October 1, 2024 Investor Beware: Port Strike Puts Key Stocks And Sectors At Risk

September 30, 2024 Market Movers: Jobs Report and Key Earnings in Focus

September 19, 2024 Federal Reserve’s Aggressive Move Hints At Bold Economic Strategy

Tesla: Robotaxi Event And Optimus Bring Both Hope And Disappointment

Apple: Limited Gains Ahead (Rating Downgrade)

Tesla’s AI Gamble: Analyzing The ‘We, Robot’ Event

Nvidia: Beyond FOMO And Deep Into Intrinsic Value (Rating Upgrade)

Apple: Investors Betting That ‘Things Are Different This Time’

October 3, 2024 Your Path to Profits: The Best Trading Platforms for New Traders

October 3, 2024 Mastering Trading Indicators: Your Essential Toolkit For Success

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

Insights On Current Stock Market Trends: Weekly Commentary

July 13, 2024

This week, U.S. indexes showed varied changes; the Dow grew by 1.6%, while Nasdaq saw a slight rise of 0.2%. Keep reading for more on the stock market trends.

Dow +1.6% to 40,001

The Dow Jones Industrial Average saw a rise of 1.6%, closing at 40,001. This significant increase reflects investor confidence and market strength. As central banks manage interest rates and the economic landscape shifts, the Dow’s movement serves as a key indicator for investors tracking equity markets’ performance.

Investments in the stock market show promising growth.

Following this trend, attention now turns to other important sectors such as S&P 500 and Nasdaq, which also witnessed changes but varied in magnitude.

S&P 500 +0.9% to 5,615

The S&P 500 rose by 0.9%, reaching a mark of 5,615 (watch last week gainers and losers). This move reflects active investor confidence and shows a positive trend in the equity market. With this increase, financial advisors might suggest diversifying asset allocations to include a mix of equities from firms listed on the S&P 500.

The rise suggests that companies within are performing well, indicating economic growth and potential for investment returns.

Investment advisers closely watch the S&P 500 as it offers insights into the broader U.S. economy’s health. An uptick by 0.9% signals to investors that the market is responding positively to current macroeconomic factors and monetary policy set by institutions like the Federal Reserve.

For those managing portfolios, incorporating stocks from various sectors represented in this index could provide balance against inflationary pressures while aiming for high yield returns in their investment product choices.

Nasdaq +0.2% to 18,397

Following the S&P 500’s climb to 5,615, Nasdaq also saw growth. It went up by 0.2%, reaching 18,397. Investors watched closely as this tech-heavy index made its move. Known for being a gauge of technology and biotech companies, this slight increase shows that even small gains are important in the stock market’s bigger picture.

Nasdaq’s performance is crucial for those investing in equities markets and holding various asset classes. This small rise may seem minor but reflects broader trends and investor sentiments towards high-tech industries within U.S. securities markets.

For anyone involved in investment products or tracking U.S. Treasuries, watching Nasdaq offers insights into how top-performing sectors might behave.

Russell 2000 +6.1% to 2,150

The Russell 2000 index saw a significant rise, climbing 6.1% to reach 2,150. This move signals strength in smaller companies that investors should take note of. With this jump, the market shows confidence in these firms’ potential for growth and profit.

Investors tracking trends on Wall Street might see this as an opportunity to explore investments outside of larger S&P 500 companies.

Given its performance, the Russell 2000’s leap could also hint at broader economic shifts favoring diverse sectors represented within this index. Such movements are crucial for those diversifying their portfolios or seeking new areas for investment returns beyond traditional large-cap stocks.

The change underlines the importance of paying attention to all market segments, including small-cap entities that often lead during times of robust economic expansion.

CBOE Volatility Index -0.2% to 12.46

Moving from the Russell 2000’s significant rise, the CBOE Volatility Index saw a slight decrease. This index dropped by 0.2% and closed at 12.46. It shows how calm the stock market was during this period.

Investors look at this index to understand market risk and fear levels.

Fear in the market is low when volatility is down.

This small change signals stability to investors who follow market trends for making decisions. They see it as a time where there might be less sudden drops or jumps in stock prices.

S&P 500 Sectors

S&P 500 sectors moved differently, showing changes in the market. For more details, keep reading.

Consumer Staples +0.1%

The Consumer Staples sector saw a slight increase of 0.1%. This small change shows stability in essential goods companies, like food and household products. Investors often look at these companies during uncertain times because people always need these items.

So, this area can be a safe choice for those looking to avoid big risks in their portfolios.

This performance also reflects how consumer habits impact the market. Even when other areas face challenges, essentials remain steady. For investors focused on long-term growth with lower risk, staples offer a clear path.

They provide essential services that are always in demand, making them an interesting option for those seeking steadiness in their investment choices.

Utilities +3.9%

Utilities stocks saw strong growth, up by 3.9%. This increase is notable in an investment environment where sectors fluctuate widely. Investors turn to utility companies for their stability and consistent dividend payments.

These firms provide essential services like electricity and water, making them less sensitive to market changes. This makes utilities a key asset for portfolios seeking steady income.

In times of volatility, the utilities sector often becomes a harbor for investors looking for security.

Utilities’ performance reflects their role as a defensive play during uncertain times in the stock market. As they keep performing well, more investors might look at these stocks not just for safety but also for potential profit in their investment strategies.

Financials +2%

The financials sector experienced a 2% increase. This rise shows investors are gaining confidence in banks, investment firms, and insurance companies. These entities form the backbone of the financials sector, guiding money flow and investments.

With this uptick, advisers at Wells Fargo Investment Institute might see it as a positive sign for future growth.

In detail, the jump suggests more people are putting their money into stocks and bonds through these institutions. It points to an improving economy where businesses and consumers feel confident about borrowing and investing.

Financial advisers play a key role here by offering investment advice that can help clients navigate these encouraging trends.

Telecom -3.6%

The telecom sector saw a drop of 3.6%. This decline happened despite the overall positive movement in other sectors. Telecom companies struggled, showing weaker results compared to industries like utilities and real estate.

Investors see this fall as important because it affects many who own stocks in these companies. Next comes insights on the healthcare sector, which had a better performance with an increase of 2.6%.

Healthcare +2.6%

Healthcare stocks saw a rise of 2.6%. This boost shows strong investor confidence in this sector. Companies that focus on medical services, equipment, and innovation are key players here.

Investors see value in these firms as healthcare needs grow worldwide.

Firms like biotech giants and medical device makers are part of this increase. They make products that help people live better lives. The growth also points to a future where investing in health could lead to more gains.

Industrials +2.4%

The Industrials sector showed strong performance with a 2.4% rise. This gain highlights positive movements within the sector, suggesting robustness in manufacturing and construction areas.

These industries are essential for economic growth, indicating investor confidence in these markets.

A 2.4% increase in industrials signals strength in foundational sectors.

Companies engaged in construction, defense, and machinery saw noticeable improvements. Such progress points to a stable demand for industrial goods and services. The uptrend reflects broader economic optimism and underlines the importance of industrial activities in fueling overall market gains.

Information Technology +0.5%

After Industrials saw a rise, Information Technology also climbed by 0.5%. This growth shows that tech companies are doing well. Investors see value in these firms as they continue to innovate and offer solutions that meet growing demands across various sectors.

With every uptick, technology stocks affirm their role in driving market trends forward.

In this sector, products like software and online services play a big part. These companies make tools that help other businesses run smoothly. As more organizations rely on digital platforms for their operations, the importance of the Information Technology sector increases.

Investors watch this area closely because it is key to future market movements.

Materials +3%

The materials sector showed a strong performance, rising by 3%. This increase reflects investors’ growing confidence in this area. Companies involved in making and supplying goods saw their values go up.

Metals, building supplies, and chemicals are examples of items these firms work with. Their success is key for many industries, from construction to tech.

Investors pay close attention to sectors like materials because they signal economic health. When people build more houses or factories order more parts, it means the economy is doing well.

That’s why a 3% jump is good news. It shows that demand across various markets is on the rise, suggesting a robust investment opportunity for those looking at long-term growth.

Energy +0.5%

The energy sector saw a rise of 0.5%. This gain shows the market’s positive response to energy stocks amid changing oil prices and economic shifts. Investors in this area look at factors like crude oil values, renewable energy trends, and geopolitical events that can sway stock prices.

With a careful eye on these indicators, they make decisions hoping for growth.

Energy companies are adjusting strategies to meet global demands for cleaner fuels and more efficient operations. As they invest in technology and explore new resources, the sector presents opportunities for those ready to take advantage of emerging market trends.

Investing in energy is investing in the future.

Next, we turn our attention to consumer discretionary spending which experienced a modest increase as well.

Consumer Discretionary +0.4%

The Consumer Discretionary sector grew by 0.4%. This points to an uptick in spending on products and services that people want but don’t always need, such as games, restaurants, and luxury items.

Investors watch this sector for signs of consumer confidence and spending patterns. A rise suggests people feel good about their finances and are willing to spend more on things that bring them joy or comfort.

Companies within this space benefit from increased sales during times when buyers have extra cash or credit. This growth can lead to higher stock prices for businesses selling cars, clothes, travels, and entertainment.

For those investing in the market, picking stocks from this area could add value to their portfolios if consumer spending continues to climb.

Real Estate +4.4%

Real Estate sector saw a big jump, going up by 4.4%. Investors in properties did well. They saw more money from their investments. This rise is a clear sign that the real estate market is strong now.

People who put their money into buildings and land made a good choice this time.

This boost also tells us that the demand for places to live and work is growing. With a 4.4% increase, real estate stands out as a top option for investors looking to grow their wealth.

This sector’s growth outshines many others, making it an attractive area for future investment opportunities.

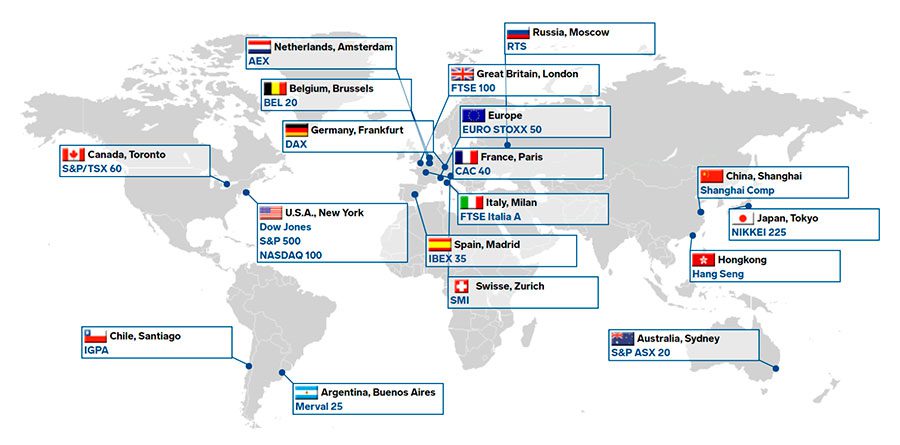

World Indices

World markets like London, France, Germany, Japan, and others saw changes this week. Check out the full update for more info.

London +0.6% to 8,253

The London index saw a rise of 0.6%, closing at 8,253. This shows investors are showing interest in the market, pushing it upward. It is clear that confidence in the financial landscape there remains strong.

This change reflects growing movements across global markets. With a steady increase to 8,253 points, London’s performance sends positive signals to investors keeping an eye on international trends and opportunities for portfolio growth.

France +0.6% to 7,724

Moving from the gains in London, France’s stock index also saw growth. It went up by 0.6% and closed at 7,724. This indicates a positive trend for investors focusing on the European market.

In France, stocks showed resilience amid global economic shifts. Investors took note as this uplift reflects confidence in the French economy and its companies. Such movements are crucial for those investing in international indices, suggesting an optimistic outlook among traders and institutions alike.

Germany +1.6% to 18,769

Germany’s stock index rose by 1.6%, closing at 18,769. Investors saw a strong performance, marking a significant move in the European market landscape. This uptick reflects confidence in Germany’s economic resilience and its role as a cornerstone in the European economy.

This gain is a key indicator for investors monitoring shifts in global equity markets, highlighting Germany’s importance within the investment grade universe and its impact on broader financial trends.

The rise to 18,769 points towards positive earnings expectations among German companies and underlines the nation’s steadiness amidst various market forces.

Japan +0.8% to 41,237

Moving from Germany’s growth, Japan saw its index rise by 0.8%, reaching a level of 41,237. This increase shows strength in the Japanese market. Investors see this as a positive signal.

The BOJ and public debt are key factors here. With the index at 41,237, it suggests confidence among investors in Japan’s economic stability and future prospects.

China +0.7% to 2,971

After Japan showed growth, China’s stock index also went up by 0.7%, reaching 2,971. This rise signals strong interest from investors who are eyeing the Chinese market for opportunities.

The slight increase reflects investor confidence in the region, despite global economic pressures.

Investors see value in adding Chinese stocks to their portfolios as they diversify and seek gains outside traditional markets. With a close at 2,971 points, the market shows potential for growth amidst challenges.

Investors keep an eye on sectors showing strength and those poised for recovery within the vast Chinese economy.

Hong Kong +2.8% to 18,293

The Hong Kong index saw a notable rise, up by 2.8%, closing at 18,293. This increase indicates a positive shift for investors looking into the Asian market trends and considering diversification beyond U.S securities.

Investors witnessed growth in this part of the world, presenting opportunities for portfolio expansion in emerging markets such as Hong Kong. This performance suggests a rebound that could attract more international investment, signaling confidence in its market stability and growth potential.

Moving to commodities and bonds offers insights into other investment avenues outside stock markets, including shifts in crude oil prices and bond yields which directly impact global financial strategies.

India +0.7% to 80,519

Following a significant jump in Hong Kong’s market, India showcased steady growth. Its index rose by 0.7%, closing at 80,519. This uptick reflects positive investor sentiment and economic optimism within the country.

Such a gain underscores India’s resilience and its appeal to both local and global investors looking for promising markets. With every point increase, confidence in India’s financial future grows stronger, marking it as a key player on the world stage of investment opportunities.

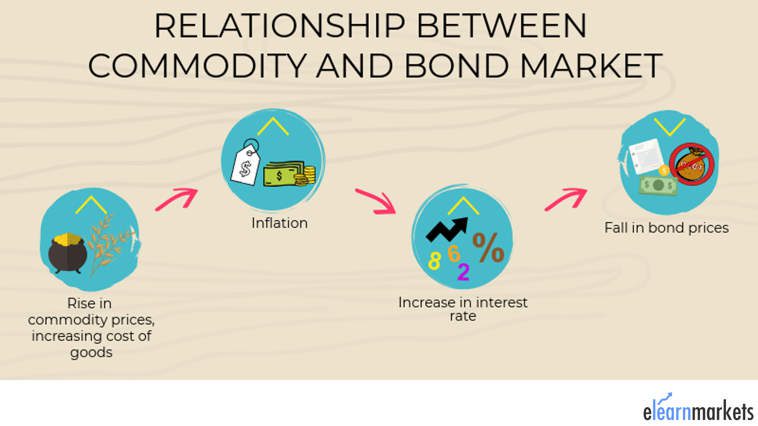

Commodities and Bonds

Oil prices dropped and gold rose. Bond returns fell slightly.

Crude Oil WTI -1.2% to $82.18/bbl

The price of Crude Oil WTI fell by 1.2%, closing at $82.18 per barrel. This change affects investors who keep an eye on commodity markets for potential impacts on their portfolios.

Changes in oil prices can influence various sectors, including energy stocks and inflation-linked bonds. As crude oil is a significant input for economies globally, its price movements are crucial for market participants to monitor.

Moving forward from commodities to other investment avenues, gold showed an upward trend with a rise of 0.8% to $2,416.1 per ounce. This shift suggests investors might be looking towards safer assets amidst fluctuations in the crude oil segment.

Gold +0.8% to $2,416.1/oz

Moving from oil’s dip, gold saw a rise, marking an 0.8% increase to settle at $2,416.1 per ounce. This shift indicates a choice for safer assets among investors. Gold acts as a hedge against market volatility and inflation, drawing attention with its steady climb in value.

With global uncertainties persisting, this precious metal continues to shine as a preferred option for securing wealth. Investors recognize its strength in diverse economic landscapes, making it an essential part of investment portfolios aimed at long-term stability and growth.

Natural Gas -0.3% to 2.313

Natural gas prices dropped by 0.3%, closing at 2.313. This decrease affects investors who track energy commodities as part of their portfolio. They understand changes in natural gas prices can signal shifts in the energy market, impacting both short-term trades and long-term strategies.

Investors use this information to adjust their positions in energy stocks or commodities futures, aiming for better returns. As prices fluctuate, those with stakes in natural gas watch the trends closely to make informed decisions on buying or selling.

Next, we delve into Ten-Year Bond Yield dynamics.

Ten-Year Bond Yield -0.2 bps to 4.187

The ten-year bond yield fell by 0.2 basis points, landing at 4.187%. This shift shows how investors view the government bond market. Bonds reflect confidence or concern in economic growth.

A drop in yield often means investors seek safer assets over stocks.

This change impacts those considering fixed income investments. It suggests a cautious perspective on long-term economic health. Investors watch these trends to guide decisions in bonds and equities markets.

Next, let’s explore Forex and Cryptos trends.

Forex and Cryptos

In the Forex and Cryptos sector, currencies and digital money show varied moves. The Euro grows against the Dollar, while Bitcoin slightly falls.

EUR/USD +0.66%

The EUR/USD pair saw a rise of 0.66%. This means for investors, the euro gained strength against the U.S. dollar. They need to know this shift could affect investments tied to currency movements.

This change shows how currencies can move and impact returns. Investors watching EUR/USD trends might adjust their strategies based on such data.

USD/JPY -1.75%

Shifting from the EUR/USD rise, the USD/JPY pair saw a significant drop of 1.75%. This major decrease shows a weakening U.S. dollar against the Japanese yen. Investors closely watched this movement as it reflects changes in market sentiment and might influence investment strategies that involve these currencies.

With the USD/JPY pair at this lower level, those holding Japanese yen could see an increase in their buying power when converting to dollars. This shift is crucial for understanding future trends in forex markets and can impact decisions made by investors looking to trade or hedge with these currencies.

GBP/USD +1.46%

Moving from the USD/JPY’s fall, the GBP/USD shows a robust increase of 1.46%. This rise signals strong investor confidence in the British economy and its currency. Investors see this as a positive sign.

They closely monitor such trends to make informed decisions about buying or selling currencies. With the pound gaining strength against the dollar, opportunities arise for those investing in forex markets.

The boost in GBP/USD is crucial for clients holding investments tied to these currencies. It impacts returns and strategies in international trading and investment portfolios managed by entities like Wells Fargo Bank, N.A., and Charles Schwab.

As forex markets are highly volatile, staying updated on currency shifts helps investors adapt quickly. This particular trend may influence decisions related to equity securities and government bonds within financial planning.

Bitcoin -0.5%

Bitcoin saw a decrease of 0.5%. This drop signals a momentary dip in its value across trading platforms. Investors keep an eye on such changes to make informed decisions about buying or selling their digital assets.

The fluctuation, although minor, affects the overall perception of Bitcoin’s stability as a cryptocurrency option. It guides users in assessing market conditions before executing their next move in the investment landscape.

Litecoin +6.9%

Litecoin saw a significant jump, rising by 6.9%. This increase reflects investors’ growing interest in alternative digital currencies beyond the major ones like Bitcoin and Ethereum.

Litecoin’s climb is noteworthy for those watching the crypto market closely.

This surge in value makes Litecoin a key player to watch in the ever-changing landscape of digital currencies. For investors eyeing diversification within their digital portfolio, this performance underlines Litecoin’s potential as an asset worth considering.

Ethereum +2.1%

Ethereum rose by 2.1%. This increase shows investors are showing more interest in Ethereum as a digital currency. As an investment, it draws attention for its potential growth and use in technologies like smart contracts on the blockchain.

Next, let’s look at Litecoin’s performance.

XRP +6.2%

XRP saw a significant jump, growing by 6.2%. This rise highlights the strong interest and positive sentiment in the crypto market. Investors are paying close attention as XRP outpaces many other digital currencies this week.

With such a notable increase, it marks a key moment for those holding or considering investing in XRP. The climb also points to broader acceptance and possibly more stability in the future for this cryptocurrency.

Conclusion

This week showed a strong performance in the U.S. stock market, with rises across all major indices and sectors. Utilities and Real Estate saw big gains, while Consumer Staples and Energy had smaller increases.

Global markets also went up, with notable growth in Europe and Asia. Crude Oil fell slightly, but Gold rose. The S&P 500 had winners like Enphase Energy leading the charge, but some companies faced declines.

Investors need to watch these trends closely for any future moves in their strategies.

FAQs

1. What is the role of a registered investment adviser in understanding current stock market trends?

A registered investment adviser can provide authoritative insights on weekly market commentary, analyze earnings reports, and guide on derivative products to help understand current stock market trends.

2. How do global events like decisions by the European Central Bank impact stock market trends?

Decisions by institutions like the European Central Bank or Federal Reserve (Fed rate) influence global fiscal policy which inevitably impacts treasury yields, inflation targets and overall stock market valuations.

3. Can you explain what ‘bullish’ means in relation to current stock market trends?

‘Bullish’ refers to a positive growth rate in the markets where economists predict an upward trend in pricing and premium based on factors such as U.S. CPI data or structural reforms in Euro area economies.

4. Does government bond performance affect general stock-market conditions?

Yes, government bonds like gilts from the Bank of England or securities regulated by U.S Securities and Exchange Commission play a significant role influencing lending rates which indirectly affects overall state of markets including stocks.

5. How does information about companies such as Wells Fargo & Company contribute to understanding of stock-market trends?

Companies like Wells Fargo & Company release regular updates regarding their financial health that includes details about their clearing services, insurance products and other key economic indicators useful for assessing broader market conditions.

6. Are there any specific regional factors that can influence international Stock Market Trends?

Yes, economic activities within regions like GCC nations – UAE’s DIFC region or KSA (Kingdom Saudi Arabia), even down to city level economics such as Dubai have potential impact on international Stock Market Trends due to interconnectedness of today’s global economy.