Apple: Sell The AI Hype (Rating Downgrade)

Microsoft: After Generative AI, The Path To More Upside

Nvidia Takes The Lead In The Silicon Valley Derby

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

S&P 500 Ends Winning Streak, Nvidia Nears Apple’s Value

June 1, 2024

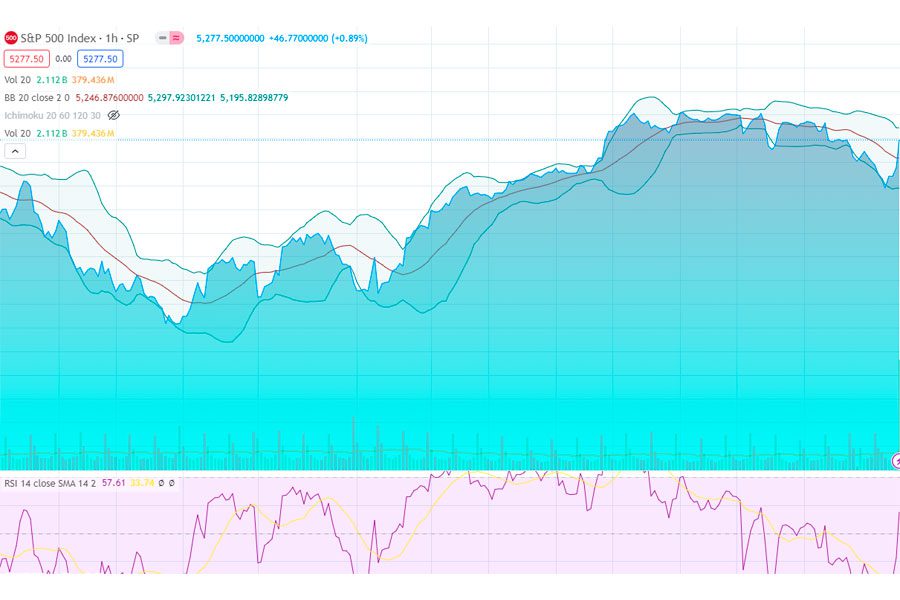

The S&P 500 recently snapped its five-week winning streak, showing its first weekly dip. We provide insights into this shift and Nvidia’s rise toward Apple’s valuation, giving readers a clearer understanding of current market dynamics.

Key Takeaways

- The S&P 500’s streak of weekly gains ended with a dip, showing its first weekly loss in a while.

- Nvidia’s shares went up 7%, making its market value almost as big as Apple’s.

- ConocoPhillips is buying Marathon Oil for $22.5 billion, which is a big deal in the energy sector.

- The White House wants more nuclear power plants to help make clean energy.

- JPMorgan plans to invest $200 billion into private credit, looking for new profit ways.

S&P 500 Performance

The S&P 500 stopped climbing, marking a rare pause. It saw a dip last week after rising in May, moving the focus to market numbers and indices closely watched by investors.

End of Winning Streak

The SP500’s five-week run of gains came to an end. This marked a shift after a robust May. Investors saw the index drop, snapping its streak of weekly wins. This change in course signals caution among them as they look ahead.

After five weeks on the rise, the SP500 faced a downturn, ending its impressive streak.

During this time, the market cap and interest rates were key factors guiding investor decisions. With eyes on stock trends like those of Nvidia shares and Apple’s performance, adjustments were made swiftly.

Each move was calculated, showing how closely market players watch the S&P index for cues on when to act or pause.

Weekly Decline

After the S&P 500’s streak ended, its performance saw a downturn over the week. The SP500 slipped by 0.5%. Nasdaq and Dow also faced losses, falling by 1.1% and losing 1.0%, respectively.

This decline marked a shift in market dynamics, impacting investors’ strategies.

Market indexes like the SP500, Nasdaq (COMP:IND), and Dow (DJI) are key indicators of stock market health. They showed that even leading markets can face setbacks, influencing stock shares and s&p value across sectors.

Investors watched closely as these changes unfolded, adjusting their approaches to navigate the shifting landscape of US 500 and stock market sp500 trends.

May Gains

The S&P 500 and other major indices saw gains in May. Specifically, the Dow Jones Industrial Average crossed the 40,000 mark for the first time. Investors noticed a positive trend across stock markets during this period.

The S&P 500 index price reflected growth, indicating investor confidence. May turned out to be a strong month for shares in value, including those of big companies and smaller firms alike.

Market analysis confirms that investing into s&p 500 was beneficial due to these May gains. Moving forward, highlights from Salesforce’s financial results will provide more insights into market behaviors and trends.

Market Highlights

Market highlights shed light on key financial moves and decisions. Salesforce showed strong results, the Federal Reserve noted changes in its core inflation measure, and the European Central Bank hinted at new interest rates.

Salesforce’s Financial Results

Salesforce, a big player in the CRM market, reported its financial results. They were not as strong as people hoped. The company shared numbers that did not meet what everyone expected.

Because of this news, Salesforce’s stock price fell quickly. Investors saw their shares lose value after the announcement about weaker future earnings.

This outcome caught many by surprise and led to more questions about what lies ahead for Salesforce and similar companies. Next up, let’s look into how changes in economic indicators like the Federal Reserve’s Core PCE Price Index can shake things up further in the stock market landscape.

Federal Reserve’s Core PCE Price Index

The Federal Reserve’s preferred inflation measure, the core PCE Price Index, hit its target in April. This shows prices are going up as expected. At the same time, people spent money more slowly than many thought they would.

Inflation is like a slow-moving car – it takes time to speed up or slow down.

European Central Bank’s Expected Interest Rate

Experts say the European Central Bank plans to cut interest rates soon. This move comes earlier than what the Federal Reserve might do. Europe’s inflation is now closer to its goal of 2%.

So, this rate drop could help keep prices stable and support the economy.

Investors watch these changes closely. Lower rates often make it cheaper for people and businesses to borrow money. This can lead to more spending and help companies grow. The bank’s decision reflects its efforts to manage inflation while encouraging economic health in Europe.

Stock Market Movement

The S&P 500, Nasdaq, and Dow showed us how stocks move up and down, with Nvidia getting close to Apple in market size. This change keeps the stock trade exciting for everyone watching.

S&P 500, Nasdaq, and Dow Performance

Investors witnessed a notable shift in the performance of major indexes last week. Here’s a succinct overview in table format:

| Index | Weekly Change |

|---|---|

| S&P 500 (SP500) | -0.5% |

| Nasdaq (COMP:IND) | -1.1% |

| Dow (DJI) | -1.0% |

All three key indexes moved downward. The S&P 500 slipped by half a percent, marking an end to its winning streak. Nasdaq saw a sharper decline, dropping by 1.1%. The Dow wasn’t spared either, losing 1.0% of its value. This movement reflects investor reactions to a range of economic signals, from company earnings reports to broader geopolitical concerns.

Each index serves as a thermometer for different sectors of the economy. S&P 500’s dip suggests a broader market apprehension. Nasdaq’s larger fall highlights tech sector volatility. The Dow’s loss indicates traditional industrial companies are also feeling the pressure.

For investors, these shifts underscore the importance of staying informed and ready to adapt strategies in response to market movements.

Nvidia’s Market Value

Nvidia’s shares soared, up 7% on a recent Tuesday. This surge pushed the company’s market value to an astonishing $2.81 trillion. Now, it stands just $100 billion shy of Apple’s towering market cap.

Investors watch closely as Nvidia edges toward becoming the highest-valued company in the S&P 500 index, competing neck and neck with tech giant Apple.

The rapid growth in Nvidia’s stock reflects investors’ confidence in its future. The company is well-known for its powerful graphics processing units (GPUs), essential for video games, professional visualization, data centers, and more recently, artificial intelligence applications.

Nvidia’s ascent underscores the growing importance of AI and computing power across industries.

Next up: how Apple performs against this backdrop—holding onto its spot or witnessing a new leader in market value within the stock 500 landscape.

Apple’s Performance

Shifting focus from Nvidia’s impressive value surge, Apple finds itself facing challenges. The tech giant’s shares have dipped by roughly 1% since the start of the year. This puts it behind other major technology firms in terms of growth.

Despite being a key player with significant influence in stock market trends and having a solid history of performance, Apple hasn’t kept pace this year.

Investors closely watch these movements, noting the contrast between Nvidia’s climb and Apple’s slower stride. Market dynamics show that even leading companies like Apple can experience fluctuations.

With its stock market value taking a slight hit, stakeholders keep an eye on how it compares to others in the S&P 500 index. These shifts underscore the competitive nature of tech stocks within broader market indices like Nasdaq and S&P 500, where Apple continues to be a major component despite its recent underperformance compared to peers.

Industry News

In the business world, ConocoPhillips is buying Marathon Oil. This big move shows how companies are growing by joining together. The White House says yes to more nuclear power plants, showing support for clean energy.

Meanwhile, JPMorgan puts money into private credit, searching for new ways to make profit.

ConocoPhillips Acquisition of Marathon Oil

ConocoPhillips has made a big move by agreeing to buy Marathon Oil for $22.5 billion. This deal is special because it’s all about shares, not cash. Investors see this as a major step for both companies in the stock market.

With ConocoPhillips getting bigger, it will now have more oil and gas to sell around the world.

This purchase means ConocoPhillips will be an even bigger player in the energy sector. By adding Marathon Oil’s resources, they strengthen their position globally. The numbers are clear: $22.5 billion tells us how serious ConocoPhillips is about growing and leading in the market.

For those holding shares in these companies, this news is key to understanding future changes in their investment value.

White House’s Support for Nuclear Reactors

The White House has shown strong support for the expansion of large-scale nuclear reactors. This move is set to speed up the development of these energy sources. With this action, the government aims to boost clean energy production and reduce reliance on fossil fuels.

Nuclear reactors offer a steady, reliable source of power with less environmental impact compared to coal or gas plants.

Investors in the energy sector should take note. The push towards nuclear reactor development could open new opportunities in clean technology investments. After reviewing White House’s stance, we will review JPMorgan’s investment strategy in private credit next.

JPMorgan’s Investment in Private Credit

JPMorgan sees a big future in private credit. Jamie Dimon, the bank’s leader, wants to put up to $200B into these special deals. They will use their own money, not someone else’s. Private credit isn’t like other banks.

It matches funds in a way that is safer.

This industry has its own model for keeping money safe. JPMorgan believes this method is more secure than what most banks do. With $200B on the line, they are making a huge move into private credit markets.

Conclusion

The S&P 500’s climb ended, marking a week of losses. In contrast, Nvidia edged closer to Apple in market value, showcasing its impressive growth. This shift highlights changing dynamics in the stock market, with tech companies continuing to gain ground.

Investors watched as historical patterns changed, reflecting broader economic trends and investor sentiments. These movements provide clear insights into the evolving nature of market leadership and investment opportunities.

FAQs

1. What ended the S&P 500’s winning streak?

The S&P 500 saw its winning streak end as market dynamics shifted, reflecting changes in investor sentiment and stock performance.

2. How close is Nvidia to Apple in terms of value?

Nvidia nears Apple’s value significantly, showcasing rapid growth in its market cap that challenges the tech giant’s leading position.

3. Can you buy shares directly in the S&P 500 index?

No, investors cannot buy shares directly in the S&P 500 index; they invest through mutual funds or ETFs tracking the index’s performance.

4. What role does Nvidia play in the S&P 500?

Nvidia contributes greatly to the tech sector within the S&P 500, influencing overall market movements with its stock price changes.

5. How do interest rates affect stocks like Apple and Nvidia?

Interest rates impact stocks such as Apple and Nvidia by affecting borrowing costs and consumer spending, thereby influencing their share values.

6. Why should one analyze company shares before investing?

Analyzing company shares provides insights into business health, market position, and potential return on investment, guiding better investment decisions.