July 14, 2024 This Week Top S&P 500 Gainers & Losers

Tesla: Time To Take Profits

Microsoft: The Q4 Results Should Surprise You

Tesla: Optimus And FSD Probably Won’t Save The Day

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

NVIDIA’s AI superpower: Stock Performance In Market Trends

May 23, 2024

NVIDIA Corporation has seen its stock soar, reaching an all-time high after a significant quarter.

Here we provide insights into NVIDIA’s financial health, stock movements, and factors driving its success in AI and computing. Stay tuned for a deep dive into how these elements influence investor decisions.

Key Takeaways

- NVIDIA’s stock price reached over $1,000 for the first time due to excellent quarterly results. Analysts think it will go up more, with a target at about $1,076.

- The company makes a lot of money from AI and computing. It earned way more than before, with earnings jumping 412%. Revenue also went up by 125.85%, reaching $60.92 billion in 2023.

- NVIDIA leads in making AI chips like the new Blackwell chip, which is twice as fast as their older ones. This helps them stand out and make even more money.

- Despite challenges like chip shortages, NVIDIA keeps growing strong in areas like gaming and cars too.

- Many experts think NVIDIA will keep doing great because of its smart moves in tech and AI.

NVIDIA’s Financial Highlights

NVIDIA shows strong numbers, with earnings on the up. Sales are climbing, too—markets watch closely.

Recent Earnings Overview

NVIDIA’s fiscal first-quarter earnings showed impressive results. The company’s earnings per share (EPS) reached $5.58, soaring by 412% from the previous year. This performance smashed analysts’ predictions and set a strong pace for the tech giant in the stock market.

Revenue during this period more than tripled, highlighting NVIDIA’s dominance in sectors like data centers, artificial intelligence (AI), and cloud-based services. A staggering 400% growth in its data center business proves NVIDIA is not just surviving but thriving amid global chip shortages – a vital component of today’s tech landscape.

Revenue Growth and Trends

Moving from its recent earnings success, NVIDIA now showcases impressive revenue growth, marking a significant upward trend. The company’s revenue soared by 125.85%, reaching $60.92 billion in 2023.

This spike stems largely from its AI-related products and services, highlighting the tech giant’s strong position in the market.

The next quarter looks promising as well with a sales forecast pegged at $26.62 billion, indicating continued strong demand for GeForce GPUs and cloud services among others. NVIDIA’s focus on graphic processing units and expansion into new markets like mobile gaming and automotive platforms fuels this momentum, setting the stage for sustained growth ahead.

NVIDIA’s Stock Movements and Analyst Insights

NVIDIA’s stock prices keep changing, showing how the market feels about them. Experts with a lot of knowledge think these changes show if you should buy or not.

Recent Stock Price Trends

On May 22, 2024, NVIDIA saw its stock price close at $949.50, marking a slight dip of 0.46%. Yet, the after-hours trading told a different story with an impressive leap to $1007.00—a 6.06% increase.

This surge showed NVIDIA’s strength in the market and set the stage for breaking records. Shortly after, NVIDIA’s stock soared past the $1,000 threshold for the first time thanks to outstanding quarterly results.

Wall Street analysts have their eyes on this tech giant, setting an average 12-month price target at $1076.68. This suggests they predict a strong upward movement—with a potential gain of 13.39% from its last closing price.

Analysts applaud NVIDIA’s performance and have high hopes for its future in graphics processing units and cloud software services alike—positioning it as a preferred pick among investors seeking growth fueled by innovation in AI and computing technologies.

Analyst Ratings and Price Targets

NVIDIA commands the market with its robust AI and computing capabilities, drawing unanimous praise from analysts. The consensus around NVIDIA’s stock is a strong buy. This shows in the numbers: 36 analysts recommend buying, while only one suggests holding. No one advises selling. The optimism from experts like Citi, Wells Fargo, and Bank of America Securities shines through their predictions. They’ve set the bar high with a peak price target of $1,400 and a floor at $850.00. On average, analysts see NVIDIA’s stock climbing to a 13.39% increase from its current standing at $949.50.

| Rating | Buy | Hold | Sell | Highest Price Target | Lowest Price Target | Average Price Target | Current Price |

|---|---|---|---|---|---|---|---|

| Analyst Consensus | 36 | 1 | 0 | $1,400 | $850.00 | $1,078.83 | $949.50 |

This table crystallizes the overarching sentiment among market experts. Their analysis suggests NVIDIA is a viable candidate for growth. The consensus points to a robust future, highlighted by a potential 13.39% uptick. Investors pay close attention. These figures aren’t just numbers; they’re a beacon for where NVIDIA, fueled by AI advancements and market expansions, might head. The journey ahead looks promising, with NVIDIA steering towards uncharted territories, ready to capitalize on the next wave of tech innovations.

Factors Influencing NVIDIA’s Stock Performance

NVIDIA’s stock sees ups and downs from AI growth and chip shortages. These big changes in tech affect how well NVIDIA does.

AI and Computing Sector Growth

The AI and computing sector is expanding fast. More businesses now need advanced AI to handle big data, making NVIDIA a key player in this field. Their chips power everything from cloud services to robotics, showing how crucial they are for tech growth.

As demand for generative AI and data processing rises, NVIDIA’s innovations lead the way. They offer solutions like GeForce Now game streaming service and Jetson robotics that set them apart.

With each new chip launch, NVIDIA paves the path for future tech trends, making its stock attractive to investors watching the sector grow.

Impact of Global Chip Shortage

NVIDIA faces a big problem: the global chip shortage. This issue makes it hard for them to meet the demand for AI products and services. Because of this, NVIDIA’s revenue growth could slow down.

They are now looking for other ways to get the parts they need.

Analysts keep an eye on how this shortage affects NVIDIA’s future. It challenges not just NVIDIA but also hits other tech companies hard. Despite these troubles, NVIDIA keeps working on new solutions and tries to stay ahead in the game.

Key Innovations and Market Expansion

NVIDIA keeps creating new computer chips, opening doors in different areas. These moves push the company into exciting markets and bring fresh tech to users around the world.

Launch of New AI Chips

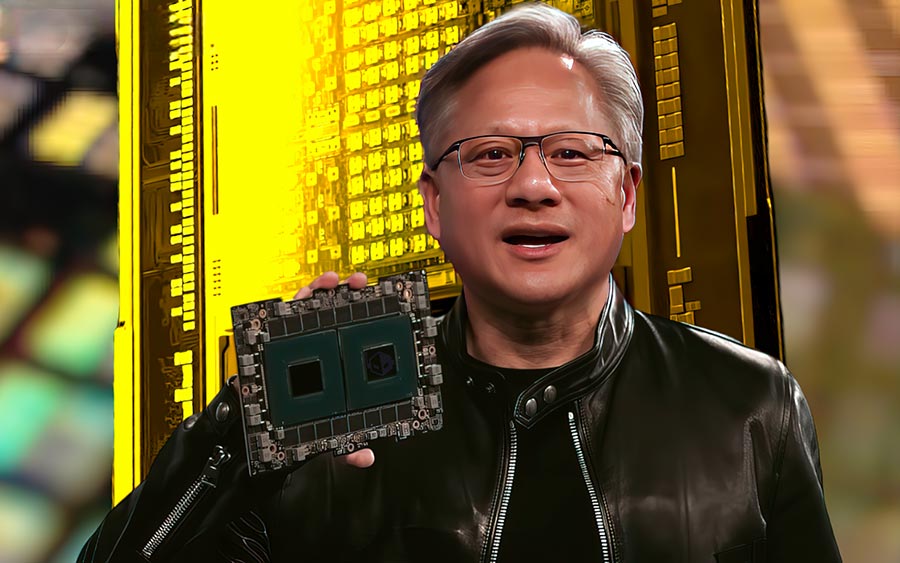

CEO Jensen Huang recently made a big announcement. NVIDIA is rolling out the Blackwell chip. This new AI brain is double as quick as their current Hopper chip. It’s not just faster, it’s a game-changer in computing power and efficiency.

Experts predict this innovation will rake in billions for NVIDIA this year alone.

Now, let’s talk money and tech—two things intertwined within NVIDIA’s DNA. The introduction of Blackwell sets NVIDIA apart in the fierce market race amongst giants like Google and Apple.

Imagine having a computer or server that works twice as fast with no extra cost on energy; that’s what Blackwell brings to the table for cloud service providers using graphics processors.

Investors are keeping an eye out, seeing dollar signs with each advance in chipset technology, especially ones promising quantum leaps like this one does.

Expansion into New Markets

NVIDIA is making big moves beyond its traditional role in computer graphics and gaming. The company now steps into new territories with the launch of artificial intelligence chips and solutions for various sectors.

These include automotive, healthcare, and robotics industries. For instance, NVIDIA’s Drive platform offers advanced AI capabilities for self-driving cars. Its Omniverse software enables digital simulation environments that can greatly benefit architects and designers.

NVIDIA understands the importance of expanding its market reach to stay ahead in the tech race. It targets areas where AI can make a huge difference, such as smart cities and IoT devices.

This strategy not only opens up new revenue streams but also strengthens NVIDIA’s position as a leader in AI innovation.

Exploring new markets ensures our growth and leadership in AI technology.

Competitive Analysis

In the tech jungle, NVIDIA stands tall. Its battle for market share pits it against giants and startups alike, with each vying for dominance in the AI and GPU arenas.

Comparison with Competitors in the Tech Industry

NVIDIA stands at the forefront of AI technology, outpacing competitors in the tech industry. Its leadership in AI has driven significant growth, especially within its data center business. This growth surpasses that of many competitors, showcasing NVIDIA’s dominance.

| Company | Market Share (%) | Revenue Growth | Innovations |

|---|---|---|---|

| NVIDIA | 80 | 400% increase in data center business | New AI chips |

| Intel | 15 | Slow growth in comparison | Traditional processors |

| AMD | 5 | Moderate increase | Graphics and computing units |

NVIDIA’s 80% market share in AI technology underscores its superiority. The company’s 400% revenue increase in its data center segment speaks volumes, sharply contrasting with Intel’s slow growth and AMD’s moderate increase. NVIDIA innovates with new AI chips, while Intel focuses on traditional processors and AMD on graphics and computing units. Moving forward, NVIDIA’s expansion into new markets positions it for continued leadership.

NVIDIA’s Market Share and Industry Ranking

NVIDIA stands as a colossus in the tech world, with its third-place ranking by market cap in the U.S. at $2.3 trillion. The company’s robust position in Nasdaq 100 and S&P 500 showcases its significant clout. Market experts are unanimous in their view that NVIDIA will keep its lead in the AI arena. This dominance reflects not just in its innovative prowess but also in its strategic market expansions and product launches. Here’s a closer look.

| Aspect | Details |

|---|---|

| Market Cap Ranking | Third in the U.S., $2.3 trillion |

| Indices Inclusion | Nasdaq 100, S&P 500 |

| AI Market Position | Leading with cutting-edge AI chips and technology solutions |

| Revenue Growth | Sustained growth driven by AI and computing sector demand |

| Global Chip Shortage Impact | Managed to navigate through supply chain challenges effectively |

| Key Innovations | Introduced groundbreaking AI chips, setting industry benchmarks |

| Market Share | Commands a significant share in the GPU and AI market segments |

| Competitive Analysis | Maintains a lead over rivals in tech innovation and market expansion |

In summary, NVIDIA’s market share and ranking testify to its supremacy in the technology sector. Its knack for innovation, coupled with a strategic approach to market expansion, cements its leading status. Investors watch NVIDIA closely, expecting its trajectory to remain upward, fueled by AI advancements and global demand for its products.

Future Outlook and Investor Sentiment

Market experts see bright days ahead for NVIDIA. Investors are showing high confidence in the company’s future.

Predictions for Future Performance

Experts see NVIDIA’s future in bright colors. The company, known for its powerful AI chips and graphics processing units (GPU), gets a “Strong Buy” nod from 37 Wall Street analysts.

This enthusiasm comes from NVIDIA’s solid role in the AI industry and tech markets. With positive earnings reports, many believe NVIDIA will keep thriving.

NVIDIA stands at the forefront of technological innovation, poised for continued growth amidst rising demand for AI capabilities, says market analyst Harlan Sur.

Investors watch closely as NVIDIA expands into new areas and launches cutting-edge products. Confidence levels are high. Given these factors, it’s clear that NVIDIA is on a path to maintain its leadership in the tech space.

Investor Expectations and Confidence Levels

Investors watch NVIDIA closely, expecting much from its powerful AI tech and market moves. With analysts giving NVDA a “Strong Buy” rating and setting a price target of $969.32, confidence is high.

People investing in stocks look at these ratings and targets to decide where to put their money. They see NVIDIA as a leader in graphics processing units (GPUs) and other tech products like the Tegra processor, driving interest in buying NVDA shares through brokerage accounts.

This enthusiasm comes from NVIDIA’s innovations in AI chips and expansion into new markets, promising growth ahead. Investors also note how well NVIDIA stands against competitors in the tech industry, holding a strong market share.

Seeing the company’s success makes them confident about investing in it for good returns.

Next, we’ll explore key points around this subject…

Conclusion

NVIDIA shines in the stock market with its AI prowess, hitting a record high last year. Experts see more growth as AI demand rises. With strong leadership and innovative solutions, NVIDIA secures its place at the top of the tech world.

Its stocks attract investors, hinting at a bright future ahead. Clearly, NVIDIA’s journey in AI and tech is one to watch.

FAQs

1. What drives NVIDIA’s stock performance?

NVIDIA, known for its graphics processing units for gaming and professional markets, sees stock performance driven by innovations in AI, chipsets for multi-core CPUs, and strong demand across workstations and consoles. Its advancements in technologies like NVIDIA RTX GPUs fuel growth.

2. How does NVIDIA’s dividend yield affect investors?

The company offers dividends, providing income to shareholders on top of potential stock price appreciation. This makes NVIDIA an attractive option for those looking at both growth and income from their investments.

3. What role do technical analysis play in predicting NVIDIA’s stock trends?

Technical analysis helps investors identify buy signals or opportunities based on patterns within the market data—like P/E ratio or beta coefficient—offering insights into future movements of NVIDIA’s stock on exchanges like NASDAQ: NVDA.

4. Can external factors influence NVIDIA’s market position?

Yes, partnerships with giants like Google and involvement in sectors such as android devices impact its market standing. Additionally, coverage by financial media outlets such as CNBC Television can sway investor sentiment.

5. How does the global presence of NVIDIA affect its stocks?

Trading on multiple stock exchanges globally—including NYSE and Euronext—amplifies its visibility among international investors, potentially increasing demand for its shares which can positively impact the stock price.

6. Why is keeping up with tech developments crucial for investing in companies like NVIDIA?

Staying informed about new products or advancements—in areas like super micro technology or InfiniBand networks—is vital because these innovations directly contribute to the company’s growth prospects and thus influence investment decisions.