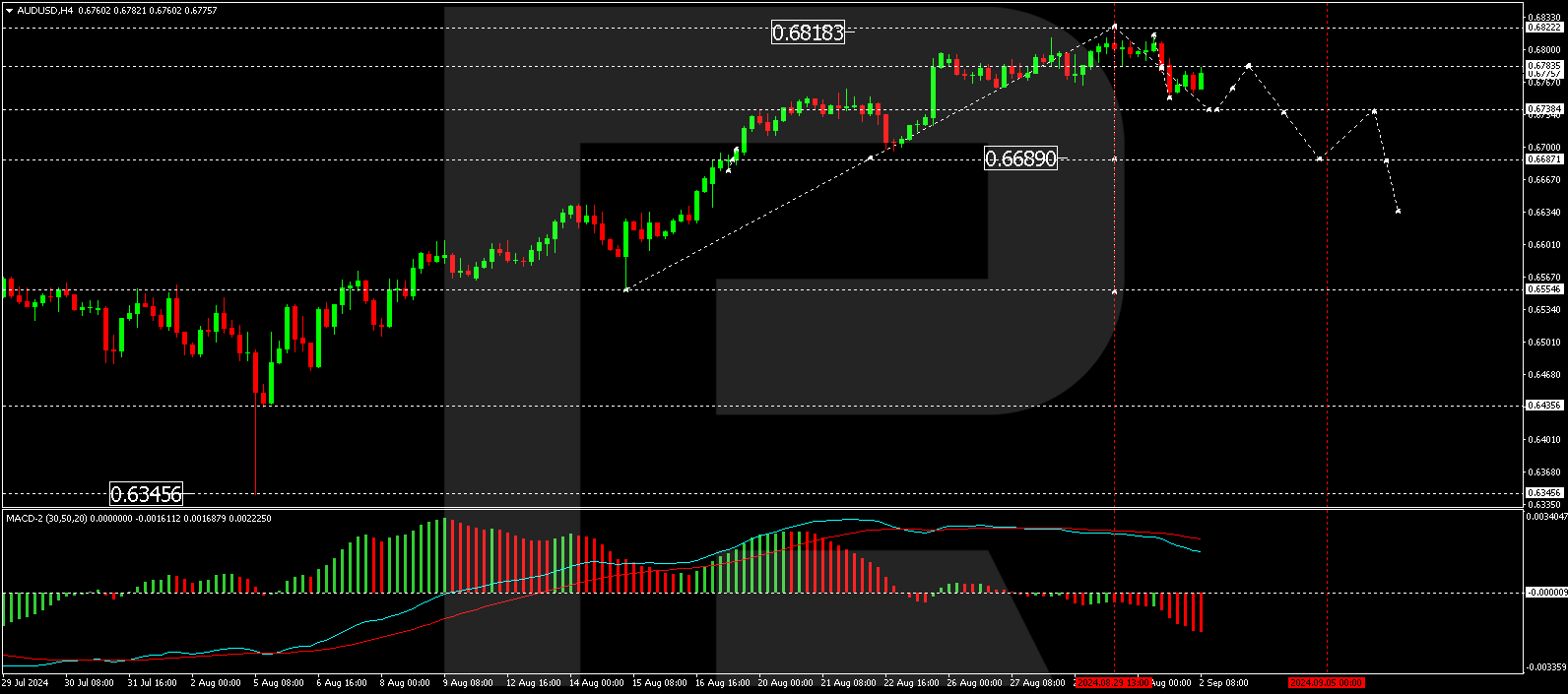

Historical and forecast chart of the Australian Dollar/US Dollar currency pair

The chart below shows the historical quotes of the AUD/USD pair and the forecast chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. A detailed forecast of the Australian Dollar/US Dollar rate can be found in the table below.

Long-term forecasts by years.

AUD Main News

Australian Dollar Hits 19-Month Peak Due to Chinese Economic Measures and Softer US Dollar

AUD/USD Hits Highest Level of 2024 Following China's Stimulus Announcement

AUD/USD Surges to Highest Peak Since December amid Improved Risk Sentiment

US Dollar Strength Leads to Australian Dollar Drop

USD Main News

US Falling Behind in Global Stablecoin Utilization - Chainalysis

World Liberty Financial Struggles to Meet Fundraising Goals with Trump Endorsement

Bitcoin Faces 'Exit Pump' Concerns Amid Strengthening USD and Rising BTC Prices

Taiwan Semiconductor Surpasses Revenue Expectations: Investment Opportunity?

Understanding Curtis Bashaw's Stance on Crypto in the Senate Race

World Liberty Financial Tokens Achieve $220M in First Hour Despite Website Issues

Ripple Unveils USD-Pegged RLUSD Amid Trump-Endorsed Push For Stablecoins Over Bitcoin

Paxos Partners with Stripe to Launch Stablecoin Payment Platform

Crude Oil Prices Plummet Amid Demand Fears; Mixed Responses in Asia and Europe

Trump-Advocated World Liberty Financial Favors Dollar-Pegged Stablecoins Over Bitcoin for US Prosperity

Tether Considers Lending to Commodity Traders to Utilize Excess Profits

Global Markets Update: Mixed European Trends, Strong Asian Gains, and U.S. Dollar Strength Amid Cooling Crude Prices

Imported Inflation Shows a Modest Increase After Long-Term Negative Trend

Rising Import Costs Prompt RBI Caution on Rupee Stability

Bitcoin Nears Key $65K Levels Amid Bullish Market Signals

Comprehensive Analysis of News and Events influencing the AUDUSD currency pair

We predict the dynamics of currency pairs using resonant artificial intelligence systems. Technical, fundamental analysis, news background, general geopolitical situation in the world and other factors are taken into account.

The results of forecasts of the Australian Dollar/US Dollar currency pair are shown below and presented in the form of charts, tables and text information, divided into time intervals (Next month, 2024, 2025 and 2026).

Forecasts are adjusted once a day taking into account the price change of the previous day.

Australian Dollar / US Dollar Daily Forecast for a Month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Oct 20 | 0.6711 | 0.6658 | 0.6752 | 1.42 % |

| Oct 21 | 0.6725 | 0.6680 | 0.6740 | 0.89 % |

| Oct 22 | 0.6800 | 0.6742 | 0.6845 | 1.53 % |

| Oct 23 | 0.6784 | 0.6757 | 0.6828 | 1.05 % |

| Oct 24 | 0.6747 | 0.6694 | 0.6800 | 1.59 % |

| Oct 25 | 0.6776 | 0.6719 | 0.6823 | 1.55 % |

| Oct 26 | 0.6787 | 0.6765 | 0.6840 | 1.10 % |

| Oct 27 | 0.6784 | 0.6744 | 0.6812 | 1.01 % |

| Oct 28 | 0.6769 | 0.6715 | 0.6815 | 1.50 % |

| Oct 29 | 0.6789 | 0.6754 | 0.6809 | 0.81 % |

| Oct 30 | 0.6798 | 0.6741 | 0.6837 | 1.43 % |

| Oct 31 | 0.6727 | 0.6703 | 0.6785 | 1.23 % |

| Nov 01 | 0.6696 | 0.6646 | 0.6746 | 1.51 % |

| Nov 02 | 0.6722 | 0.6701 | 0.6764 | 0.93 % |

| Nov 03 | 0.6752 | 0.6734 | 0.6798 | 0.95 % |

| Nov 04 | 0.6736 | 0.6689 | 0.6779 | 1.34 % |

| Nov 05 | 0.6761 | 0.6711 | 0.6801 | 1.34 % |

| Nov 06 | 0.6780 | 0.6725 | 0.6839 | 1.70 % |

| Nov 07 | 0.6767 | 0.6732 | 0.6818 | 1.29 % |

| Nov 08 | 0.6786 | 0.6748 | 0.6832 | 1.24 % |

| Nov 09 | 0.6819 | 0.6774 | 0.6867 | 1.37 % |

| Nov 10 | 0.6847 | 0.6801 | 0.6889 | 1.29 % |

| Nov 11 | 0.6850 | 0.6798 | 0.6889 | 1.33 % |

| Nov 12 | 0.6799 | 0.6748 | 0.6838 | 1.34 % |

| Nov 13 | 0.6772 | 0.6724 | 0.6793 | 1.03 % |

| Nov 14 | 0.6760 | 0.6729 | 0.6785 | 0.83 % |

| Nov 15 | 0.6752 | 0.6736 | 0.6801 | 0.96 % |

| Nov 16 | 0.6776 | 0.6737 | 0.6836 | 1.48 % |

| Nov 17 | 0.6755 | 0.6738 | 0.6800 | 0.93 % |

| Nov 18 | 0.6818 | 0.6780 | 0.6838 | 0.86 % |

Target daily price AUD/USD

Target values of the AUD/USD currency pair as of 10-20-2024.

Optimistic target level: 0.6752

Pessimistic target level: 0.6658

Target values of the AUD/USD currency pair as of 10-21-2024.

Optimistic target level: 0.6740

Pessimistic target level: 0.6680

Target values of the AUD/USD currency pair as of 10-22-2024.

Optimistic target level: 0.6845

Pessimistic target level: 0.6742

Target values of the AUD/USD currency pair as of 10-23-2024.

Optimistic target level: 0.6828

Pessimistic target level: 0.6757

Target values of the AUD/USD currency pair as of 10-24-2024.

Optimistic target level: 0.6800

Pessimistic target level: 0.6694

Australian Dollar / US Dollar (AUD/USD) Forecast 2024 Monthly

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Nov | 0.6582 | 0.6406 | 0.6733 | 4.86 % |

| Dec | 0.6403 | 0.6189 | 0.6476 | 4.44 % |

AUD/USD forecast for this year

Forecast of the AUD/USD pair for Nov 2024

Forecast of the AUD/USD pair for Dec 2024

Australian Dollar / US Dollar (AUD/USD) Forecast 2025 Monthly

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 0.6541 | 0.6406 | 0.6646 | 3.61 % |

| Feb | 0.6833 | 0.6695 | 0.6956 | 3.75 % |

| Mar | 0.6997 | 0.6873 | 0.7064 | 2.70 % |

| Apr | 0.6828 | 0.6767 | 0.6985 | 3.12 % |

| May | 0.6637 | 0.6569 | 0.6821 | 3.70 % |

| Jun | 0.6520 | 0.6323 | 0.6639 | 4.76 % |

| Jul | 0.6567 | 0.6378 | 0.6806 | 6.29 % |

| Aug | 0.6408 | 0.6186 | 0.6547 | 5.52 % |

| Sep | 0.6377 | 0.6204 | 0.6603 | 6.04 % |

| Oct | 0.6278 | 0.6132 | 0.6390 | 4.04 % |

| Nov | 0.6332 | 0.6195 | 0.6436 | 3.74 % |

| Dec | 0.6163 | 0.6027 | 0.6264 | 3.78 % |

Australian Dollar / US Dollar (AUD/USD) Forecast 2026 Monthly

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 0.5972 | 0.5820 | 0.6161 | 5.53 % |

| Feb | 0.5874 | 0.5799 | 0.5979 | 3.02 % |

| Mar | 0.5730 | 0.5552 | 0.5897 | 5.84 % |

| Apr | 0.5699 | 0.5566 | 0.5838 | 4.66 % |

| May | 0.5525 | 0.5342 | 0.5596 | 4.53 % |

| Jun | 0.5647 | 0.5467 | 0.5719 | 4.40 % |

| Jul | 0.5891 | 0.5766 | 0.5996 | 3.83 % |

| Aug | 0.5872 | 0.5787 | 0.5966 | 3.02 % |

| Sep | 0.6005 | 0.5801 | 0.6076 | 4.52 % |

| Oct | 0.5927 | 0.5722 | 0.6089 | 6.04 % |

| Nov | 0.5998 | 0.5863 | 0.6099 | 3.87 % |

| Dec | 0.5739 | 0.5542 | 0.5945 | 6.78 % |