Apple: Sell The AI Hype (Rating Downgrade)

Microsoft: After Generative AI, The Path To More Upside

Nvidia Takes The Lead In The Silicon Valley Derby

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

The Week Ahead: Fed’s June Decision, Earnings This Week

June 3, 2024

The Federal Reserve’s June decision could impact the market volatility. We will guide you through key economic events and earnings reports coming up, offering insight into what to expect.

Do not feel lost with the fast-changing stock market. Stay informed here.

Key Takeaways

- The Federal Reserve’s decision in June could change stock prices. Before that, the jobs report on Friday and Europe’s central bank rate cut on June 6 are important for investors.

- Companies like Hewlett Packard Enterprise, lululemon, NIO, Walmart, Nvidia, GitLab, and many others will share how they are doing this week. Their reports can make stock prices move up or down.

- New companies Novelis and Gauzy are starting to sell their stocks for the first time. Also, there’s a lot of trading happening with options on Robinhood Markets which shows people are very active in buying and selling.

- Big meetings like Nareit REITweek conference and Jefferies Global Healthcare Conference will happen where people talk about real estate and healthcare investments. This gives investors new ideas.

- Snowflake, Cisco, Precigen, and Entergy events will show what is new in cloud data platforms, internet infrastructure improvements biotechnology innovations (like gene editing), power generation advancements focusing on sustainable energy solutions

Key Economic Events This Week

This week, investors will watch for the May work numbers and the April price growth report. They’ll also pay attention to what Europe’s central bank decides next.

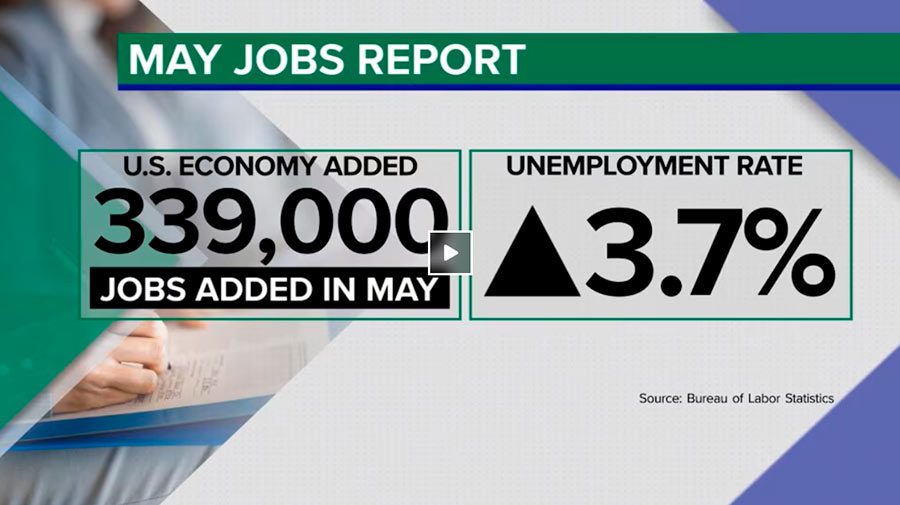

May jobs report

The May jobs report comes out on Friday. It’s a big deal for Wall Street. This is because it’s the last one before the Federal Reserve decides what to do in June, on the 11th and 12th.

Everyone looking at the stock market will watch this closely. The numbers in this report will show how many jobs were added last month. They tell us if more people are working or not.

This can change how investors think about stocks.

If lots of jobs were added, it might mean businesses are doing well. But if not many jobs were added, some might worry about the economy slowing down. So, this report can make stock prices go up or down quickly.

Investors use it to guess what the Fed will do next—like changing interest rates which affects everything from how much you pay for a loan to how much you earn on savings. That’s why everyone waits for the May jobs report before making big decisions with their money.

April PCE inflation report

The April PCE inflation report states the 12-month Core PCE at 2.8%. This figure did not change from March’s numbers. Investors watch this closely, as it is the Federal Reserve’s official target for inflation.

Stable rates like these influence stock market forecasts and investor decisions. It shows inflation pressures might be easing, guiding future actions by the Fed regarding interest rates.

European Central Bank decision

Shifting focus from inflation, attention now turns to the European Central Bank’s next move. On June 6, a significant decision will take place. The bank plans to cut rates. This is not just any day; it marks the 80th anniversary of D-Day.

Investors keenly watch this event, knowing rate cuts can influence market trends and investment decisions.

The European Central Union aims for a steadier economy with its decision to cut rates on June 6.

Rate adjustments are crucial tools for central banks in managing economic stability and growth. By cutting rates, the ECB signals its commitment to supporting the economy amid varying global financial conditions.

Such actions affect everything from currency values to stock prices across Europe and beyond, making it a pivotal moment for anyone involved in international trading or investing.

Earnings Reports to Watch

This week, keep an eye on earnings from big names like Hewlett Packard Enterprise and lululemon. They’ll show how companies are doing, affecting stock prices.

Hewlett Packard Enterprise (HPE)

Hewlett Packard Enterprise, known as HPE, is set to share its earnings report this week. Investors watch closely as these numbers often signal the company’s health and future performance.

This tech giant specializes in cloud computing and cybersecurity solutions, serving businesses worldwide. Its earnings can move stock prices and affect market trends.

Market analysts pay attention to HPE’s revenue, profit margins, and growth forecasts during the earnings call. These figures will offer insights into the tech sector’s resilience amidst global economic shifts.

For investors focusing on wall street stock market today or planning their next moves in stock trading, keeping an eye on HPE’s outcomes is crucial.

lululemon (LULU)

Switching from the tech sector, investors turn their attention to lululemon (LULU), a leader in the athletic apparel market. LULU is set to release its earnings report this week, an event eagerly awaited by Wall Street and share market analysts alike.

This announcement holds significant weight, as it reflects not just on lululemon’s performance but also provides insight into consumer spending trends within the retail industry.

The outcome of this report could influence stock prices across the board, making it a crucial moment for those holding LULU shares or considering them for purchase. With a keen eye on earnings per share and revenue figures, investors seek clues about future growth prospects and market positioning.

Empty shelves or robust sales—this earnings call will shed light on how well lululemon has navigated recent market challenges.

Earnings season brings critical insights for investors aiming to gauge company health and market direction.

NIO (NIO)

Moving from lululemon, attention turns to NIO (NIO), set for its earnings report. Investors watch closely, eager to see how this electric carmaker has performed. With the stock market always on the lookout for signs of growth, NIO’s numbers could signal trends in the electric vehicle sector.

Earnings week is a critical time, and NIO’s share price may react strongly to its financial results. The company plays a significant role in the trading market, especially for those interested in sustainable investments.

Its performance insights will provide valuable data for stock analysis, influencing decisions on whether to buy or sell NIO stock during earnings calendar this week.

Walmart (WMT)

Walmart (WMT) gears up for a big week with its shareholder meeting in focus. This event draws investors’ attention as it could hint at future company strategies and stock market trends.

On separate days, Walmart also celebrates its Associates with a special event, underlining the company’s commitment to its team members. These gatherings are crucial for both shareholders and employees, offering insights into Walmart’s performance and its plans looking ahead in the stock market.

With eyes on these events, investors watch closely for impacts on Wall Street reports and potential shifts in stock ratings.

Nvidia (NVDA)

Nvidia’s eyes are set on the stock market this week. Investors watch closely as the company prepares for a 10-for-1 stock split. This big move happens after trading ends on Friday.

Such splits often attract more investors, making shares easier to buy due to their lower price post-split. Nvidia, known for its powerful graphics processing units, plays a vital role in gaming and AI industries.

The split aims to make share ownership more accessible, potentially boosting Nvidia’s stock value in the tech sector and Wall Street analysis.

Market analysts see Nvidia’s decision as a strategic step to increase liquidity and attract small investors. By reducing the cost per share without changing the company’s overall market value, Nvidia ensures its place among attractive stocks in New York’s bustling market this year.

With such financial maneuvers, Nvidia strengthens its standing not just among tech giants but also on Wall Street, signaling strong growth prospects ahead of its earnings report next week.

GitLab (GTLB)

GitLab (GTLB) steps into the earnings spotlight this week, drawing Wall Street’s focus. Investors eagerly await GitLab’s report, eyeing it as a significant indicator of the company’s current health and future prospects.

Known for its DevOps platform that streamlines software development and operation processes, GitLab has positioned itself as a key player in tech innovation.

Earnings reports serve as a company’s report card, and we’re keen to see how GitLab scores.

As market watchers closely follow stock earnings this week, GTLB stands out. Analysts predict numbers that could influence stock market trends. The performance of companies like GitLab often provides valuable insights into broader industry health—making this week crucial for investors tracking stock market analytics.

With eyes on the New York stock market, reports from firms such as GitLab offer essential data for those making informed trading decisions. This update will not only affect GitLab’s own share price but also contribute to broader market outlook discussions among investors seeking comprehensive stock analysis.

Science Applications (SAIC)

Science Applications (SAIC) stands out in the stock market outlook for this week. Investors watch SAIC closely for its earnings report, which serves as a key indicator of the company’s financial health and future prospects.

With a strong focus on providing services and solutions in information technology and engineering, SAIC plays a critical role in sectors like defense, intelligence, and healthcare.

The company’s performance is crucial not just for shareholders but also for analysts who track its impact on the broader market reports this week. As SAIC releases its figures, market participants will look at revenue growth, profit margins, and forward guidance to make informed trading decisions.

This analysis helps paint a larger picture of where SAIC stands within the industry and how it contributes to stock index trends.

CrowdStrike (CRWD)

CrowdStrike, marked by the ticker CRWD on stock exchanges, gears up to share its earnings report. Investors keep eyes peeled for these numbers, as they often move the market. Known for its cybersecurity services, CrowdStrike’s performance serves as a pulse check on tech security demand.

This week, as their financial health comes under scrutiny, specifics like revenue growth and profit margins take center stage. Market watchers compare these results against past quarters to gauge trends.

CRWD stands out in the stock reports this week. Analysts predict figures that could sway investors’ confidence in tech stocks broadly and cybersecurity shares specifically. The company has set benchmarks in protecting digital assets from threats—a critical need across industries today.

Thus, its earnings reveal its standing and hint at wider market sentiments towards tech security investments.

PVH (PVH)

PVH Corp, a giant in the apparel market, marks a critical watch for investors this week. The company oversees famous brands like Tommy Hilfiger and Calvin Klein. Eyes will closely follow its earnings report, anticipating impacts on stock rates and market positions.

Analysts predict numbers that could set trends in the fashion industry and alter investor decisions.

The focus sharpens on how PVH deals with current economic challenges, with investors seeking insights into consumer spending habits on luxury brands. These figures gauge PVH’s health and offer clues about wider retail trends.

Clear signs point to PVH influencing future market directions—a vital note for those tracking stock performances closely.

Dollar Tree (DLTR)

Dollar Tree, a well-known chain in the bargain retail sector, grabs attention with its unique selling point: items sold at fixed low prices. This simplicity draws a wide customer base seeking deals on everyday goods.

In the coming week, investors keep an eagle eye on Dollar Tree’s earnings report, marking it as a potential stock market highlight. The expectation is clear; numbers will show how effectively the company has managed costs while keeping sales robust.

Earnings spotlight shines brightly on Dollar Tree as it presents its financial health to Wall Street.

The focus is not just on profit but also how consumer behavior impacts sales trends. With every report, Dollar Tree gives insights into spending patterns that go beyond mere numbers.

The upcoming release will clarify actions and future strategies potentially influencing stock analysts’ ratings and market commentary. Thus, providing first-hand insight into the fiscal dynamics of discount retailing during economic fluctuations.

Brown-Forman (BF.A)

Brown-Forman, the company behind iconic brands like Jack Daniel’s and Woodford Reserve, is set to release its earnings report. Investors watch closely as this beverage giant shares performance figures that could influence stock market positions.

Known for consistent growth in the spirits sector, Brown-Forman plays a crucial role in shaping market trends and investor strategies. With an eye on sales numbers and profit margins, stakeholders aim to gauge consumer demand patterns and economic health through these reports.

The upcoming announcement will offer insights into the company’s ability to navigate market challenges while bolstering stock portfolios. Key factors include shifts in consumer preferences and impacts of global supply chain issues on operations.

As a leader in the beverage industry, Brown-Forman’s financial health signals broader trends, making its earnings an essential watch for those involved in stock trading analysis and capital market movements.

Campbell Soup (CPB)

Campbell Soup Company, known as CPB on the stock market, is set to share its earnings this week. Investors closely watch these reports to gauge the company’s health and future prospects.

With a diverse product range spanning soups, snacks, and simple meals, Campbell’s financial performance can reflect wider consumer trends. Past numbers have shown resilience in demand for their comfort foods, which often see a spike during colder months or uncertain times.

This week’s announcement will provide critical insights into how CPB is handling current market challenges and consumer preferences. Analysts predict steady figures due to consistent brand loyalty and strong retail partnerships.

As investors evaluate CPB’s data alongside other companies’, they’ll be keen on spotting growth opportunities or red flags within the sector. Next up after Campbell Soup: Five Below announces its results, another key event in a busy earnings season.

Five Below (FIVE)

After discussing Campbell Soup (CPB), the focus shifts to Five Below (FIVE), a popular retail chain. This company stands out in the earnings reports to watch, appealing to investors who track stock market performances closely.

Five Below operates stores that sell items for $5 or less, offering a variety of products from toys to tech accessories. Their unique pricing strategy makes them a key player in the retail sector, especially when consumers are looking for deals.

Investors pay close attention to Five Below’s earnings because they provide insights into consumer spending habits and the health of the retail industry. The upcoming report will reveal how effective their low-price model is in driving traffic and sales amid economic changes.

With stores across many states, their performance can also hint at regional shopping trends, making it vital data for market analysis.

Five Below’s success hinges on understanding its customer base and adapting swiftly.

Market Events to Monitor

Watch for new public offerings from Novelis and Gauzy this week. Also, keep an eye on options activity on Robinhood Markets for hints at investor moves.

Options trading volume on Robinhood Markets (HOOD)

Options trading volume on Robinhood Markets has seen a significant increase. This uptick shows more traders are choosing options to speculate or hedge in the stock market. Robinhood, known for making trading accessible to all, offers a platform where investors can trade options without paying commissions.

This trend highlights how individual investors use Robinhood for not just buying and selling stocks but also for complex strategies involving options. With its user-friendly app, Robinhood attracts a diverse group of traders looking to take advantage of stock market movements through options trading.

IPOs from Novelis (NVL) and Gauzy (GAUZ)

Shifting focus from options trading volumes on Robinhood Markets, investors now set their sights on upcoming IPOs. This week, market participants will watch as Novelis and Gauzy begin their journey in the stock market.

- Novelis, a leader in aluminum recycling, is set to price its IPO. This move attracts attention from those invested in sustainable materials and green initiatives.

- Following closely, Gauzy, an innovator in Israeli glass film manufacturing, also eyes its market debut. Its unique offering sparks interest among tech-savvy investors and those keen on advanced materials.

- Both companies have chosen this week for their trading kickoff. Timing is crucial as it coincides with a peak in investor interest towards fresh market entries.

- Their performance will offer insights into the current IPO climate, providing valuable data for future offerings.

- For investors focused on diversification, these IPOs present new opportunities to explore sectors poised for growth—manufacturing and technology.

- Market analysts eagerly await these debuts to gauge investor sentiment towards innovative and eco-conscious companies.

- Success of these IPOs could signal a strong market appetite for shares with a focus on sustainability and innovation.

- Those holding portfolios heavy in tech or green stocks may find Gauzy and Novelis attractive additions, enhancing their investment strategy.

- Participation in these IPOs requires swift action due to high interest levels across the investing community.

- Finally, the outcome of Novelis and Gauzy’s first trading day will set the tone for others considering going public under similar themes—innovation and environmental consciousness stand out as key trends.

Investors keep close tabs on these entries as they promise growth and diversification away from traditional sectors into more forward-thinking industries such as sustainable materials and high-tech manufacturing solutions.

Investor events including Nareit REITweek conference, Jefferies Global Healthcare Conference, and Deutsche Bank Global Consumer Conference

Investors look forward to major conferences for insights and trends. These events draw companies, executives, and investors from various sectors.

- Nareit REITweek conference gathers real estate investment trusts (REITs) and investors to discuss the future of real estate markets. Attendees gain insights into property investments, finance models, and market forecasts.

- Jefferies Global Healthcare Conference brings together health care firms, technology innovators, and financial experts. They share breakthroughs in medicine, digital health advancements, and investment opportunities within the healthcare sector.

- Deutsche Bank Global Consumer Conference focuses on consumer goods and retail industries. Leaders present emerging trends, strategies for growth, and consumer behavior patterns affecting global markets.

These events offer a platform for networking, partnership opportunities, and direct discussions with senior executives. Participants leave with a deeper understanding of market dynamics and potential investment areas.

Investor events from Snowflake (NYSE:SNOW), Cisco (CSCO), Precigen (PGEN), and Entergy (NYSE:ETR)

Following key conferences, more investor events are on the horizon. Four big names, Snowflake, Cisco, Precigen, and Entergy will share their insights.

- Snowflake plans an investor event that promises updates on cloud data platforms. Attendees can expect experiences about advancements in data warehousing.

- Cisco will host a gathering focusing on networking hardware. They aim to reveal new strategies for enhancing internet infrastructure.

- Precigen’s discussion will explore biotechnology innovations. This includes breakthroughs in gene editing tools and therapeutic development.

- Entergy is set to talk about its strides in power generation and distribution. The focus will be on sustainable energy solutions and grid reliability improvements.

Each event offers unique insights into industry trends and company performance directly from leading enterprises.

Conclusion

This week promises big developments for investors. With the Federal Reserve’s decision looming, markets are on edge. The jobs report and inflation data will set the stage. Companies from various sectors will share their earnings, giving a peek into economic health.

New IPOs hit the market too. Each event adds a piece to the puzzle of future investments. Investors watch closely, ready to act on these insights.

FAQs

1. What will the Fed decide in June?

The Federal Reserve, often called the Fed, makes a decision that affects Wall Street and stock prices. This week, they will announce their choice on interest rates.

2. How do earnings reports impact the stock market?

Earnings reports from companies give us numbers for their money made and spent. When these numbers are good, stock market prices usually go up. If not, prices might drop.

3. What should investors watch for this week on Wall Street?

Investors should keep an eye on earnings schedules and the Fed’s decision. These events can change stock values fast.

Yes, factors include: company earnings reports, the Fed’s rate decision, and overall trading market analysis.

5. Why is it important to follow the earnings calendar?

Following it helps investors know when companies will share their earnings report—key times that can move stock prices up or down.

6. What does “oversold stocks” mean for buyers?

Oversold stocks may signal a buying opportunity; they’re like items priced too low which might soon increase in value again.