May 11, 2024 AppLovin Joins Elite 100% Return Club!

Apple: Here’s My Price Target And WWDC Strategy

Tesla Is Selling More Than Cars With FSD

Nvidia Faces Macro Headwinds And Micro Tailwinds

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

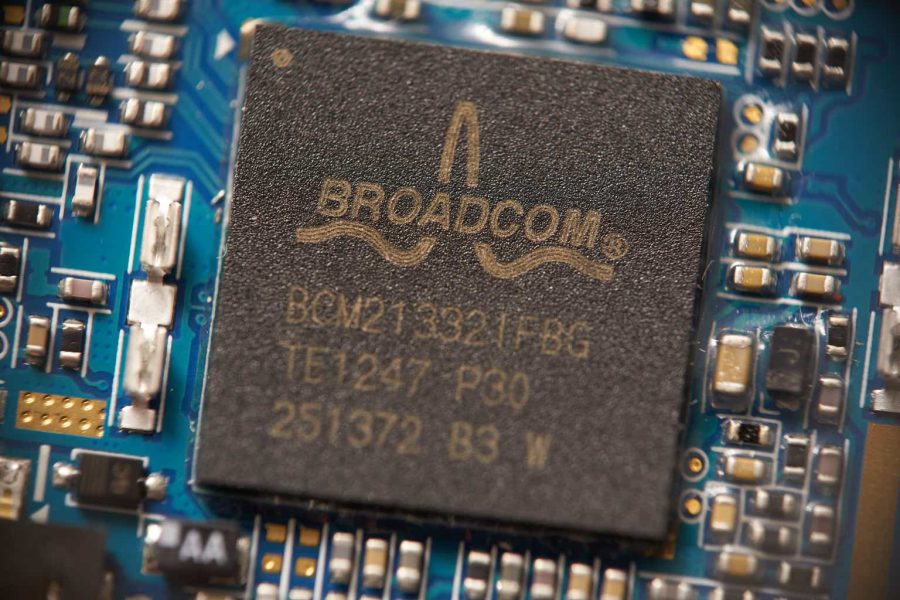

Broadcom (AVGO) Stock Forecast for 2024–2028. Sell or Buy?

Updated: May 18, 2024 (14:28)

Sector: TechnologyThe share price of Broadcom Inc. (AVGO) now

50/200 Day Moving Average: $ / $

This figure corresponds to the Average Price over the previous 50/200 days. For Broadcom stocks, the 50-day moving average is the support level today.

For Broadcom stocks, the 200-day moving average is the support level today.

Are you interested in Broadcom Inc. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Broadcom stock price in 2024, 2025, 2026, 2027, 2028. How much will one Broadcom share be worth in 2024 - 2028?

When should I take profit in Broadcom stock? When should I record a loss on Broadcom stock? What are analysts' forecasts for Broadcom stock? What is the future of Broadcom stock? We forecast Broadcom stock performance using neural networks based on historical data on Broadcom stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Broadcom stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Broadcom shares. This happens once a day.

Historical and forecast chart of Broadcom stock

The chart below shows the historical price of Broadcom stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Broadcom stock price can be found in the table below.

Long-term forecasts by years.

Unveiling Broadcom's Stock Potential: AI, Software, and Dividends Set the Stage

As we dive into the dynamic world of stock market predictions, Broadcom Inc. (AVGO) emerges as a fascinating case study for analysts and investors alike. With a future brightened by technological advancements and strategic business moves, AVGO stocks are on the cusp of potentially significant changes. The key factors influencing these stock rate adjustments are rooted in the company's rapid growth in AI-related revenue, the burgeoning significance of its software business post-VMWare acquisition, and an attractive trend of growing free cash flow and dividends.

Analyst Perspective: Making Sense of AVGO's Future

An in-depth analysis of AVGO's progress reveals that the company's strong positioning in AI-related revenue expansion, particularly through its custom silicon solutions, stands out as a primary growth driver. This AI fascination doesn't just highlight AVGO as a good stock to buy; it underpins a forecast of exponential growth in this segment, expected to soar from less than 5% to an impressive 35% in fiscal 2024. Such a leap suggests a bullish AVGO stock price prediction, drawing attention from investors seeking robust growth avenues.

Furthermore, Broadcom's software business is shaping up as a formidable revenue pillar, promising to account for 40% of earnings in fiscal 2024. This shift comes on the heels of the strategic VMWare acquisition, promising enhanced up-selling opportunities and a smoother transition from license to subscription models. It's a compelling narrative for those pondering, "Is AVGO a good stock to buy?"

Finally, the allure of growing free cash flow and increased dividends cannot be overstated. Not just a testament to Broadcom's financial health, this trend also paints a picture of stability and growth, reinforcing the Broadcom stock forecast as increasingly positive. For investors and analysts alike, these indicators serve as a beacon for recalibrating AVGO stock price target estimates, laying down a fertile ground for both buy or sell decisions.

- AI-Driven Growth Trajectory

- Software Segment Expansion

- Dividends and Free Cash Flow Surge

In summary, Broadcom Inc.'s stock trajectory is poised at an exciting juncture, shaped by critical developments in AI, software, and dividends. For analysts aiming to make the most accurate AVGO stock forecast, dissecting these elements offers a compass for navigating the stock's potential. Each factor, especially when analyzed cohesively, not only answers 'why AVGO stock down?' queries but also frames a future where AVGO emerges as a compelling buy or sell proposition.

Review the original Analysis

Unlocking the Puzzle of AVGO Stock: A Holy Grail in Semiconductor Forecasts

In the bustling world of semiconductor investments, Broadcom (AVGO) stands as a beacon for analysts and investors alike, but understanding its stock price movements requires a keen eye on several pivotal factors. Foremost among these is the anticipated exponential growth in AI revenue, a sector where AVGO is poised to exceed a staggering $10 billion this fiscal year. This leap in AI advancements is not just a testament to technological innovation but also a critical driver expected to propel AVGO stock rates to new heights.

Navigating Through the Optimism: AVGO's Valuation and Revenue Composition

However, the journey doesn't end with AI's golden horizon. The valuation of AVGO, now soaring above its long-term average, presents a double-edged sword. While signaling investor confidence and an optimistic outlook towards the company's AI-infused future, it also treads on the thin ice of potential overvaluation. Analysts must tread carefully, balancing the euphoria around Broadcom's stock forecast with the pragmatic reality of whether it's a good time to buy or sell AVGO stock.

Moreover, while AI dazzles, it constitutes only about 20% of AVGO's revenue pie. This composition urges a broader lens to assess the company's prospects, considering other segments and the overall semiconductor market's health. Fluctuations in areas such as cloud, data center, and networking could spell significant shifts in AVGO's stock price prediction and its viability as a long-term investment.

Therefore, by dissecting these factors—growth of AI revenue, elevated valuation, and revenue composition, along with the broader semiconductor market health—analysts can sharpen their AVGO stock price target predictions. These components, intertwined, offer a map to navigate the intricate dance of Broadcom stock forecasts, transforming speculation into educated foresight. Whether deciding on buying or selling Broadcom stock, these considerations illuminate the path ahead with a blend of caution and optimism.

- Growth of AI Revenue: A beacon for revenue expansion and investment attraction.

- Valuation: A reflection of optimism but a signal for potential overvaluation hazards.

- Revenue Composition and Semiconductor Market Health: Essential elements for a holistic approach to AVGO stock analysis.

In conclusion, AVGO presents a compelling narrative in the semiconductor industry, but it's one that demands a nuanced understanding of the factors at play to accurately forecast its stock trajectory.

Review the original Analysis

AVGO Stock Forecast: Navigating Through Geopolitical Tensions and China's Market Shifts

Investors keeping a close watch on AVGO stock are standing at a critical juncture where geopolitical dynamics and market strategies are set to redefine Broadcom's stock trajectory. The foreseeable future presents a mix of challenges and opportunities that could significantly influence AVGO's stock rates. The major forces at play include heightened geopolitical tensions between the US and China, and China's aggressive push towards self-reliance in chip manufacturing under its "Made in China 2025" initiative. Additionally, Broadcom's strategic acquisition of VMware is a new variable in this complex equation.

Deciphering the Future: Analysts' Approach to AVGO

Analysts aiming to make accurate AVGO stock price predictions need to delve deep into these factors. The geopolitical landscape, especially the ongoing US-China technology war, stands as the primary determinant of Broadcom's fate in one of its largest markets. An understanding of how these tensions could escalate to bans or stricter regulations on chip sales is essential. Moreover, China's determination to minimize dependency on foreign chip technology could see a drastic reduction in Broadcom's Chinese market revenues, potentially impacting its stock value. On the upside, Broadcom's acquisition of VMware presents a growth avenue that analysts must factor into any AVGO stock forecast, evaluating if it could counterbalance the adverse effects of market losses in China.

To navigate the volatile waters of AVGO's stock market predictions, analysts are encouraged to blend these critical insights with broader market trends. Keeping a pulse on the unfolding geopolitical narratives and China's tech independence journey, combined with the strategic moves by Broadcom, like the VMware acquisition, will be pivotal. Whether looking to buy or sell Broadcom stock, understanding these dynamics offers a lens into the future of AVGO stock rates and places investors ahead in making informed decisions in an increasingly unpredictable market.

- Geopolitical tensions between the US and China

- China's push for tech self-reliance

- Impact of VMware acquisition on Broadcom

Broadcom Ltd is a semiconductor development company headquartered in San Jose, California and Singapore. A global supplier of products based on analog and digital semiconductor technologies, it covers four major market segments: wired infrastructure, wireless, enterprise storage, industrial and others.

In early 2016, following the completion of the acquisition of Avago Technologies of Broadcom Corporation, the combined company, with an annual turnover of about $ 15 billion, became the seventh largest semiconductor manufacturer. Broadcom generated over $ 1 billion in net income for fiscal 2017. In total, the company’s revenues amounted to more than $ 17 billion.

The company was founded in 1961 and was originally the semiconductor division of Hewlett-Packard. The division split from Hewlett-Packard as part of Agilent Technologies in 1999.

Broadcom daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May 20 | 1 443.13 | 1 427.54 | 1 452.94 | 1.78 |

| May 21 | 1 457.56 | 1 447.94 | 1 474.17 | 1.81 |

| May 22 | 1 444.15 | 1 421.33 | 1 458.88 | 2.64 |

| May 23 | 1 422.20 | 1 410.54 | 1 437.56 | 1.92 |

| May 24 | 1 429.88 | 1 417.01 | 1 446.46 | 2.08 |

| May 25 | 1 431.59 | 1 409.55 | 1 447.63 | 2.70 |

| May 26 | 1 432.45 | 1 426.15 | 1 445.92 | 1.39 |

| May 27 | 1 439.04 | 1 430.12 | 1 446.24 | 1.13 |

| May 28 | 1 460.34 | 1 437.56 | 1 483.71 | 3.21 |

| May 29 | 1 457.13 | 1 448.09 | 1 468.78 | 1.43 |

| May 30 | 1 460.92 | 1 442.22 | 1 481.66 | 2.73 |

| May 31 | 1 469.97 | 1 459.10 | 1 484.67 | 1.75 |

| Jun 01 | 1 455.57 | 1 436.94 | 1 477.98 | 2.86 |

| Jun 02 | 1 468.67 | 1 461.03 | 1 489.23 | 1.93 |

| Jun 03 | 1 464.56 | 1 453.13 | 1 473.05 | 1.37 |

| Jun 04 | 1 454.01 | 1 442.38 | 1 470.59 | 1.96 |

| Jun 05 | 1 447.61 | 1 427.35 | 1 468.75 | 2.90 |

| Jun 06 | 1 473.96 | 1 452.15 | 1 490.76 | 2.66 |

| Jun 07 | 1 485.46 | 1 466.15 | 1 503.88 | 2.57 |

| Jun 08 | 1 491.70 | 1 474.09 | 1 506.91 | 2.23 |

| Jun 09 | 1 481.55 | 1 471.18 | 1 503.78 | 2.22 |

| Jun 10 | 1 469.40 | 1 445.89 | 1 487.33 | 2.87 |

| Jun 11 | 1 464.41 | 1 446.54 | 1 480.81 | 2.37 |

| Jun 12 | 1 462.36 | 1 451.24 | 1 484.29 | 2.28 |

| Jun 13 | 1 467.33 | 1 451.48 | 1 477.31 | 1.78 |

| Jun 14 | 1 470.26 | 1 449.68 | 1 489.97 | 2.78 |

| Jun 15 | 1 441.15 | 1 434.52 | 1 458.45 | 1.67 |

| Jun 16 | 1 414.92 | 1 397.66 | 1 427.37 | 2.13 |

| Jun 17 | 1 391.15 | 1 379.47 | 1 407.57 | 2.04 |

| Jun 18 | 1 382.81 | 1 367.87 | 1 389.72 | 1.60 |

Broadcom Daily Price Targets

Broadcom Stock Forecast 05-20-2024.

Forecast target price for 05-20-2024: $1 443.13.

Positive dynamics for Broadcom shares will prevail with possible volatility of 1.748%.

Pessimistic target level: 1 427.54

Optimistic target level: 1 452.94

Broadcom Stock Forecast 05-21-2024.

Forecast target price for 05-21-2024: $1 457.56.

Positive dynamics for Broadcom shares will prevail with possible volatility of 1.779%.

Pessimistic target level: 1 447.94

Optimistic target level: 1 474.17

Broadcom Stock Forecast 05-22-2024.

Forecast target price for 05-22-2024: $1 444.15.

Negative dynamics for Broadcom shares will prevail with possible volatility of 2.574%.

Pessimistic target level: 1 421.33

Optimistic target level: 1 458.88

Broadcom Stock Forecast 05-23-2024.

Forecast target price for 05-23-2024: $1 422.20.

Negative dynamics for Broadcom shares will prevail with possible volatility of 1.880%.

Pessimistic target level: 1 410.54

Optimistic target level: 1 437.56

Broadcom Stock Forecast 05-24-2024.

Forecast target price for 05-24-2024: $1 429.88.

Positive dynamics for Broadcom shares will prevail with possible volatility of 2.036%.

Pessimistic target level: 1 417.01

Optimistic target level: 1 446.46

Broadcom Stock Forecast 05-25-2024.

Forecast target price for 05-25-2024: $1 431.59.

Positive dynamics for Broadcom shares will prevail with possible volatility of 2.631%.

Pessimistic target level: 1 409.55

Optimistic target level: 1 447.63

AVGO (AVGO) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jun. | 1 551.93 | 1 465.02 | 1 669.88 | 12.27 |

| Jul. | 1 480.54 | 1 387.27 | 1 578.26 | 12.10 |

| Aug. | 1 408.00 | 1 379.84 | 1 502.33 | 8.15 |

| Sep. | 1 446.01 | 1 411.31 | 1 508.19 | 6.42 |

| Oct. | 1 479.27 | 1 362.41 | 1 575.42 | 13.52 |

| Nov. | 1 458.56 | 1 381.26 | 1 511.07 | 8.59 |

| Dec. | 1 502.32 | 1 403.16 | 1 593.96 | 11.97 |

Broadcom forecast for this year

Broadcom Stock Prediction for Jun 2024

An uptrend is forecast for this month with an optimal target price of $1551.93. Pessimistic: $1 465.02. Optimistic: $1 669.88

Broadcom Stock Prediction for Jul 2024

An downtrend is forecast for this month with an optimal target price of $1480.54. Pessimistic: $1 387.27. Optimistic: $1 578.26

Broadcom Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $1408. Pessimistic: $1 379.84. Optimistic: $1 502.33

Broadcom Stock Prediction for Sep 2024

An uptrend is forecast for this month with an optimal target price of $1446.01. Pessimistic: $1 411.31. Optimistic: $1 508.19

Broadcom Stock Prediction for Oct 2024

An uptrend is forecast for this month with an optimal target price of $1479.27. Pessimistic: $1 362.41. Optimistic: $1 575.42

Broadcom Stock Prediction for Nov 2024

An downtrend is forecast for this month with an optimal target price of $1458.56. Pessimistic: $1 381.26. Optimistic: $1 511.07

Broadcom Stock Prediction for Dec 2024

An uptrend is forecast for this month with an optimal target price of $1502.32. Pessimistic: $1 403.16. Optimistic: $1 593.96

Broadcom (AVGO) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1 452.74 | 1 340.88 | 1 506.49 | 10.99 |

| Feb | 1 417.87 | 1 334.22 | 1 505.78 | 11.39 |

| Mar | 1 485.93 | 1 405.69 | 1 591.43 | 11.67 |

| Apr | 1 536.45 | 1 441.19 | 1 593.30 | 9.55 |

| May | 1 422.76 | 1 321.74 | 1 506.70 | 12.28 |

| Jun | 1 501.01 | 1 457.48 | 1 592.57 | 8.48 |

| Jul | 1 493.50 | 1 382.98 | 1 563.70 | 11.56 |

| Aug | 1 447.20 | 1 357.48 | 1 561.53 | 13.07 |

| Sep | 1 500.75 | 1 397.20 | 1 551.78 | 9.96 |

| Oct | 1 484.24 | 1 380.35 | 1 564.39 | 11.76 |

| Nov | 1 588.14 | 1 537.32 | 1 637.37 | 6.11 |

| Dec | 1 540.50 | 1 426.50 | 1 625.22 | 12.23 |

Broadcom (AVGO) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1 549.74 | 1 476.90 | 1 588.48 | 7.02 |

| Feb | 1 579.18 | 1 522.33 | 1 666.04 | 8.63 |

| Mar | 1 568.13 | 1 475.61 | 1 693.58 | 12.87 |

| Apr | 1 623.01 | 1 517.52 | 1 699.30 | 10.70 |

| May | 1 644.11 | 1 555.33 | 1 701.66 | 8.60 |

| Jun | 1 606.30 | 1 542.05 | 1 702.68 | 9.43 |

| Jul | 1 685.01 | 1 602.44 | 1 769.26 | 9.43 |

| Aug | 1 767.57 | 1 719.85 | 1 871.86 | 8.12 |

| Sep | 1 677.43 | 1 573.43 | 1 768.01 | 11.01 |

| Oct | 1 513.04 | 1 469.16 | 1 600.79 | 8.22 |

| Nov | 1 519.09 | 1 427.95 | 1 598.08 | 10.65 |

| Dec | 1 475.04 | 1 427.84 | 1 593.04 | 10.37 |

Broadcom (AVGO) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1 417.51 | 1 312.61 | 1 469.96 | 10.70 |

| Feb | 1 526.66 | 1 432.01 | 1 595.36 | 10.24 |

| Mar | 1 483.91 | 1 423.07 | 1 531.40 | 7.07 |

| Apr | 1 618.95 | 1 549.33 | 1 699.90 | 8.86 |

| May | 1 719.32 | 1 643.67 | 1 779.50 | 7.63 |

| Jun | 1 746.83 | 1 642.02 | 1 809.72 | 9.27 |

| Jul | 1 724.12 | 1 677.57 | 1 758.61 | 4.61 |

| Aug | 1 849.98 | 1 801.89 | 1 911.03 | 5.71 |

| Sep | 1 687.19 | 1 629.82 | 1 754.67 | 7.12 |

| Oct | 1 599.45 | 1 529.08 | 1 701.82 | 10.15 |

| Nov | 1 634.64 | 1 593.77 | 1 709.83 | 6.79 |

| Dec | 1 606.85 | 1 561.86 | 1 680.77 | 7.07 |

Broadcom (AVGO) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1 688.80 | 1 570.58 | 1 788.44 | 12.18 |

| Feb | 1 839.10 | 1 741.63 | 1 953.13 | 10.83 |

| Mar | 1 837.26 | 1 761.94 | 1 910.76 | 7.79 |

| Apr | 1 875.85 | 1 778.30 | 2 016.54 | 11.81 |

| May | 2 039.05 | 1 967.68 | 2 200.13 | 10.57 |

| Jun | 2 183.82 | 2 057.16 | 2 306.11 | 10.80 |

| Jul | 2 286.46 | 2 229.30 | 2 377.92 | 6.25 |

| Aug | 2 462.52 | 2 290.14 | 2 617.65 | 12.51 |

| Sep | 2 388.64 | 2 293.09 | 2 553.46 | 10.20 |

| Oct | 2 273.99 | 2 112.53 | 2 383.14 | 11.36 |

| Nov | 2 089.79 | 1 956.05 | 2 252.80 | 13.17 |

| Dec | 1 920.52 | 1 772.64 | 2 041.51 | 13.17 |

Broadcom information and performance

N/A

Market capitalization of the Broadcom Inc. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of AVGO shares in the company outstanding by the market price of one share.

EBITDA of Broadcom is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.