September 11, 2024 Top Stocks For Smart Investment Choices

September 8, 2024 S&P 500 In Freefall: Is This The End Of The Bull Market?

September 6, 2024 Jobs Report Spotlight As Fed Weighs Rate Cut Decision

August 26, 2024 NVDA Earnings Report Insights

Apple: Not Ready To Glow Up

Nvidia: The King Of Semiconductor Stocks Is Back – Still Cheap Here

Tesla Robotaxi: Fool Me Ten Times, Shame On Me

Amazon: Oracle Partnership Highlights Margin Expansion Potential

Nvidia: Why You Should Buy Before It Hits $145

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

US Dollar to Canadian Dollar (USD/CAD) Forecast for 2024, 2025, 2026. Sell or Buy?

Updated: September 16, 2024 (7:31)

Reverse forecast: CAD to USD

US Dollar / Canadian Dollar price online today

| Now | Tomorrow | 7 Days | 30 Days | |

|---|---|---|---|---|

| 100 US Dollar (USD) to Canadian Dollar (CAD) | 136.3 | 138.8 | 141.8 | |

| 200 US Dollar (USD) to Canadian Dollar (CAD) | 272.6 | 277.6 | 283.6 | |

| 500 US Dollar (USD) to Canadian Dollar (CAD) | 681.5 | 694 | 709.1 | |

| 1000 US Dollar (USD) to Canadian Dollar (CAD) | 1363.1 | 1388 | 1418.2 | |

| 3000 US Dollar (USD) to Canadian Dollar (CAD) | 4089.2 | 4163.9 | 4254.7 |

How much will the USD/CAD currency pair cost in 2024, 2025 and 2026? What is the forecast for the USD/CAD currency pair? What is the target price of the US Dollar / Canadian Dollar currency pair for 2024-2026?

We continuously scrutinize the key events in the news flow to assist you in tackling the essential question: Will the US Dollar rise or fall against the Canadian Dollar?

Identifying the trend of the USD/CAD currency pair

The recent rise in net speculative long positions for the US dollar futures indicates a strengthening bias among traders, potentially exerting upward pressure on the USD. This scenario could play a significant role in the USD/CAD exchange rate, keeping the dollar strong relative to the Canadian dollar.

Concurrently, the rupee's slight appreciation against the dollar, driven by the weakening US dollar in overseas markets and favorable foreign inflows, suggests possible volatility in the USD/CAD rate. This change hints at a trend of fluctuating demand and positioning, as investors adjust to the evolving forex landscape.

Adding to this dynamic, the market is anticipating the Federal Reserve's potential rate cut, which might diminish the attractiveness of USD-denominated assets. Such an event could lead to a broader impact on the USD/CAD valuation, potentially resulting in a temporary weakening of the USD, if interest rate cuts materialize.

Investors should remain vigilant, as these combined signals suggest a period of cautious optimism. Fluctuations in investor sentiments might create short-term opportunities in the USD/CAD market as it adjusts to these financial and geopolitical shifts.

USD Trend Prediction

As of now, Panda has analyzed 106 news pieces concerning the USD currency. The average relevance score for these news items is 0.36 (with the closer to 1 being more relevant).|

2024-09-16

|

Neutral | Impact: 0.08 | News: 5 (0/5/0) |

|

2024-09-15

|

Bullish | Impact: 0.08 | News: 2 (1/1/0) |

|

2024-09-13

|

Neutral | Impact: 0.06 | News: 12 (4/6/2) |

|

2024-09-12

|

Neutral | Impact: 0 | News: 12 (2/6/4) |

|

2024-09-11

|

Neutral | Impact: -0.03 | News: 16 (1/12/3) |

|

2024-09-10

|

Neutral | Impact: 0.01 | News: 10 (2/6/2) |

|

2024-09-09

|

Neutral | Impact: 0.06 | News: 14 (3/10/1) |

|

2024-09-07

|

Neutral | Impact: 0.02 | News: 1 (0/1/0) |

|

2024-09-06

|

Neutral | Impact: -0.05 | News: 13 (1/8/4) |

|

2024-09-08

|

Neutral | Impact: 0 | News: 3 (0/3/0) |

|

2024-09-05

|

Neutral | Impact: 0.03 | News: 12 (3/7/2) |

|

2024-09-04

|

Neutral | Impact: -0.04 | News: 5 (1/3/1) |

Circle Joins Others in Blacklisting Lazarus Group-Linked Wallets

Speculative Long Positions in US Dollar Index Reach Six-Month High

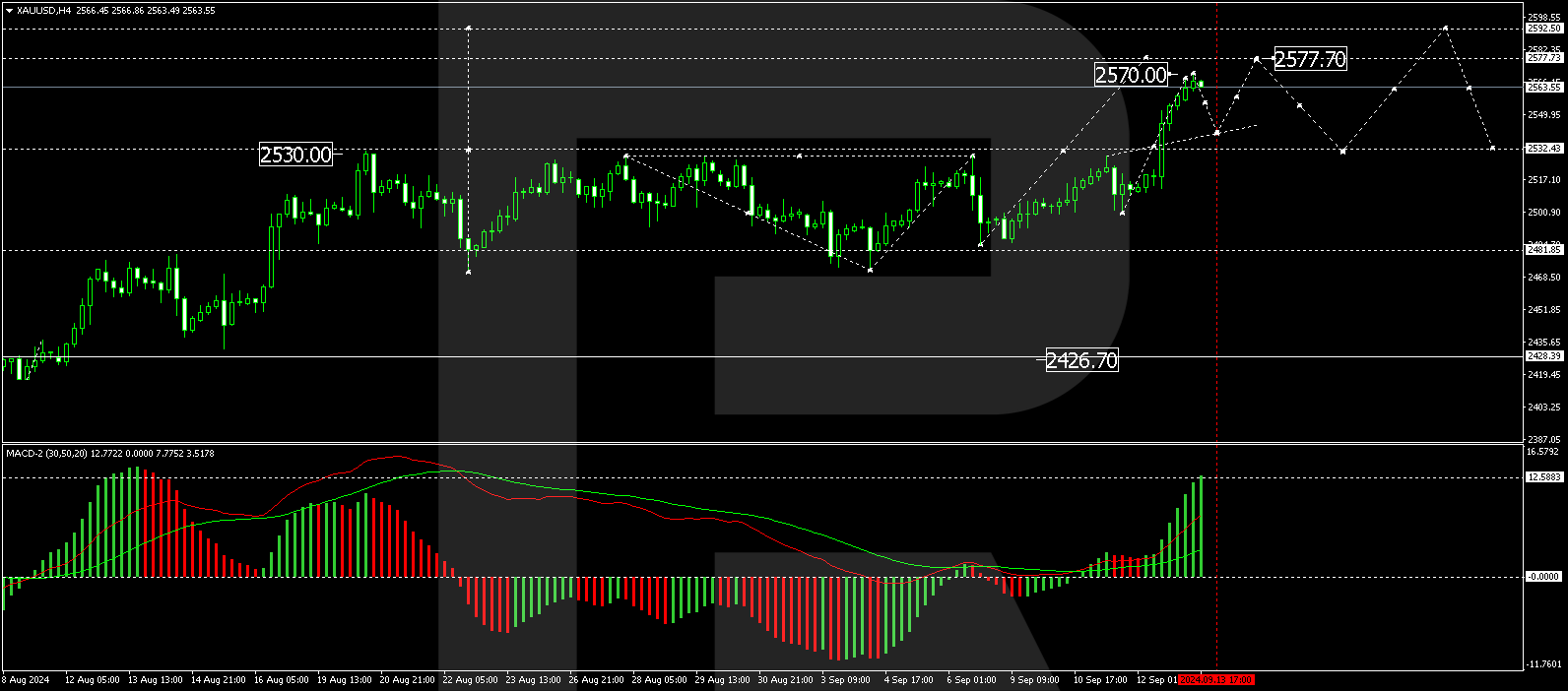

Historical and forecast chart of the US Dollar/Canadian Dollar currency pair

The chart below shows the historical quotes of the USD/CAD pair and the forecast chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. A detailed forecast of the US Dollar/Canadian Dollar rate can be found in the table below.

Long-term forecasts by years.

USD Main News

Rupee Appreciates 5 Paise to Reach 83.87 Against US Dollar in Early Session

Markets Open Higher with Strong Breadth

Rupee Strengthens Amid Expectations of Large Federal Reserve Rate Cut

Financial Expert Robert Kiyosaki Warns of US Debt Crisis: 'Dollar's Worth Declining'

Donald Trump Launches World Liberty Financial DeFi Project to Boost Stablecoin Adoption

Market Indices Dip Slightly Amid Strong Breadth

Bitcoin and Gold Surge Amid Anticipated Interest Rate Cuts

Watchdog Warns Tether May Pose Consumer Risks Similar to FTX and Celsius

Gold Prices Reach Unprecedented Levels as US Dollar Weakens

Indian Rupee Strengthens as US Dollar Dips

Rupee Strengthens, Marks Best Weekly Performance Since June

Crude Increases Amid Supply Issues, Gold Surges to Record, Dollar Dips to Weekly Low

Shanghai Composite Index Sees 0.48% Decline

Market indices show slight decrease; interest in PSU banks rises

Lagarde's Remarks Propel Euro to One-Week High

Comprehensive Analysis of News and Events influencing the USDCAD currency pair

We predict the dynamics of currency pairs using resonant artificial intelligence systems. Technical, fundamental analysis, news background, general geopolitical situation in the world and other factors are taken into account.

The results of forecasts of the US Dollar/Canadian Dollar currency pair are shown below and presented in the form of charts, tables and text information, divided into time intervals (Next month, 2024, 2025 and 2026).

Forecasts are adjusted once a day taking into account the price change of the previous day.

US Dollar / Canadian Dollar Daily Forecast for a Month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Sep 18 | 1.3631 | 1.3593 | 1.3716 | 0.91 % |

| Sep 19 | 1.3653 | 1.3584 | 1.3729 | 1.07 % |

| Sep 20 | 1.3687 | 1.3605 | 1.3731 | 0.93 % |

| Sep 21 | 1.3675 | 1.3590 | 1.3697 | 0.79 % |

| Sep 22 | 1.3775 | 1.3692 | 1.3810 | 0.86 % |

| Sep 23 | 1.3880 | 1.3833 | 1.3954 | 0.87 % |

| Sep 24 | 1.3912 | 1.3882 | 1.3998 | 0.83 % |

| Sep 25 | 1.3933 | 1.3887 | 1.3995 | 0.78 % |

| Sep 26 | 1.3921 | 1.3849 | 1.3950 | 0.72 % |

| Sep 27 | 1.3974 | 1.3916 | 1.4020 | 0.75 % |

| Sep 28 | 1.4020 | 1.3965 | 1.4068 | 0.74 % |

| Sep 29 | 1.4048 | 1.3994 | 1.4124 | 0.93 % |

| Sep 30 | 1.4116 | 1.4059 | 1.4173 | 0.81 % |

| Oct 01 | 1.4108 | 1.4048 | 1.4192 | 1.03 % |

| Oct 02 | 1.4060 | 1.4034 | 1.4097 | 0.45 % |

| Oct 03 | 1.4121 | 1.4032 | 1.4158 | 0.90 % |

| Oct 04 | 1.4198 | 1.4123 | 1.4263 | 0.99 % |

| Oct 05 | 1.4269 | 1.4184 | 1.4342 | 1.12 % |

| Oct 06 | 1.4254 | 1.4224 | 1.4335 | 0.79 % |

| Oct 07 | 1.4245 | 1.4167 | 1.4289 | 0.86 % |

| Oct 08 | 1.4291 | 1.4259 | 1.4365 | 0.75 % |

| Oct 09 | 1.4190 | 1.4135 | 1.4255 | 0.85 % |

| Oct 10 | 1.4134 | 1.4053 | 1.4213 | 1.13 % |

| Oct 11 | 1.4223 | 1.4166 | 1.4246 | 0.56 % |

| Oct 12 | 1.4197 | 1.4157 | 1.4269 | 0.79 % |

| Oct 13 | 1.4301 | 1.4234 | 1.4354 | 0.84 % |

| Oct 14 | 1.4217 | 1.4162 | 1.4272 | 0.78 % |

| Oct 15 | 1.4247 | 1.4190 | 1.4333 | 1.00 % |

| Oct 16 | 1.4172 | 1.4082 | 1.4256 | 1.23 % |

| Oct 17 | 1.4182 | 1.4113 | 1.4222 | 0.77 % |

Target daily price USD/CAD

Target values of the USD/CAD currency pair as of 09-18-2024.

Optimistic target level: 1.3716

Pessimistic target level: 1.3593

Target values of the USD/CAD currency pair as of 09-19-2024.

Optimistic target level: 1.3729

Pessimistic target level: 1.3584

Target values of the USD/CAD currency pair as of 09-20-2024.

Optimistic target level: 1.3731

Pessimistic target level: 1.3605

Target values of the USD/CAD currency pair as of 09-21-2024.

Optimistic target level: 1.3697

Pessimistic target level: 1.3590

Target values of the USD/CAD currency pair as of 09-22-2024.

Optimistic target level: 1.3810

Pessimistic target level: 1.3692

US Dollar / Canadian Dollar (USD/CAD) Forecast 2024 Monthly

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Oct | 1.4016 | 1.3568 | 1.4192 | 4.40 % |

| Nov | 1.4217 | 1.3802 | 1.4537 | 5.06 % |

| Dec | 1.4230 | 1.4057 | 1.4608 | 3.77 % |

USD/CAD forecast for this year

Forecast of the USD/CAD pair for Oct 2024

Forecast of the USD/CAD pair for Nov 2024

Forecast of the USD/CAD pair for Dec 2024

US Dollar / Canadian Dollar (USD/CAD) Forecast 2025 Monthly

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1.4480 | 1.4219 | 1.4838 | 4.17 % |

| Feb | 1.4662 | 1.4319 | 1.5091 | 5.11 % |

| Mar | 1.4735 | 1.4377 | 1.4967 | 3.94 % |

| Apr | 1.4742 | 1.4284 | 1.5100 | 5.40 % |

| May | 1.4775 | 1.4489 | 1.4948 | 3.07 % |

| Jun | 1.5101 | 1.4720 | 1.5515 | 5.12 % |

| Jul | 1.4795 | 1.4602 | 1.5081 | 3.18 % |

| Aug | 1.4522 | 1.4215 | 1.4907 | 4.65 % |

| Sep | 1.4528 | 1.4247 | 1.4894 | 4.35 % |

| Oct | 1.4986 | 1.4703 | 1.5343 | 4.18 % |

| Nov | 1.4757 | 1.4611 | 1.4923 | 2.09 % |

| Dec | 1.4591 | 1.4440 | 1.5011 | 3.81 % |

US Dollar / Canadian Dollar (USD/CAD) Forecast 2026 Monthly

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1.5247 | 1.4980 | 1.5412 | 2.80 % |

| Feb | 1.5371 | 1.5108 | 1.5751 | 4.08 % |

| Mar | 1.5191 | 1.4788 | 1.5540 | 4.84 % |

| Apr | 1.5587 | 1.5349 | 1.6008 | 4.12 % |

| May | 1.5616 | 1.5194 | 1.5861 | 4.21 % |

| Jun | 1.5124 | 1.4777 | 1.5641 | 5.53 % |

| Jul | 1.5164 | 1.4823 | 1.5383 | 3.64 % |

| Aug | 1.5014 | 1.4481 | 1.5183 | 4.63 % |

| Sep | 1.4704 | 1.4287 | 1.4915 | 4.21 % |

| Oct | 1.5001 | 1.4657 | 1.5170 | 3.38 % |

| Nov | 1.5454 | 1.5245 | 1.5864 | 3.90 % |

| Dec | 1.5301 | 1.4949 | 1.5672 | 4.61 % |