September 8, 2024 S&P 500 In Freefall: Is This The End Of The Bull Market?

September 6, 2024 Jobs Report Spotlight As Fed Weighs Rate Cut Decision

August 26, 2024 NVDA Earnings Report Insights

August 22, 2024 Massive U.S. Job Growth Revision Shakes Economy And Markets

Nvidia: The Blackwell Delay And Its Consequences

Nvidia Q2 Offers Several Clues To Sustainable Growth Ahead

The Power Of Expectations: Nvidia’s Earnings And The Market Reaction

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

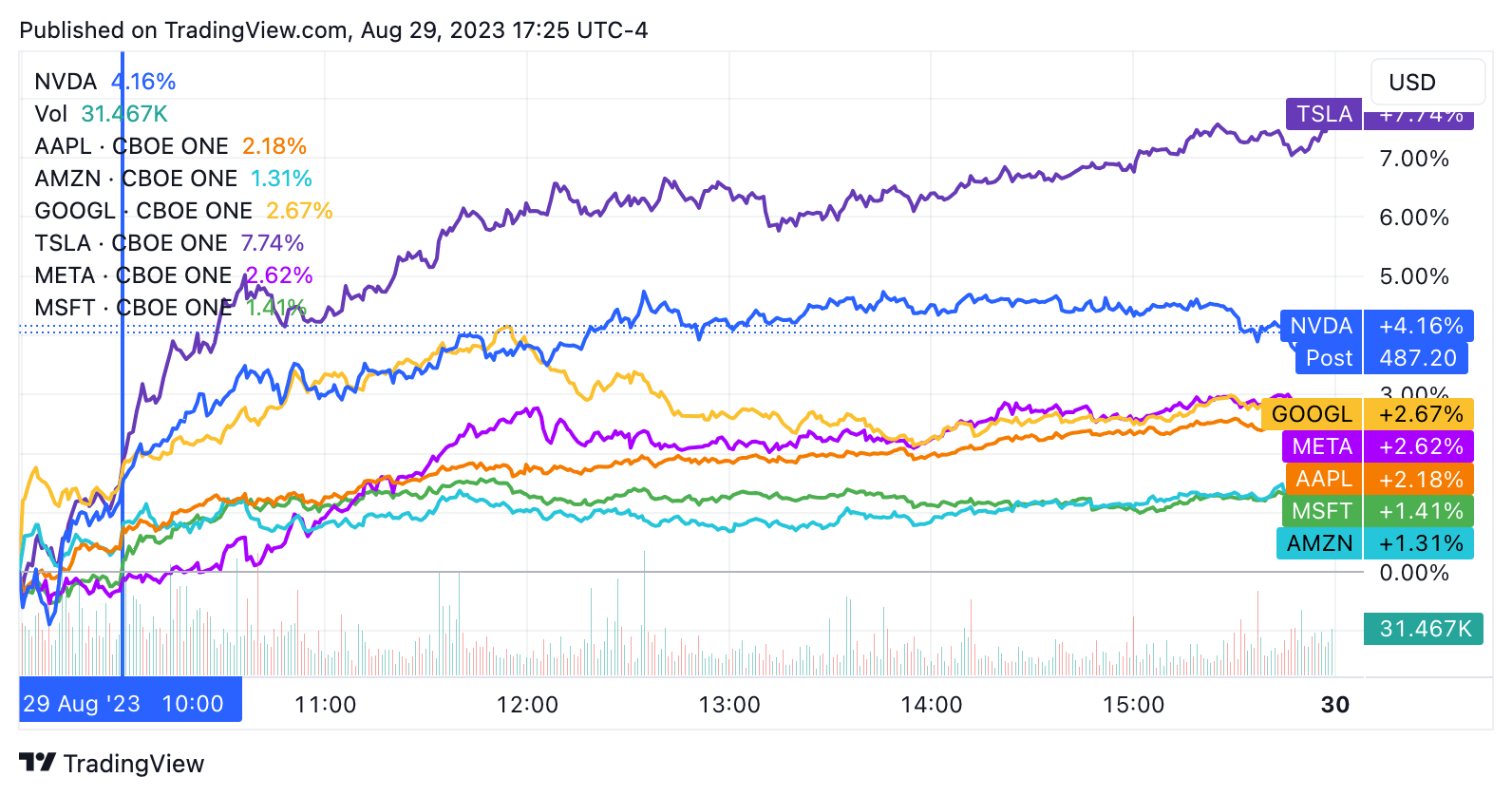

AI’s Future Still Contingent on Federal Reserve’s Influence: Megacaps Rally and Markets Green for Third Consecutive Session

August 31, 2023

The current day still holds much significance for the Federal Reserve in relation to risk assets, despite predictions of AI dominating the future. Tuesday’s trading saw all seven of the major megacap companies rallying, prompting a third consecutive market rise and the most impressive single-day performance since June. Key stock indexes enjoyed positive trading; the S&P 500 rose 1.5%, the Nasdaq surged 1.7%, and Info Tech gained over 2% on the day. Additionally, the Volatility Index, or VIX, fell to its lowest in a month.

Info Tech’s Historic Rise

It’s been several months since Info Tech experienced such a growth spurt; the last comparable increase occurred in June, with AI firm Nvidia’s promising projections setting the pace. Despite initial sell-the-news reactions leading to an oversupply speculation in the AI market, Nvidia exceeded high expectations with their most recent performance and guidance report. The company saw their shares increase by over 4% on Tuesday, marking a new record high. This was aided by the announcement of a partnership with Google AI and further boosted by weak data supporting Federal Reserve’s policies.

Economic Indicators and the Fed

The Job Openings and Labor Turnover Survey (JOLTS) kicked off the week’s essential economic data, revealing a surprising drop in job openings, which fell below 9 million for the first time since March 2021. Analysts from Wells Fargo noted this as a positive sign for the Federal Reserve’s aspirations for a “soft landing”. Indicators show a declining trend amid slowing growth in labor demand and a strong surge in labor supply. This, combined with the recent data, suggests that the intense inflation pressure witnessed over the past few years may be gradually subsiding.

Impact on Consumer Confidence and Market Predictions

In other economic news, the latest measure of consumer confidence from the Conference Board erased the gains seen in June and July. This sparked the ‘bad news is good news’ trade, with equities rallying and Treasury yields returning to previous levels. This reflects anticipation of a slightly more cautious approach from the Fed than the one implied by Chairman Jay Powell’s Jackson Hole speech. Also, fed funds futures shifted back to a 52% chance of a pause, after previously pricing in another quarter-point hike for November. Expectations for a first rate cut were also brought forward from June to May.