May 1, 2024 Inflation Persistence: No Fed Rate Cuts in Sight

April 29, 2024 Tesla, Baidu Join Forces for Self-Driving Tech in China

April 27, 2024 Alphabet and Microsoft’s AI Investments Yield Strong Returns

3M: A Successful Spinoff And Strong Q1 Earnings

Nvidia’s Stock Is Still A Bargain

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

TOP Stocks About $5 To Buy Now

November 4, 2023

Stocks valued under $5 tend to display higher risk and greater volatility compared to their more expensive and established counterparts. But keep in mind that with a larger risk often comes a bigger potential payoff. These three “under $5” quant-based selections come with ‘Strong Buy’ recommendations.

Due to geopolitical factors and broader economic trends, don’t let their fluctuating prices deter you. Despite possibly hitting their year’s lowest point soon, these stocks offer excellent opportunities for buying on a dip. The micro-cap stocks featured here have solid fundamentals that could add diversity to your investment portfolio.

What exactly are penny stocks?

Commonly deemed one of the most affordable investments available, penny stocks can diversify your portfolio while offering potential long-term advantages. Though they primarily excel at generating notable short-term profits, they typically fall short as durable investments. Generally speaking, companies trading below $1 per share with a market capitalization under $300 million are classified as penny stocks or micro-caps.

In time, this price ceiling shifted from being less than $1 to under $5. While it’s common to avoid stocks priced below $10, smart investing often involves sifting through shares that showcase solid fundamentals. Finding them at a reasonable price is merely an added advantage.

Being part of the wider small-cap category, penny stocks may display unpredictable price patterns, making them more volatile compared to more expensive options with larger market capitalizations. Due to fewer disclosure requirements and regulatory supervision, these low-priced shares are more prone to fraudulent activities.

Furthermore, geopolitical influences and industrial regulations can hamper their growth or shift their focus from expansion towards modifications that suit regulatory changes. This could result in several quarters of lackluster earnings reports. Despite these constraints, certain penny stocks like Petróleo Brasileiro S.A.-Petrobras (PBR), Freeport-McMoRan Inc. (FCX), and renowned meme stock GameStop Corp. (GME) have shown remarkable growth over time. While they don’t currently meet the ‘Strong Buy’ quant metrics, their ascent has yielded immediate success for many investors.

3 Penny Stocks Worthy of Your Consideration

Investing in cost-effective stocks that boast remarkable profitability, an impressive return on equity, and consistent growth in earnings can be an excellent strategy to enhance your investment portfolio. But what makes these stocks so appealing?

- Predominantly, these types of stocks tend to provide long-term value.

- They contribute towards diversifying your investment portfolio.

- They also offer investors the chance to share in potential growth.

One such example worth considering is LATAM Airlines Group S.A. This airline has a D+ rating for its profitability but displays significant strength across most of its central profitability indicators and is set to exit bankruptcy later this month. The approach usually revolves around pinpointing the top-performing small-cap stocks. Over the past year, this strategy has proven quite fruitful, thanks to many picks made using a quantitative rating system flourishing significantly.

The secret lies in identifying companies that demonstrate attractive combined fiscal attributes, including valuation, growth, EPS revisions, profitability, and momentum. These essential features are prevalent among the three penny stocks we are advocating for today.

1. Introducing LATAM Airlines Group S.A. (OTCPK:LTMAY)

Boasting a market value of approximately $4.72 billion, LATAM Airlines Group S.A. stands as an impressive investment opportunity, with each share valued at a mere 47 cents (as of 11/2/23). The company holds high esteem among investors, reflected in its strong buy ratings and ranking 18th out of 655 in a quant sector ranking. Further, it impresses as being the second in a group of 27 within the quant industry rankings.

Despite facing significant challenges like filing for U.S. Chapter bankruptcy in May 2020 due to COVID-19 repercussions, this Chile-based airline did not let this crisis hamper its drive for success. By November 3rd, 2023, the company is scheduled to exit Chapter 11 proceedings thanks to two and a half years’ focus on reorganization, competitive cost structures, and robust liquidity planning for future ventures. Key shareholders such as Delta Air Lines Inc., Qatar Airways, and Cueto Group, along with creditors like Evercore Group, fully endorse their reorganization plan.

Specializing in air travel services, including both passenger and cargo transport, mainly across Latin American countries, the company successfully bounced back from Q2 of 2023 onwards, even reaching an admirable recovery rate of 93% based on pre-pandemic levels. Additional increases in passenger and cargo capacity by +28.4% and +20.7%, respectively, paved the way for a year-over-year revenue rise of +20%. These factors played pivotal roles in boosting LATAM’s stock price by 29% over the past year without showing signs of slowing down.

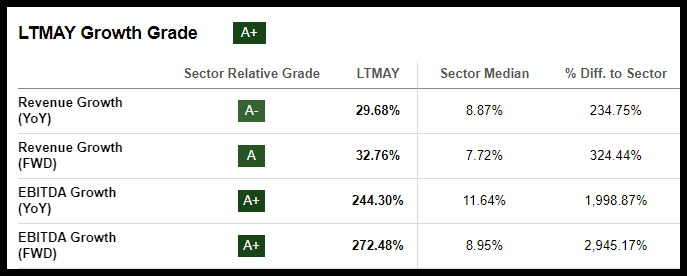

LTMAY Airlines Stock Growth and Profitability

After making immense progress during Q2, LATAM released record-breaking total revenue figures, hitting $3.1B for Q3—marking an increase of 18.1% compared to that same period the previous year! The ownership-linked net income for the company peaked at $232 million in Q3.

The commendable financial milestones led to S&P promoting LATAM’s corporate rating to a promising ‘B’, with Moody’s issuing a stable B1 rating. LATAM then secured its spot within the esteemed Global Equity Index issued by FTSE during September 15, 2023!

Its D+ profitability rating, however, indicates that the journey hasn’t been entirely smooth. Despite this, they’ve kept up impressive underlying profitability, with a Net Income Margin exceeding the rest of the sector by a hefty 345%. They have also managed to generate $1.2B in cash from operations within the Trailing Twelve Months (TTM). Furthermore, their Return on Capital stands at an impressive 11.17% within TTM, surpassing the industry average of 6.87%. Additionally, they have exhibited consistent improvements in liquidity from one quarter to the next.

“We owe our record-breaking revenue to our unwavering commitment towards achieving long-term goals and consistent recovery in passenger transportation,” credits CFO Ramiro Alfonsin of LATAM.

Even though there’s been some increased activity over recent months (it rose by about 30% over six months and within the past year), shares are still well priced, trading close to their 52-week low, making it an ideal time for investors looking at affordable investment options.

This seems like a perfect option worth taking flight with given that it has an overall A-Valuation Grade and a forward P/E of just 0.39x (much lower than the sector median of 19.51x), pointing towards undervalued pricing at nearly 98% against sector norms. Embark on a journey with LATAM Airlines, which is consistently delivering improving results after extensive restructuring efforts.

2. A Closer Look at Clover Health Investments, Corp. (CLOV)

With a market capitalization of approximately $441.6 million, Clover Health Investments is presently listed under the stock ticker “CLOV”. As of November 2nd, 2023, its shares were hovering around the price of $1.01. The industry experts at Quant have confidently assigned it a “Strong Buy” rating for prospective investors.

Examining Clover’s standing within the industry reveals its high position, ranking 44th out of a total of 1117 in Quant’s sector ranking as per the same date. Impressively enough, it holds third place amongst just nine competitors in its sector!

So what makes Clover Health Investments function so effectively? Their primary offer is superior Medicare Advantage plans across America. They have positioned themselves as pioneers by introducing affordable, user-friendly managed health care plans designed specifically for senior citizens. Their intelligent AI-based platform, Clover Assistant, which gathers and analyzes patient data to streamline healthcare processes, is what powers this initiative.

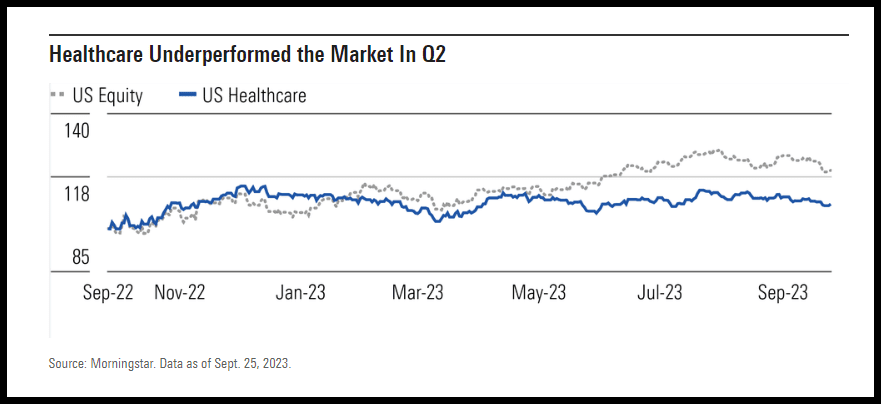

Switching our attention to assess the performance of the Healthcare Sector in Q2 (as per Morningstar reports), it appears that this sector didn’t perform exceptionally compared to US Equities as a whole.

Even though it has been rather sluggish over the past year, demonstrating uninspiring performance behind the market in Q2, there remains significant optimism for steady growth opportunities down the line. Importantly, the healthcare industry maintains one of the most substantial positions in terms of market capital, an observation underscored by Morningstar Equity Research.

Even though problems like upcoming changes to pharmacy benefits and less funding for Medicaid and Medicare Advantage are hurting this sector right now, these short-term issues could lead to good investments for people who want to see it grow in the long term.

With annual U.S. healthcare spending projected to rise to an estimated $7.2 trillion by 2031, Clover Health Investments is positioning itself perfectly with its revolutionary insurance model. The company utilizes financial technology to provide personalized healthcare insights and collaborates with physicians to guarantee optimal patient care.

Admittedly, the journey has included some obstacles, such as resolving a SPAC transaction in 2021. However, they haven’t let this deter them. Instead, they’re demonstrating signs of continual improvement, quarter after quarter. All stakeholders are anticipating their Q3 results on November 6.

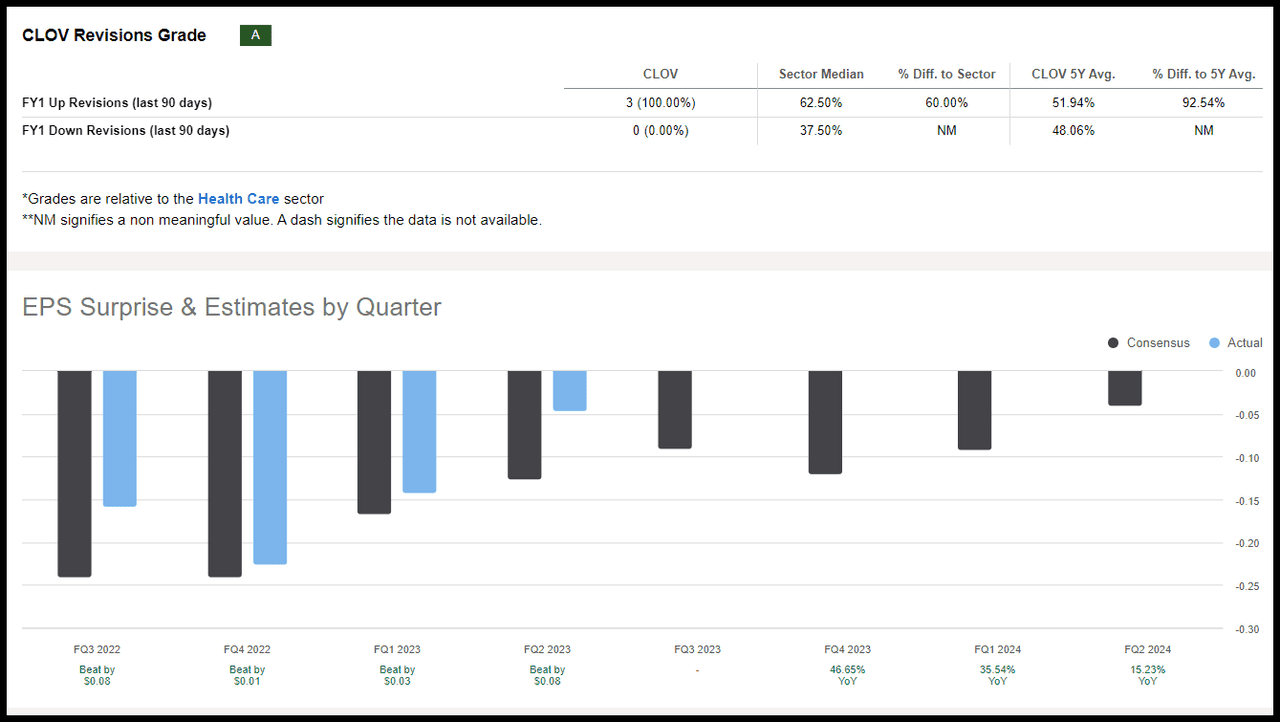

Clover Health Edges Towards Profit with Strong Performance

Remarkably, Clover Health is on a roll, consistently exceeding earnings expectations and significantly upping their performance in Q2. The company saw impressive revenue growth, with better-than-anticipated MCR predictions between 83% and 85%, thanks to a strong Medical Cost Ratio (MCR). These factors, alongside an insurance revenue of $1.2 billion to $1.23B, point towards Clover’s potential profitability. Interestingly, this quarter marked the company’s first positive adjusted EBITDA since it went public, alongside its best-ever MCR record of more than 77%. The EPS stood at -$0.05, outperforming forecasts by $0.08, while revenue reached a total of $513.63M and exceeded estimates by $22.81 million.

The determined health tech firm isn’t resting on its laurels; its steady performance and focused market approach have analysts reconsidering their estimates positively. The growing registration of end-of-life and low-income members—groups that often have higher disease rates—consolidates Clover’s position as a reliable healthcare provider for vulnerable communities.

“Our unwavering commitment to these communities confirms that our technology-driven model can achieve health equity while maintaining economic sustainability,” says Andrew Toy, CEO.

With their dedication to prioritizing health equity, akin to CMS’s recalibration of their star rating mechanism for future evaluations—a change that Clover’s team enthusiastically supports—the company is hopeful for continued success in the future.

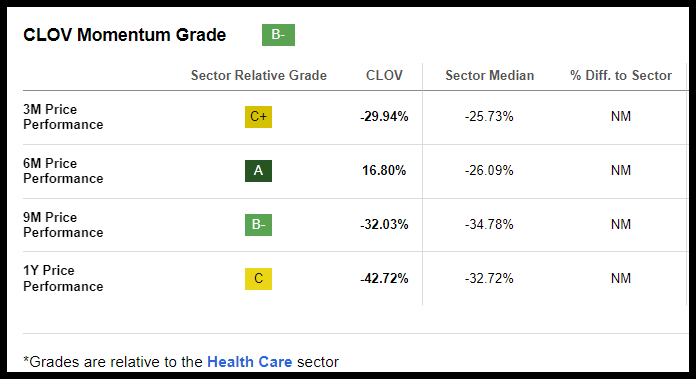

Clover Stock Value Shows Promise

Despite being relatively small-scale compared to some rivals, Clover Health demonstrates maturity through its emphasis on elevating profitability, improving margins, and optimizing operations. Although the stock fell around 31% over the past year, it made an encouraging comeback with a 12% rise yesterday, maintaining strong momentum and even outstripping sector peers in the six- and nine-month periods.

Ready for an exciting ride, CLOV stock shines with its A+ valuation rating. Currently trading below its mid-52-week range, it exhibits a considerable 97% discrepancy when compared to EV/Sales figures in its sector. Nonetheless, the upcoming Price/Sales stand at just 0.22x compared to the sector’s dense 3.34x, while its P/B ratio surpasses a substantial 20% gap.

Early disease detection, along with tech-enabled healthcare delivery and access to a comprehensive physician network, put Clover Health on the watch list. Indeed, this penny stock is worth considering for your portfolio!

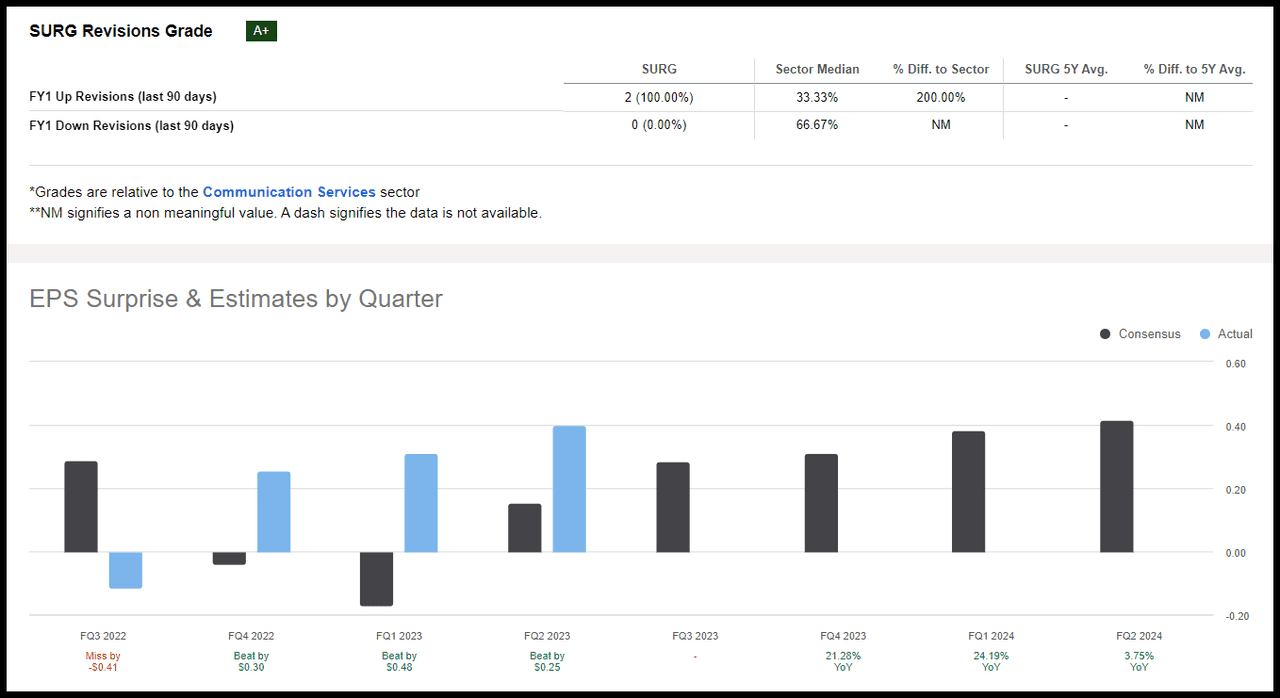

3. SurgePays, Inc. (SURG)

Let’s delve into SurgePays, Inc. (SURG), a cutting-edge financial technology firm servicing in the telecom sector. Its key objective is to cater to the underserved population with an extensive range of prepaid and financial solutions.

The Affordable Connectivity Program aligns with SurgePays’ mission to benefit over 20 million households enlisted in this program. Apart from this, its targeted outreach extends to convenience stores and other distribution points located within marginalized communities, reflecting its proactive and ambitious vision.

Starting 2022 on a positive note, SurgePays reported a promising GAAP net income of $3M in their first quarter. Despite some minor setbacks, like missing revenue estimates in Q2 2023, their consistent performance was highlighted by registering an Earnings Per Share (EPS) of $0.40, defeating projections by a substantial $0.25.

Combining this success with collaborative ventures involving major convenience stores—LeadEx Solutions for yielding high-profile leads and ClearLine Mobile for enhancing customer interaction through innovative LCD tablet interfaces—it seems evident that SURG is indeed living up to its moniker!

Comparisons to Clover Health aside, despite facing few hurdles in the stock market over the past year, prudent investors are aware that capitalizing on emerging stocks during transitional phases and subsequent value appreciation can be fruitful! Wall Street analysts’ predictions of a successful trajectory for SurgePays further support this idea.

The company’s statistics further underscore its strengths: SurgePays reports impressive forward year-over-year growth of +52%, outperforming the entire sector by only 3.58%. Coupled with data revealing that its ROC nearly quadruples the sector average, alongside an Asset Turnover Ratio of 4.12x (substantially exceeding the industry-standard 0.48x), SurgePays not only stands as a formidable adversary on Wall Street but also comes at an attractive discounted proposition!

SURG Stock Analysis

Currently trading at an impressively low price, SURG earns an A- on its valuation scorecard. A forward P/E ratio of 3.44x, which is significantly different from the sector’s average of 13.74x, supports this valuation. Furthermore, SurgePays’ forward EV/Sales and EV/EBIT ratios are over 75% lower than the industry average.

One should consider SurgePays’ prospective growth indicators: emergent partnerships, operations spanning approximately 13,000 shops, an expanding consumer base, and a projected ending cash balance of $5.2M and above $10M in receivables due for Q2 2023. As articulated by Alessandro Calvo, Seeking Alpha analyst, in his piece “Riding The Surge: SurgePays Could Be The Next Big Asymmetric Bet”:

“It’s noteworthy that SurgePays, bearing a significantly petite market capitalization currently, can potentially double its clientele within a year while conserving prevailing profitability levels leading to a surge in its stock prices. We’re examining a company which could feasibly rake in profits exceeding $30 million by the close of FY 2024 despite flaunting a market cap below $70 million.”

Thus, if you’re scanning for undervalued stocks underpinned by robust fundamentals, my top three selections definitely warrant your attention.

Stocks valued under $5 can offer potentially rewarding outcomes.

If you’re a bargain hunter, stocks priced under $5 might pique your interest. However, remember that these low-cost stocks can either be a bargain or significantly overpriced. Indeed, they may be more volatile and carry higher risk, but the upside is the excitement of potential massive returns from their dramatic lows and dizzying highs. Utilizing our unique Quant Screening System, we’ve selected three stocks with solid fundamentals.

Consider investing in these ‘under $5’ shares—LTMAY, CLOV, and SURG—to bring an edge to your portfolio. These inexpensive assets could lay the foundation for substantial earnings growth.

Editor’s Note: The article mentions securities that are not traded on any primary U.S. exchange. Therefore, be mindful of the risks associated with these types of stocks.

With guidance from SA Quant Strategist Steven Cress.