April 24, 2024 Google’s Third Cookie Phaseout Delay Amid Regulatory Hurdles

April 19, 2024 Bitcoin Halving: Catalyst for New Price Heights?

April 18, 2024 EU Moves Toward Single Capital Market Union

Amazon Web Services Expands Bedrock GenAI Service

Why Microsoft Stands Out As A Pre-Earnings Buy

Wall Street Lunch: Big Tech Bearishness?

April 23, 2024 Maximizing Profits: When is the Right Time to Sell Your Business?

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

Innovative Industrial Properties (IIPR) Stock Forecast for 2024–2028. Sell or Buy?

Updated: April 24, 2024 (11:46)

Sector: Real EstateThe share price of Innovative Industrial Properties, Inc. (IIPR) now

50/200 Day Moving Average: $96.64 / $86.44

This figure corresponds to the Average Price over the previous 50/200 days. For Innovative Industrial Properties stocks, the 50-day moving average is the support level today.

For Innovative Industrial Properties stocks, the 200-day moving average is the support level today.

Are you interested in Innovative Industrial Properties, Inc. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Innovative Industrial Properties stock price in 2024, 2025, 2026, 2027, 2028. How much will one Innovative Industrial Properties share be worth in 2024 - 2028?

When should I take profit in Innovative Industrial Properties stock? When should I record a loss on Innovative Industrial Properties stock? What are analysts' forecasts for Innovative Industrial Properties stock? What is the future of Innovative Industrial Properties stock? We forecast Innovative Industrial Properties stock performance using neural networks based on historical data on Innovative Industrial Properties stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Innovative Industrial Properties stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Innovative Industrial Properties shares. This happens once a day.

Historical and forecast chart of Innovative Industrial Properties stock

The chart below shows the historical price of Innovative Industrial Properties stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Innovative Industrial Properties stock price can be found in the table below.

Long-term forecasts by years.

Unlocking the Future of IIPR Stocks: A Glimpse into Tomorrow

For investors eyeing the Innovative Industrial Properties (IIPR) stock, deciphering the future landscape of this burgeoning sector is tantamount to striking gold. Riding the crest of the cannabis industry, IIPR's stock price prediction teeters on two pivotal events that analysts and investors alike are watching with bated breath. The foremost among these is the potential rescheduling of cannabis from Schedule 1 to Schedule 3, a move that promises to dramatically transform the financial health of IIPR's tenants by slashing their tax burdens and boosting their operational cash flow.

Strategic Forecasting: Reading Between the Lines

Delving deeper, the enactment of the SAFER Banking Act stands as yet another beacon on the horizon. This legislation could streamline state-legal cannabis businesses' access to essential banking capital, fostering an environment ripe for growth and expansion. Together, these catalysts not only underscore the question of "Is IIPR a good stock to buy?" but also kindle robust dialogues regarding the IIPR stock forecast, nudging analysts to refine their IIPR stock price target with a keen eye on these developments.

To weave an accurate narrative for the Innovative Industrial Properties stock forecast, analysts are mining these events for insights. Prioritizing the rescheduling of cannabis could spell instant benefits for IIPR’s valuation, propelling a likely buy or sell pivot, while banking regulation changes could serve as the linchpin for sustained growth. Thus, embracing a holistic view that accounts for these factors may very well unveil the most dependable route toward navigating the future of IIPR's stock trajectory.

- Rescheduling of cannabis from Schedule 1 to Schedule 3

- Changes in banking regulations (SAFER Banking Act)

Ultimately, understanding these undercurrents may offer a reliable compass for those wrestling with decisions around buying or selling Innovative Industrial Properties stock, grounding predictions in the fertile soil of informed speculation and strategic foresight.

Review the original Analysis

The Surge Ahead: Navigating IIPR Stock Predictions

In the whirlwind world of stock forecasting, navigating the future of Innovative Industrial Properties (IIPR) stocks demands a keen eye on pivotal events and factors. Analysts looking to chart the course of IIPR's stock rates have their gaze fixed on a few critical developments. At the forefront is the potential rescheduling of cannabis on the Federal level. Should cannabis be reclassified to Schedule III, the ripple effects would significantly enhance the free cash flow generation of IIPR's tenants, thereby brightening the prospects of IIPR stock.

Key Catalysts Shaping IIPR's Future

Additionally, the IIPR stock forecast can't ignore the potential legalization of adult-use sales in Florida. Many of IIPR's tenants have a stronghold in Florida, and a shift towards legalization could bolster their financial standing, reflecting positively on IIPR's stock price target. Moreover, the stock's appeal is magnified by its robust cash flow generation and a generous 7.2% dividend yield. In an era where yields are hard to come by, this aspect makes IIPR a good stock to buy for those craving income alongside growth.

However, it's not all smooth sailing. Tenant difficulties pose a risk, albeit one that seems manageable and reflected in the current stock prices. By closely monitoring these factors, analysts can provide a more accurate IIPR stock price prediction, making a buy or sell decision clearer for investors navigating the high seas of the stock market.

So, whether you're pondering "Is IIPR a good stock to buy?" or fine-tuning your investment strategies, keeping a pulse on these developments could be your compass in the turbulent but potentially rewarding waters of IIPR stock investing.

Review the original Analysis

Unlocking the Future: Forecasting IIPR's Stock Performance

When it comes to predicting the stock prices for Innovative Industrial Properties (IIPR), several factors stand out. Tenant quality and financial sustainability emerge as pivotal, as the financial stability and credit profiles of IIPR's cannabis tenants are under the microscope. A major concern is if the biggest tenant were to falter on leases, potentially leading to a significant dip in IIPR's stock rates. This paints a cautionary scenario similar to what happened with Power REIT, alerting investors to keep a keen eye on these indicators.

Regulatory Changes and Valuation: The Twin Engines of Change

Next in the forecast line are the regulatory changes in the cannabis industry. A rescheduling by the DEA could positively shock the market, pivoting growth for IIPR's tenants. However, the unpredictable nature of such developments throws a wrench in the works for making precise predictions. Analysts looking to tap into accurate forecasts should balance these potential regulatory lifts against the uncertainties they carry.

Lastly, valuation and asset quality can't be ignored. A comparative analysis reveals a mispricing of IIPR's stock when pegged against high-quality industrial peers, with a particular eye on the inflated implied EV per sqft against companies like Prologis. The asset quality, in tandem with replacement costs, hints at a downside risk which smart analysts will incorporate into their prediction models.

- Tenant quality and financial sustainability

- Regulatory changes in the cannabis industry

- Valuation and asset quality

In summary, a blend of scrutiny on tenant stability, regulatory landscape shifts, and valuation disparities will offer analysts a detailed roadmap to navigate IIPR’s stock price predictions. Keeping these factors in check, experts can leverage this information to carve out more accurate and less speculative forecasts about IIPR's trajectory in the ever-volatile market landscape.

Review the original Analysis

Innovative Industrial Properties Inc., an industrial REIT that caters to operators of regulated cannabis facilities with a valid state license, could be a smart pick if you’re in for buying when prices drop. This ‘strong buy’ recommendation holds its ground thanks to consistently paying dividends despite a decline in its stock price, solid financials, favorable valuations and an upward trend in earnings revision.

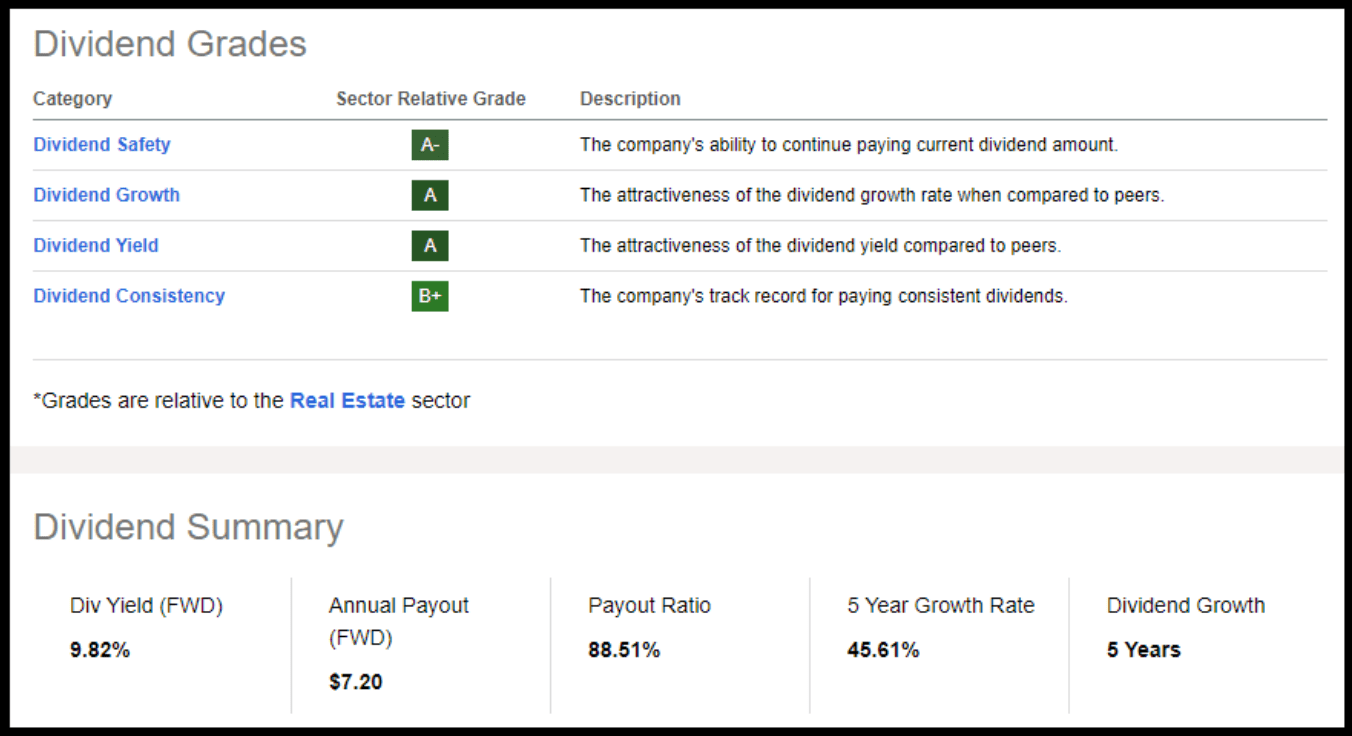

Changes in monetary policy have dealt harsh blows to a range of sectors and industries, including real estate. Despite these challenges which include rising interest rates, analyst downgrades and broader economic headwinds, Innovative Industrial Properties still stands strong as a quant-rated ‘buy’. The stock has taken a hit, falling 23% YTD. However, its impressive dividend growth coupled with an upcoming 9.82% dividend yield makes it extremely attractive as we expect REITs to recover.

Innovative Industrials (IIPR) really stands out due to its impressive cash flow, remarkable growth, and the ability to uphold its dividend scorecard from the solid profitability it maintains. What’s noteworthy is that it boasts a healthy revenue influx and an advance in Adjusted Funds from Operations (AFFO) Growth which are a whole 141.12% greater compared to other businesses in the same sector.

Thanks to its hefty cash reserves, IIPR can proudly sustain its dividend and report a nearly 30% Compound Annual Growth Rate (CAGR) in dividends over the past three years. Also, it’s interesting that the company’s stock is trading below its peak price from the past year. This makes Innovative Industrials quite an attractive option given its forward Price to AFFO ratio stands at 9.14x, which is a 31% lower rate compared to other companies in this industry.

The cherry on top? The company’s Total Debt-to-Capital ratio for the trailing 12 months is astoundingly lower by -73.23% than its industry peers! Meaning, it has very little debt on its shoulders. Plus, IIPR focuses mostly on industrial properties, which don’t have much overhead costs; hence it’s able to keep expenses low—a smart strategy indeed!

Innovative Industrial Properties daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Apr 26 | 101.24 | 99.49 | 102.70 | 3.23 |

| Apr 27 | 101.87 | 101.00 | 103.40 | 2.37 |

| Apr 28 | 101.97 | 101.08 | 103.12 | 2.02 |

| Apr 29 | 100.21 | 98.81 | 101.34 | 2.56 |

| Apr 30 | 99.51 | 98.89 | 101.03 | 2.16 |

| May 01 | 99.78 | 98.91 | 100.83 | 1.94 |

| May 02 | 99.78 | 98.54 | 100.38 | 1.87 |

| May 03 | 98.81 | 97.92 | 100.15 | 2.27 |

| May 04 | 98.00 | 96.53 | 98.63 | 2.18 |

| May 05 | 99.02 | 97.89 | 100.83 | 3.01 |

| May 06 | 99.07 | 98.03 | 100.98 | 3.01 |

| May 07 | 100.96 | 100.02 | 102.82 | 2.80 |

| May 08 | 100.81 | 100.23 | 101.76 | 1.53 |

| May 09 | 101.31 | 99.71 | 102.42 | 2.72 |

| May 10 | 101.59 | 99.84 | 102.30 | 2.47 |

| May 11 | 103.77 | 102.79 | 104.68 | 1.84 |

| May 12 | 104.71 | 104.05 | 106.62 | 2.47 |

| May 13 | 106.02 | 104.48 | 107.61 | 2.99 |

| May 14 | 106.39 | 104.95 | 108.49 | 3.37 |

| May 15 | 105.32 | 103.80 | 105.93 | 2.05 |

| May 16 | 106.22 | 104.09 | 107.62 | 3.39 |

| May 17 | 106.64 | 106.11 | 108.24 | 2.01 |

| May 18 | 109.02 | 108.33 | 110.24 | 1.76 |

| May 19 | 108.06 | 106.55 | 110.09 | 3.32 |

| May 20 | 107.71 | 105.58 | 109.33 | 3.55 |

| May 21 | 106.74 | 105.89 | 108.34 | 2.32 |

| May 22 | 105.09 | 103.67 | 105.95 | 2.21 |

| May 23 | 103.30 | 101.67 | 105.26 | 3.53 |

| May 24 | 103.82 | 102.86 | 104.39 | 1.49 |

| May 25 | 103.19 | 101.23 | 104.61 | 3.34 |

Innovative Industrial Properties Daily Price Targets

Innovative Industrial Properties Stock Forecast 04-26-2024.

Forecast target price for 04-26-2024: $101.24.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 3.130%.

Pessimistic target level: 99.49

Optimistic target level: 102.70

Innovative Industrial Properties Stock Forecast 04-27-2024.

Forecast target price for 04-27-2024: $101.87.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 2.315%.

Pessimistic target level: 101.00

Optimistic target level: 103.40

Innovative Industrial Properties Stock Forecast 04-28-2024.

Forecast target price for 04-28-2024: $101.97.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 1.978%.

Pessimistic target level: 101.08

Optimistic target level: 103.12

Innovative Industrial Properties Stock Forecast 04-29-2024.

Forecast target price for 04-29-2024: $100.21.

Negative dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 2.497%.

Pessimistic target level: 98.81

Optimistic target level: 101.34

Innovative Industrial Properties Stock Forecast 04-30-2024.

Forecast target price for 04-30-2024: $99.51.

Negative dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 2.118%.

Pessimistic target level: 98.89

Optimistic target level: 101.03

Innovative Industrial Properties Stock Forecast 05-01-2024.

Forecast target price for 05-01-2024: $99.78.

Positive dynamics for Innovative Industrial Properties shares will prevail with possible volatility of 1.905%.

Pessimistic target level: 98.91

Optimistic target level: 100.83

IIPR (IIPR) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May. | 90.76 | 86.75 | 95.25 | 8.92 |

| Jun. | 94.02 | 89.71 | 100.62 | 10.85 |

| Jul. | 93.51 | 90.65 | 95.96 | 5.53 |

| Aug. | 91.83 | 85.63 | 95.72 | 10.53 |

| Sep. | 94.97 | 90.61 | 101.64 | 10.85 |

| Oct. | 93.69 | 91.75 | 96.30 | 4.73 |

| Nov. | 95.04 | 92.73 | 101.11 | 8.29 |

| Dec. | 91.96 | 87.99 | 95.52 | 7.88 |

Innovative Industrial Properties forecast for this year

Innovative Industrial Properties Stock Prediction for May 2024

An downtrend is forecast for this month with an optimal target price of $90.7552. Pessimistic: $86.75. Optimistic: $95.25

Innovative Industrial Properties Stock Prediction for Jun 2024

An uptrend is forecast for this month with an optimal target price of $94.0224. Pessimistic: $89.71. Optimistic: $100.62

Innovative Industrial Properties Stock Prediction for Jul 2024

An downtrend is forecast for this month with an optimal target price of $93.5147. Pessimistic: $90.65. Optimistic: $95.96

Innovative Industrial Properties Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $91.8314. Pessimistic: $85.63. Optimistic: $95.72

Innovative Industrial Properties Stock Prediction for Sep 2024

An uptrend is forecast for this month with an optimal target price of $94.9721. Pessimistic: $90.61. Optimistic: $101.64

Innovative Industrial Properties Stock Prediction for Oct 2024

An downtrend is forecast for this month with an optimal target price of $93.6899. Pessimistic: $91.75. Optimistic: $96.30

Innovative Industrial Properties Stock Prediction for Nov 2024

An uptrend is forecast for this month with an optimal target price of $95.0391. Pessimistic: $92.73. Optimistic: $101.11

Innovative Industrial Properties Stock Prediction for Dec 2024

An downtrend is forecast for this month with an optimal target price of $91.9598. Pessimistic: $87.99. Optimistic: $95.52

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 89.89 | 84.47 | 93.85 | 10.00 |

| Feb | 93.29 | 87.58 | 95.56 | 8.35 |

| Mar | 88.59 | 84.36 | 94.57 | 10.79 |

| Apr | 89.94 | 86.46 | 92.37 | 6.40 |

| May | 94.96 | 90.77 | 101.20 | 10.30 |

| Jun | 102.82 | 100.33 | 109.67 | 8.52 |

| Jul | 108.47 | 105.44 | 112.67 | 6.41 |

| Aug | 115.60 | 109.87 | 122.25 | 10.13 |

| Sep | 117.36 | 109.76 | 122.33 | 10.27 |

| Oct | 115.57 | 107.46 | 121.60 | 11.63 |

| Nov | 122.12 | 113.88 | 124.65 | 8.64 |

| Dec | 123.11 | 120.78 | 130.09 | 7.15 |

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 126.88 | 120.83 | 135.90 | 11.09 |

| Feb | 121.40 | 112.77 | 124.02 | 9.07 |

| Mar | 122.71 | 116.63 | 130.99 | 10.96 |

| Apr | 122.82 | 118.07 | 129.45 | 8.79 |

| May | 129.12 | 120.64 | 136.09 | 11.36 |

| Jun | 135.74 | 132.08 | 140.87 | 6.24 |

| Jul | 142.83 | 134.99 | 147.84 | 8.70 |

| Aug | 144.37 | 135.54 | 152.30 | 11.01 |

| Sep | 132.68 | 128.14 | 139.96 | 8.45 |

| Oct | 126.11 | 120.55 | 132.58 | 9.07 |

| Nov | 125.20 | 122.83 | 130.95 | 6.20 |

| Dec | 131.29 | 125.38 | 137.67 | 8.93 |

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 129.04 | 123.47 | 134.73 | 8.36 |

| Feb | 124.86 | 118.34 | 128.68 | 8.03 |

| Mar | 119.35 | 114.09 | 122.15 | 6.60 |

| Apr | 119.78 | 115.26 | 122.69 | 6.06 |

| May | 116.44 | 111.52 | 120.95 | 7.80 |

| Jun | 119.38 | 112.39 | 123.78 | 9.20 |

| Jul | 130.01 | 121.47 | 133.41 | 8.95 |

| Aug | 131.07 | 121.63 | 138.14 | 11.95 |

| Sep | 125.17 | 121.11 | 132.04 | 8.28 |

| Oct | 130.80 | 125.38 | 138.69 | 9.59 |

| Nov | 125.97 | 118.15 | 133.46 | 11.47 |

| Dec | 125.52 | 117.05 | 131.51 | 11.00 |

Innovative Industrial Properties (IIPR) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 134.67 | 128.37 | 139.64 | 8.07 |

| Feb | 140.25 | 132.92 | 148.20 | 10.31 |

| Mar | 144.16 | 134.69 | 148.44 | 9.26 |

| Apr | 155.84 | 151.49 | 163.83 | 7.53 |

| May | 160.88 | 150.75 | 170.59 | 11.63 |

| Jun | 171.60 | 168.20 | 180.40 | 6.76 |

| Jul | 177.16 | 167.43 | 188.32 | 11.09 |

| Aug | 175.56 | 165.77 | 180.46 | 8.14 |

| Sep | 179.51 | 167.72 | 190.66 | 12.03 |

| Oct | 178.87 | 166.79 | 185.63 | 10.15 |

| Nov | 185.31 | 176.64 | 198.48 | 11.01 |

| Dec | 185.47 | 180.47 | 191.32 | 5.67 |

Innovative Industrial Properties information and performance

1389 CENTER DRIVE, SUITE 200, PARK CITY, UT, US

Market capitalization of the Innovative Industrial Properties, Inc. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of IIPR shares in the company outstanding by the market price of one share.

EBITDA of Innovative Industrial Properties is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.

Innovative Industrial Properties (IIPR) stock dividend

Innovative Industrial Properties last paid dividends on 03/27/2024. The next scheduled payment will be on 04/15/2024. The amount of dividends is $7.22 per share. If the date of the next dividend payment has not been updated, it means that the issuer has not yet announced the exact payment. As soon as information becomes available, we will immediately update the data. Bookmark our portal to stay updated.

Last Split Date: 01/01/1970

Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

For example, a 5: 1 ratio means that the value of one share will decrease 5 times, the total amount will increase 5 times. It is important to understand that this procedure does not change the capitalization of the company, as well as the total value of assets held in private hands.