July 14, 2024 This Week Top S&P 500 Gainers & Losers

Tesla: Time To Take Profits

Microsoft: The Q4 Results Should Surprise You

Tesla: Optimus And FSD Probably Won’t Save The Day

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Bitcoin Halving 2024: Market Impact Predictions

April 17, 2024

PandaForecast.com

Bitcoin enthusiasts are on the edge of their seats as a pivotal moment in the digital currency world draws closer—the Bitcoin halving. This event, marked on every crypto aficionado’s calendar, is poised to shake up the world of investment, mining operations, and the broader cryptocurrency ecosystem. For those with a vested interest in Bitcoin, grasping the ramifications of this event is of paramount importance.

Decoding the Bitcoin Halving

The halving is an ingenious mechanism hardwired into the Bitcoin protocol that happens roughly every four years. It’s designed to cut the miners’ block rewards in half, significantly influencing Bitcoin’s scarcity and, in turn, its value by throttling the pace of new coin creation. Historically, this scarcity has sent ripples through the market, triggering notable price volatility.

The countdown is on for the fourth Bitcoin halving, expected to unfold around April 20, 2024, which will slash mining rewards to a mere 3.125 BTC. This milestone is a nod to Bitcoin’s deflationary nature, further limiting the stream of new coins into the market and edging ever closer to that cap of 21 million Bitcoins.

The Halving’s Ripple Effects on Miners and Investors

Miners will be the first to feel the halving’s pinch as their earnings from block rewards are halved, potentially driving up the costs of Bitcoin production. Heavy hitters in the mining industry, like MARA and RIOT, are in for a substantial shift.

Investors, meanwhile, have the past to guide their expectations; each prior halving has preceded a bull run for Bitcoin. Given the tightening supply and the ever-growing allure of Bitcoin as a hedge against inflation, the anticipation of how the market will react is almost palpable.

The stakes are high, with Bitcoin boasting a mammoth market cap of $1.3 trillion and Ethereum also turning heads with its climb to $431 billion. These numbers mirror a dynamic and maturing cryptocurrency marketplace that’s bracing for the halving’s transformative impact.

A Look Back at Previous Halvings and the Market’s Response

Historically, each Bitcoin halving has ushered in a significant surge in the cryptocurrency’s value. For instance, the 2020 halving was followed by a staggering 559% price increase. While these past surges paint an optimistic picture, it’s critical to remember that they’re not a promise of future performance, especially considering Bitcoin’s inherent volatility.

Envisioning Bitcoin’s Post-Halving Landscape

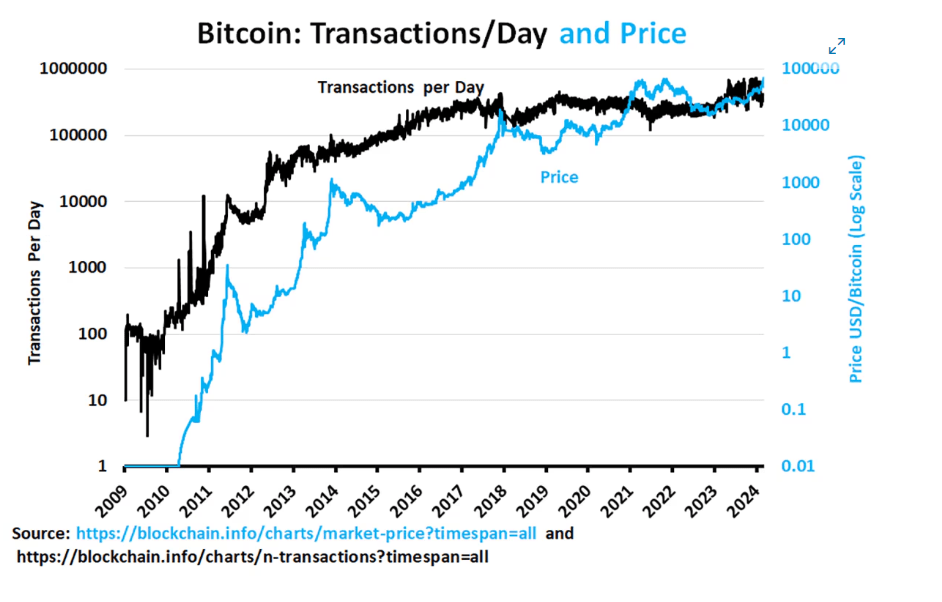

With the halving on the horizon, the crypto community is awash with conjecture about whether it will catapult Bitcoin to unprecedented levels or send it tumbling into a slump. Even amidst a recent dip in network user growth, robust transaction activity spurred by Bitcoin ETFs indicates the market might be gearing up for another lift post-halving.

While Bitcoin’s early days saw millions of new coins enter circulation each year, subsequent halvings have whittled down that number significantly. As the next halving approaches, investors and industry observers alike are keeping a watchful eye for any indication of how this event might once more reshape the cryptocurrency world.

To wrap it up, though the market has tended to rally after previous halvings, the unpredictable and volatile nature of cryptocurrencies means nothing is set in stone. Upcoming regulatory changes, the progress of crypto financial products, and overall market sentiment are all pivotal factors that will help chart Bitcoin’s course following this eagerly awaited halving.