July 14, 2024 This Week Top S&P 500 Gainers & Losers

Tesla Q2: The Bottom Is Likely In

Tesla: Time To Take Profits

Microsoft: The Q4 Results Should Surprise You

Tesla: Optimus And FSD Probably Won’t Save The Day

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Agilent Technologies (A) Stock Forecast for 2024–2028. Sell or Buy?

Updated: July 27, 2024 (00:36)

Sector: HealthcareThe share price of Agilent Technologies, Inc. (A) now

50/200 Day Moving Average: $135.86 / $132.26

This figure corresponds to the Average Price over the previous 50/200 days. For Agilent Technologies stocks, the 50-day moving average is the support level today.

For Agilent Technologies stocks, the 200-day moving average is the support level today.

Are you interested in Agilent Technologies, Inc. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Agilent Technologies stock price in 2024, 2025, 2026, 2027, 2028. How much will one Agilent Technologies share be worth in 2024 - 2028?

When should I take profit in Agilent Technologies stock? When should I record a loss on Agilent Technologies stock? What are analysts' forecasts for Agilent Technologies stock? What is the future of Agilent Technologies stock? We forecast Agilent Technologies stock performance using neural networks based on historical data on Agilent Technologies stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Agilent Technologies stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Agilent Technologies shares. This happens once a day.

Historical and forecast chart of Agilent Technologies stock

The chart below shows the historical price of Agilent Technologies stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Agilent Technologies stock price can be found in the table below.

Long-term forecasts by years.

Agilent Technologies: Key Factors Shaping Future Stock Performance

As investors evaluate the trajectory of Agilent Technologies (A), several upcoming events and factors are poised to shape its stock rate. Most notably, the company's operating performance and financial guidance for 2024 will play a pivotal role. Recent earnings have underperformed, and next year's projections indicate stagnant or declining revenues, which could further erode investor confidence and negatively impact stock valuations.

Impact of Strategic Acquisitions and Market Valuation

Another significant factor is Agilent's strategic acquisitions, such as the $925 million BIOVECTRA deal. While this acquisition aims to enhance capabilities in biologics and potent active pharmaceutical ingredients, its steep cost and near-term earnings dilution—estimated at $0.05 per share—raise concerns. However, if the acquisition drives long-term growth, it could revitalize earnings and positively affect stock prices.

Broader market conditions and how Agilent is valued in comparison to its peers are critical as well. The stock's valuation has surged, reaching 25 times earnings, making it appear overvalued given the current performance metrics. Analysts should closely monitor market trends and sector health to gauge potential shifts in investor sentiment.

Additionally, Agilent's debt levels play an essential role in investor perception. The reduction of net debt from $1.5 billion to $0.75 billion by mid-2024 highlights improved financial health, yet any adverse changes, particularly from further M&A activities, could have negative repercussions.

The Life Sciences and Applied Markets Group, responsible for nearly half of Agilent's revenue, will also be a determining factor. Fluctuations in this segment's performance will significantly affect overall financial results and stock valuation.

- Operating performance and financial guidance

- Strategic acquisitions like BIOVECTRA

- Market conditions and comparative valuation

- Debt levels and financial health

- Life Sciences segment performance

By closely tracking these key elements, analysts can make more precise predictions on Agilent Technologies' stock price changes. Whether considering if A is a good stock to buy or forecasting the A stock price prediction, these factors are crucial in formulating an informed investment strategy.

Review the original Analysis

Unlocking Agilent Technologies Stock Forecast: The Triad of Opportunities

Forecasting the trajectory of Agilent Technologies (A) stock in the volatile market landscape requires a keen eye on pivotal events and burgeoning trends. Analysts and investors alike are closely monitoring several critical factors that could serve as catalysts for Agilent's stock performance in the near future. At the forefront, Alnylam's clinical accomplishments and the potential collaborative effort with Agilent in producing Amvuttra anchor down the most immediate influences. This anticipated partnership heralds a promising revenue stream that could substantially elevate Agilent's stock price.

Navigating Through Cyclical and Structural Tailwinds

However, the journey doesn't end there. The broader economic environment, characterized by capex spending cutbacks across diverse industries, casts a temporary shadow over Agilent's prospects. Yet, this tide is expected to turn. Analysts are optimistic about leveraging this information to predict a rebound in Agilent's stock value as capex cycles revive and investment flows resume enthusiastically into sectors like biopharma, chemical, and academic labs.

Finally, Agilent's strategic positioning within the growth terrains of advanced materials, biopharma, and genomics outlines a robust foundation for long-term success. The company's alignment with cutting-edge trends such as genomics advancements, the chemical industry's greening, and novel therapeutic modalities offers a clear path for revenue and margin growth. For those crafting an Agilent Technologies stock forecast or pondering over 'A stock buy or sell' decisions, these elements form a compelling narrative. The 'A stock price prediction' now transcends mere speculation, morphing into a strategic assessment grounded in tangible growth drivers and cyclical recoveries.

As market participants weigh their 'buy or sell Agilent Technologies stock' options, understanding the interplay between immediate revenue opportunities, cyclical economic patterns, and structural growth levers becomes crucial. This multifaceted approach not only aids in navigating present uncertainties but also in harnessing the long-term potential Agilent promises, making 'is A a good stock to buy' less of a question and more of a foresighted investment in tomorrow's innovations.

Review the original Analysis

Decoding Agilent Technologies: A Strategic Forecast of A Stock Dynamics

As analysts delve into the intricate world of stock forecasting, Agilent Technologies (A) stands out with its promising landscape shaped by dynamic factors. These elements collectively orchestrate the symphony of A stock's future movements, inviting a meticulous analysis to predict its trajectory. In the spotlight, certain events and factors emerge as pivotal influencers on the Agilent Technologies stock forecast, offering a fertile ground for analysts aiming to craft an accurate A stock price prediction.

Gauging the Forces Shaping Agilent's Financial Future

Primarily, Agilent's resilient performance amid turbulent times acts as a beacon of its robust fundamental health. This resilience not only instils confidence but also anchors the company's long-term A stock price target. Meanwhile, the vibrant tapestry of Agilent's growth potential, painted with expectations of 5-7% annual organic growth and margin enhancements, beckons investors with its allure, promising a bullish narrative for the A stock forecast.

Beyond the borders, Agilent's extensive global reach, especially in the burgeoning markets of Europe and APAC, outlines a strategic advantage. However, this advantage comes with its share of shadows, as geopolitical risks, particularly in China, and market volatility threaten to sway the Agilent Technologies stock forecast. Herein lies the art of stock prediction: leveraging these factors, with a keen eye on valuation concerns that hint at potential overvaluation.

Thus, for those debating whether Agilent is a buy or sell, understanding these cornerstone elements becomes crucial. Analyzing how resilient performance, growth potential, and global outreach intersect with the fog of valuation and geopolitical uncertainties enables analysts to navigate the complex terrain of A's stock buy or sell decisions. It's through this prism that the most accurate and insightful A stock price predictions emerge, offering a compass for investors navigating the Agilent Technologies name stock forecast.

- Resilient Performance and Growth Potential

- Global Reach versus Geopolitical Risks

- Valuation Concerns amid Market Volatility

In sum, the narrative woven by these factors crafts a multifaceted view on "Is A a good stock to buy?". Tracking these indicators with an analytical lens offers a map to predicting the winds of change in Agilent Technologies’ stock market journey.

Review the original Analysis

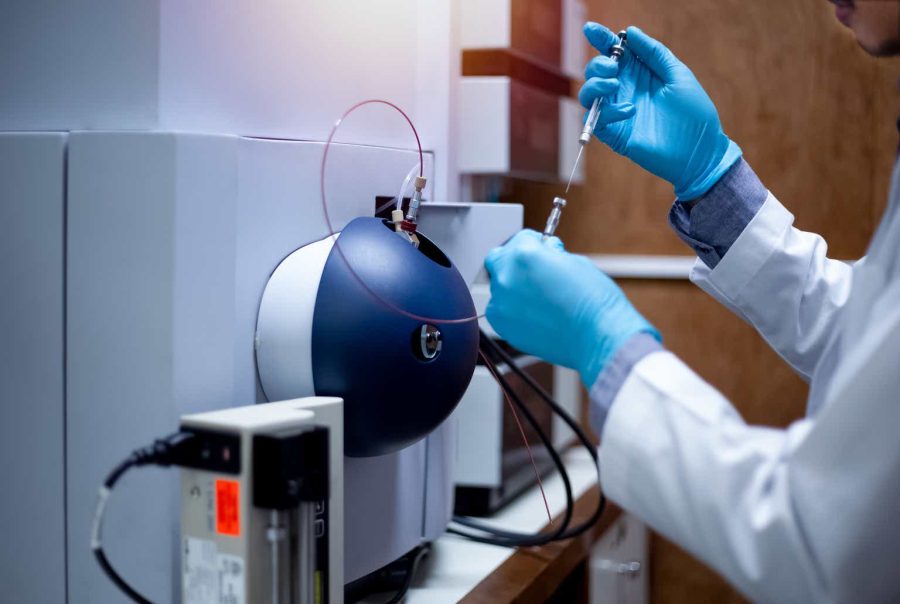

Agilent Technologies is an American manufacturer of measuring, electronic medical and chemical biological equipment. Most of the company’s product lines were developed by Hewlett-Packard, an American company founded in 1939. Agilent maintains a central R&D team at Agilent Laboratories, which conducts research in areas such as MEMS, nanotechnology, and biochemistry.

Agilent Technologies daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jul 28 | 137.02 | 136.61 | 137.84 | 0.90 |

| Jul 29 | 136.98 | 136.43 | 137.60 | 0.85 |

| Jul 30 | 137.39 | 137.06 | 137.91 | 0.62 |

| Jul 31 | 136.82 | 135.75 | 137.66 | 1.41 |

| Aug 01 | 136.28 | 135.67 | 137.15 | 1.09 |

| Aug 02 | 136.35 | 135.64 | 137.07 | 1.06 |

| Aug 03 | 136.01 | 135.26 | 136.55 | 0.96 |

| Aug 04 | 135.66 | 135.33 | 136.50 | 0.86 |

| Aug 05 | 135.19 | 134.34 | 136.09 | 1.30 |

| Aug 06 | 135.87 | 135.53 | 136.81 | 0.94 |

| Aug 07 | 136.45 | 135.62 | 136.96 | 0.99 |

| Aug 08 | 136.73 | 135.72 | 137.59 | 1.38 |

| Aug 09 | 137.21 | 136.81 | 138.12 | 0.96 |

| Aug 10 | 137.99 | 137.46 | 138.62 | 0.84 |

| Aug 11 | 138.11 | 137.79 | 138.51 | 0.52 |

| Aug 12 | 138.66 | 137.60 | 139.39 | 1.30 |

| Aug 13 | 138.76 | 138.05 | 139.21 | 0.83 |

| Aug 14 | 138.44 | 137.56 | 139.07 | 1.10 |

| Aug 15 | 138.28 | 137.88 | 139.05 | 0.85 |

| Aug 16 | 136.89 | 136.33 | 137.84 | 1.10 |

| Aug 17 | 137.25 | 136.63 | 137.69 | 0.77 |

| Aug 18 | 137.63 | 136.63 | 138.24 | 1.18 |

| Aug 19 | 137.17 | 136.37 | 138.03 | 1.22 |

| Aug 20 | 137.59 | 137.16 | 138.29 | 0.82 |

| Aug 21 | 138.38 | 137.68 | 139.03 | 0.97 |

| Aug 22 | 138.54 | 137.90 | 139.40 | 1.09 |

| Aug 23 | 138.03 | 137.35 | 138.79 | 1.04 |

| Aug 24 | 137.99 | 137.19 | 138.61 | 1.04 |

| Aug 25 | 137.03 | 136.08 | 137.65 | 1.16 |

| Aug 26 | 136.14 | 135.78 | 137.23 | 1.07 |

Agilent Technologies Daily Price Targets

Agilent Technologies Stock Forecast 07-28-2024.

Forecast target price for 07-28-2024: $137.02.

Negative dynamics for Agilent Technologies shares will prevail with possible volatility of 0.894%.

Pessimistic target level: 136.61

Optimistic target level: 137.84

Agilent Technologies Stock Forecast 07-29-2024.

Forecast target price for 07-29-2024: $136.98.

Negative dynamics for Agilent Technologies shares will prevail with possible volatility of 0.846%.

Pessimistic target level: 136.43

Optimistic target level: 137.60

Agilent Technologies Stock Forecast 07-30-2024.

Forecast target price for 07-30-2024: $137.39.

Positive dynamics for Agilent Technologies shares will prevail with possible volatility of 0.618%.

Pessimistic target level: 137.06

Optimistic target level: 137.91

Agilent Technologies Stock Forecast 07-31-2024.

Forecast target price for 07-31-2024: $136.82.

Negative dynamics for Agilent Technologies shares will prevail with possible volatility of 1.392%.

Pessimistic target level: 135.75

Optimistic target level: 137.66

Agilent Technologies Stock Forecast 08-01-2024.

Forecast target price for 08-01-2024: $136.28.

Negative dynamics for Agilent Technologies shares will prevail with possible volatility of 1.083%.

Pessimistic target level: 135.67

Optimistic target level: 137.15

Agilent Technologies Stock Forecast 08-02-2024.

Forecast target price for 08-02-2024: $136.35.

Positive dynamics for Agilent Technologies shares will prevail with possible volatility of 1.045%.

Pessimistic target level: 135.64

Optimistic target level: 137.07

A (A) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Aug. | 132.75 | 131.43 | 137.13 | 4.16 |

| Sep. | 138.33 | 135.01 | 140.27 | 3.75 |

| Oct. | 138.54 | 133.06 | 140.48 | 5.28 |

| Nov. | 133.34 | 131.14 | 136.27 | 3.77 |

| Dec. | 127.34 | 124.73 | 131.73 | 5.32 |

Agilent Technologies forecast for this year

Agilent Technologies Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $132.753. Pessimistic: $131.43. Optimistic: $137.13

Agilent Technologies Stock Prediction for Sep 2024

An uptrend is forecast for this month with an optimal target price of $138.328. Pessimistic: $135.01. Optimistic: $140.27

Agilent Technologies Stock Prediction for Oct 2024

An uptrend is forecast for this month with an optimal target price of $138.536. Pessimistic: $133.06. Optimistic: $140.48

Agilent Technologies Stock Prediction for Nov 2024

An downtrend is forecast for this month with an optimal target price of $133.341. Pessimistic: $131.14. Optimistic: $136.27

Agilent Technologies Stock Prediction for Dec 2024

An downtrend is forecast for this month with an optimal target price of $127.341. Pessimistic: $124.73. Optimistic: $131.73

Agilent Technologies (A) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 126.77 | 123.98 | 131.46 | 5.69 |

| Feb | 126.89 | 122.33 | 130.89 | 6.54 |

| Mar | 123.85 | 122.12 | 125.21 | 2.47 |

| Apr | 126.64 | 124.42 | 128.73 | 3.35 |

| May | 124.04 | 120.26 | 128.38 | 6.33 |

| Jun | 126.77 | 123.98 | 131.65 | 5.83 |

| Jul | 124.80 | 121.62 | 128.17 | 5.11 |

| Aug | 127.92 | 125.30 | 132.34 | 5.32 |

| Sep | 125.81 | 121.66 | 127.20 | 4.35 |

| Oct | 124.56 | 123.06 | 128.67 | 4.36 |

| Nov | 130.28 | 128.27 | 132.83 | 3.43 |

| Dec | 134.19 | 130.57 | 137.75 | 5.21 |

Agilent Technologies (A) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 131.11 | 126.85 | 134.91 | 5.98 |

| Feb | 134.12 | 131.98 | 138.15 | 4.47 |

| Mar | 134.32 | 129.08 | 139.23 | 7.28 |

| Apr | 129.89 | 124.89 | 132.55 | 5.78 |

| May | 127.94 | 123.78 | 133.00 | 6.93 |

| Jun | 125.90 | 122.43 | 127.34 | 3.85 |

| Jul | 129.86 | 127.46 | 133.82 | 4.75 |

| Aug | 131.42 | 126.29 | 133.46 | 5.37 |

| Sep | 136.54 | 134.91 | 142.01 | 5.00 |

| Oct | 134.36 | 131.61 | 139.47 | 5.64 |

| Nov | 130.40 | 127.27 | 133.33 | 4.55 |

| Dec | 130.59 | 128.76 | 133.01 | 3.19 |

Agilent Technologies (A) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 128.63 | 125.55 | 132.23 | 5.06 |

| Feb | 128.89 | 125.73 | 132.31 | 4.97 |

| Mar | 131.60 | 126.99 | 133.64 | 4.97 |

| Apr | 134.16 | 131.68 | 136.71 | 3.68 |

| May | 140.54 | 135.90 | 145.95 | 6.88 |

| Jun | 138.08 | 135.31 | 141.39 | 4.30 |

| Jul | 141.87 | 139.89 | 145.85 | 4.09 |

| Aug | 140.24 | 135.82 | 145.64 | 6.74 |

| Sep | 145.78 | 140.17 | 150.37 | 6.79 |

| Oct | 152.05 | 147.72 | 157.45 | 6.18 |

| Nov | 153.11 | 150.74 | 157.33 | 4.18 |

| Dec | 150.59 | 148.93 | 153.37 | 2.90 |

Agilent Technologies (A) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 151.57 | 147.55 | 156.42 | 5.67 |

| Feb | 149.52 | 146.23 | 155.43 | 5.92 |

| Mar | 148.10 | 142.99 | 150.03 | 4.69 |

| Apr | 150.77 | 147.22 | 152.88 | 3.70 |

| May | 149.94 | 144.76 | 153.31 | 5.57 |

| Jun | 151.59 | 146.13 | 153.10 | 4.55 |

| Jul | 151.43 | 148.71 | 155.60 | 4.43 |

| Aug | 157.19 | 153.34 | 160.65 | 4.55 |

| Sep | 157.90 | 151.58 | 162.95 | 6.98 |

| Oct | 158.92 | 155.19 | 163.13 | 4.87 |

| Nov | 156.54 | 153.72 | 161.63 | 4.89 |

| Dec | 160.06 | 155.58 | 163.58 | 4.89 |

Agilent Technologies information and performance

5301 STEVENS CREEK BLVD, SANTA CLARA, CA, US

Market capitalization of the Agilent Technologies, Inc. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of A shares in the company outstanding by the market price of one share.

EBITDA of Agilent Technologies is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.

Agilent Technologies (A) stock dividend

Agilent Technologies last paid dividends on 07/02/2024. The next scheduled payment will be on 07/24/2024. The amount of dividends is $0.922 per share. If the date of the next dividend payment has not been updated, it means that the issuer has not yet announced the exact payment. As soon as information becomes available, we will immediately update the data. Bookmark our portal to stay updated.

Last Split Date: 01/01/1970

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

For example, a 5: 1 ratio means that the value of one share will decrease 5 times, the total amount will increase 5 times. It is important to understand that this procedure does not change the capitalization of the company, as well as the total value of assets held in private hands.