April 18, 2024 EU Moves Toward Single Capital Market Union

April 17, 2024 Bitcoin Halving 2024: Market Impact Predictions

April 14, 2024 Markets Rattle: Iran-Israel Conflict and Economic Data Ahead

April 12, 2024 Banks Brace for Earnings Amid Rate Cut Speculations

Apple’s Technical Climb To $240 By Year-End

April 12, 2024 Improve Your Financial Status: A How-To Guide

April 12, 2024 How ZIM Integrated Container Tracking is Revolutionizing Global Trade

March 15, 2024 6 Best Growth Stocks To Buy Now According to Metatrader 5

March 6, 2024 Navigating GBP Forecast: Mistakes To Avoid In Forex Trading

Bitfarms (BITF) Stock Forecast for 2024–2028. Sell or Buy?

Updated: April 19, 2024 (07:03)

Sector: FinancialThe share price of Bitfarms Ltd. (BITF) now

50/200 Day Moving Average: $2.551 / $1.883

This figure corresponds to the Average Price over the previous 50/200 days. For Bitfarms stocks, the 50-day moving average is the resistance level today.

For Bitfarms stocks, the 200-day moving average is the resistance level today.

Are you interested in Bitfarms Ltd. stocks and want to buy them, or are they already in your portfolio? If yes, then on this page you will find useful information about the dynamics of the Bitfarms stock price in 2024, 2025, 2026, 2027, 2028. How much will one Bitfarms share be worth in 2024 - 2028?

When should I take profit in Bitfarms stock? When should I record a loss on Bitfarms stock? What are analysts' forecasts for Bitfarms stock? What is the future of Bitfarms stock? We forecast Bitfarms stock performance using neural networks based on historical data on Bitfarms stocks. Also, when forecasting, technical analysis tools are used, world geopolitical and news factors are taken into account.

Bitfarms stock prediction results are shown below and presented in the form of graphs, tables and text information, divided into time intervals. (Next month, 2024, 2025, 2026, 2027 and 2028) The final quotes of the instrument at the close of the previous trading day are a signal to adjust the forecasts for Bitfarms shares. This happens once a day.

Historical and forecast chart of Bitfarms stock

The chart below shows the historical price of Bitfarms stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Bitfarms stock price can be found in the table below.

Long-term forecasts by years.

Unlocking the Future of BITF Stock: Predictive Insights

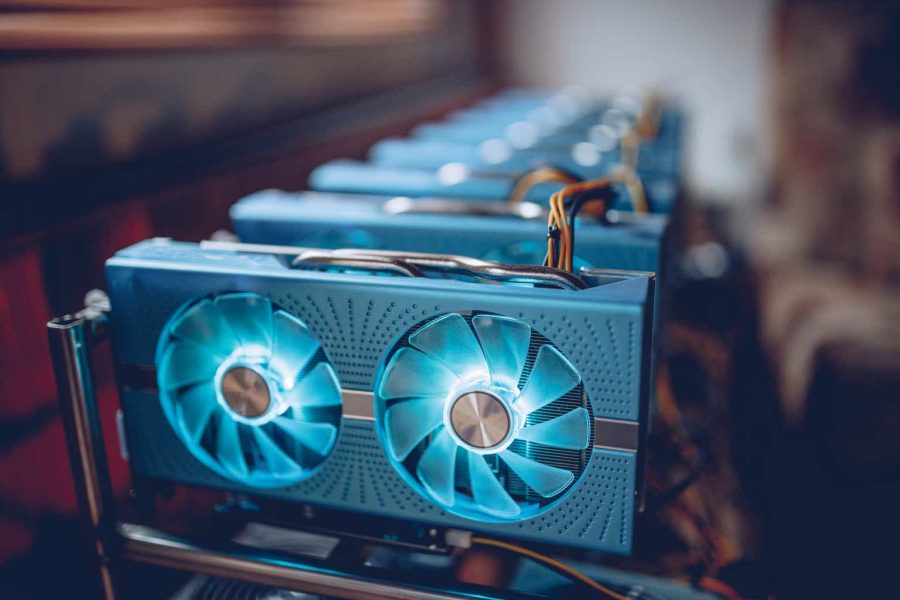

In the bustling world of cryptocurrency mining, Bitfarms stands out as a beacon for investors looking for promising opportunities. However, accurately forecasting BITF stock rates requires a deep dive into several key factors dominating the landscape. Among these, the impending halving of Bitcoin production, the company's capex strategy, the political windfalls in Argentina, and the potential for share dilution emerge as critical influencers.

Navigating BITF's Financial Waters

For analysts aiming to craft the most on-point BITF stock price prediction, understanding the interplay between these factors is crucial. The halving event is a double-edged sword; it can constrain Bitfarms' Bitcoin output, potentially hiking up the stock value if BTC prices soar. Meanwhile, the company's capex on mining infrastructures is a determinant of future profitability, making it an essential variable in predicting whether BITF is a good stock to buy.

The recent election of a pro-BTC government in Argentina introduces a boisterous dynamic, opening avenues for reduced energy costs and favorable mining conditions. This ‘Argentine Tailwind’ could very well be the golden ticket for Bitfarms, significantly impacting the Bitfarms stock forecast. Lastly, the specter of share dilution looms large, a common concern for investors wary of their share value decreasing.

To synthesize these factors into a coherent BITF stock forecast, analysts must weigh their respective impacts. Clearly, the mastery of capex and leveraging Argentine tailwinds hold the keys to unlocking Bitfarms' financial ascent. However, the balancing act with halving and share dilution will also dramatically shape BITF stock price targets. With these insights, investors can navigate the turbulent waters of cryptocurrency with a tad more confidence.

As we inch closer to these pivotal moments, keeping a close eye on these variables will undoubtedly offer a glimpse into the future of buying or selling Bitfarms stock.

Review the original Analysis

A Closer Look at BITF Stock Forecast: Navigating Through Market Sentiments and Future Events

When it comes to predicting the ebbs and flows of the BITF stock price, analysts are eyeing several critical factors that could shape its trajectory. Among these, the financial performance, Bitcoin halving event, and prevailing market sentiment hold the reins. Understanding these components can help investors and analysts decipher the Bitfarms stock forecast with greater accuracy.

Deciphering the Future: Key Factors to Watch

The upcoming Bitcoin halving event is a pivotal occurrence, poised to decrease mining rewards significantly. This reduction may lead to a lower hash rate, challenging Bitfarms (BITF) in maintaining its revenue generation, thereby potentially affecting its stock price. Analysts utilizing this knowledge in their BITF stock price prediction understand the weight of such events on investor sentiment.

Moreover, BITF's recent financial performance has been less than stellar, reporting a sizable net loss in 2023. The company's reliance on raising capital through the markets for operational funding could lead to shareholder dilution, impacting the BITF stock price target. Analysts taking this into account for the BITF stock forecast are keenly aware that the company's approach to capital raising and financial health is crucial for its stock buy or sell recommendation.

Lastly, the broader market performance and investor sentiment towards crypto miners have a significant influence. A cloud of uncertainty or a wave of optimism can sway the BITF stock buy or sell decision markedly. By weaving these elements together, analysts are better equipped to navigate the fluctuating waters of the Bitfarms stock forecast, aiming to provide guidance on whether BITF is a good stock to buy or sell.

In a landscape brimming with potential shifts, keeping an eye on these factors could be key to making the most accurate BITF stock price predictions, offering investors a well-rounded view amidst the volatile domain of crypto mining stocks.

Review the original Analysis

The Rocky Road Ahead for BITF Stocks

As we peer into the future of Bitfarms (BITF) stock, a mosaic of influencing factors emerges, poised to sway its rates significantly. Foremost among these is the trend of declining Bitcoin production, primarily attributed to BITF's shrinking share in the Bitcoin Network. This fundamental issue stands as the bedrock of the challenges ahead, casting a long shadow on profitability and, by extension, BITF's stock valuation.

Key Dynamics Shaping BITF's Forecast

Analysts eyeing the BITF horizon should be particularly vigilant about network share dynamics. A decreasing share spells lower production volumes, directly impacting the company's bottom line. Concurrently, the competition from other miners like CleanSpark (CLSK) and Riot Platforms (RIOT), racing ahead with ambitious expansion plans, threatens to compress BITF's market presence even further. These rivals' projected growth rates underscore the competitive pressures BITF faces, potentially exacerbating its production woes.

In addition to these, the Bitcoin halving cycle, an event that will cut BITF's already dwindling mining yield by half, looms large. This anticipated development could trigger sector-wide consolidation, putting companies like BITF at a disadvantage. To harness these insights for forecasting, analysts must weigh these factors meticulously, blending them into a cohesive analysis that reflects BITF's nuanced market position.

Understanding these intertwined elements offers a glimpse into BITF’s challenging path ahead. For investors and analysts alike, these factors present a framework for making informed predictions about BITF's stock trajectory in a landscape marked by rapid changes and intense competition.

Review the original Analysis

Bitfarms Ltd. owns and operates blockchain farms that power the global decentralized financial economy. It provides computing power to crypto currency networks such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dash, earning fees from each network for securing and processing transactions. The company was founded on October 11, 2018 and is headquartered in Toronto, Canada.

Bitfarms daily forecast for a month

| Date | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Apr 21 | 1.77 | 1.72 | 1.84 | 6.92 |

| Apr 22 | 1.77 | 1.69 | 1.85 | 9.17 |

| Apr 23 | 1.69 | 1.61 | 1.75 | 8.57 |

| Apr 24 | 1.74 | 1.71 | 1.82 | 6.13 |

| Apr 25 | 1.79 | 1.72 | 1.85 | 7.36 |

| Apr 26 | 1.84 | 1.77 | 1.91 | 7.87 |

| Apr 27 | 1.88 | 1.78 | 1.97 | 10.94 |

| Apr 28 | 1.93 | 1.88 | 1.96 | 4.31 |

| Apr 29 | 2.04 | 1.93 | 2.09 | 7.83 |

| Apr 30 | 1.98 | 1.93 | 2.05 | 6.11 |

| May 01 | 2.04 | 1.92 | 2.08 | 8.30 |

| May 02 | 2.10 | 2.01 | 2.21 | 9.85 |

| May 03 | 2.04 | 1.97 | 2.12 | 7.45 |

| May 04 | 2.17 | 2.12 | 2.22 | 5.09 |

| May 05 | 2.11 | 2.07 | 2.18 | 5.29 |

| May 06 | 2.20 | 2.11 | 2.24 | 6.35 |

| May 07 | 2.30 | 2.26 | 2.36 | 4.26 |

| May 08 | 2.24 | 2.19 | 2.35 | 7.52 |

| May 09 | 2.16 | 2.07 | 2.27 | 9.59 |

| May 10 | 2.13 | 2.02 | 2.20 | 9.14 |

| May 11 | 2.07 | 2.00 | 2.12 | 5.86 |

| May 12 | 1.96 | 1.85 | 2.03 | 9.68 |

| May 13 | 1.98 | 1.95 | 2.04 | 4.92 |

| May 14 | 1.96 | 1.87 | 2.01 | 7.39 |

| May 15 | 1.98 | 1.88 | 2.05 | 8.82 |

| May 16 | 1.96 | 1.86 | 2.01 | 8.50 |

| May 17 | 1.97 | 1.93 | 2.04 | 6.07 |

| May 18 | 1.97 | 1.91 | 2.01 | 5.20 |

| May 19 | 1.85 | 1.78 | 1.92 | 7.78 |

| May 20 | 1.76 | 1.68 | 1.79 | 6.22 |

Bitfarms Daily Price Targets

Bitfarms Stock Forecast 04-21-2024.

Forecast target price for 04-21-2024: $1.77.

Negative dynamics for Bitfarms shares will prevail with possible volatility of 6.471%.

Pessimistic target level: 1.72

Optimistic target level: 1.84

Bitfarms Stock Forecast 04-22-2024.

Forecast target price for 04-22-2024: $1.77.

Positive dynamics for Bitfarms shares will prevail with possible volatility of 8.403%.

Pessimistic target level: 1.69

Optimistic target level: 1.85

Bitfarms Stock Forecast 04-23-2024.

Forecast target price for 04-23-2024: $1.69.

Negative dynamics for Bitfarms shares will prevail with possible volatility of 7.897%.

Pessimistic target level: 1.61

Optimistic target level: 1.75

Bitfarms Stock Forecast 04-24-2024.

Forecast target price for 04-24-2024: $1.74.

Positive dynamics for Bitfarms shares will prevail with possible volatility of 5.773%.

Pessimistic target level: 1.71

Optimistic target level: 1.82

Bitfarms Stock Forecast 04-25-2024.

Forecast target price for 04-25-2024: $1.79.

Positive dynamics for Bitfarms shares will prevail with possible volatility of 6.859%.

Pessimistic target level: 1.72

Optimistic target level: 1.85

Bitfarms Stock Forecast 04-26-2024.

Forecast target price for 04-26-2024: $1.84.

Positive dynamics for Bitfarms shares will prevail with possible volatility of 7.299%.

Pessimistic target level: 1.77

Optimistic target level: 1.91

BITF (BITF) Monthly Stock Prediction for 2024

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| May. | 2.01 | 1.77 | 2.15 | 18.05 |

| Jun. | 2.24 | 2.03 | 2.46 | 17.65 |

| Jul. | 2.47 | 2.35 | 2.75 | 14.61 |

| Aug. | 1.99 | 1.85 | 2.12 | 12.82 |

| Sep. | 2.12 | 1.87 | 2.46 | 24.22 |

| Oct. | 2.24 | 1.90 | 2.50 | 24.04 |

| Nov. | 2.59 | 2.28 | 2.89 | 21.08 |

| Dec. | 2.58 | 2.32 | 2.85 | 18.51 |

Bitfarms forecast for this year

Bitfarms Stock Prediction for May 2024

An uptrend is forecast for this month with an optimal target price of $2.0091. Pessimistic: $1.77. Optimistic: $2.15

Bitfarms Stock Prediction for Jun 2024

An uptrend is forecast for this month with an optimal target price of $2.24336. Pessimistic: $2.03. Optimistic: $2.46

Bitfarms Stock Prediction for Jul 2024

An uptrend is forecast for this month with an optimal target price of $2.47039. Pessimistic: $2.35. Optimistic: $2.75

Bitfarms Stock Prediction for Aug 2024

An downtrend is forecast for this month with an optimal target price of $1.99212. Pessimistic: $1.85. Optimistic: $2.12

Bitfarms Stock Prediction for Sep 2024

An uptrend is forecast for this month with an optimal target price of $2.11922. Pessimistic: $1.87. Optimistic: $2.46

Bitfarms Stock Prediction for Oct 2024

An uptrend is forecast for this month with an optimal target price of $2.23578. Pessimistic: $1.90. Optimistic: $2.50

Bitfarms Stock Prediction for Nov 2024

An uptrend is forecast for this month with an optimal target price of $2.585. Pessimistic: $2.28. Optimistic: $2.89

Bitfarms Stock Prediction for Dec 2024

An downtrend is forecast for this month with an optimal target price of $2.57932. Pessimistic: $2.32. Optimistic: $2.85

Bitfarms (BITF) Monthly Stock Prediction for 2025

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 2.41 | 2.22 | 2.55 | 12.72 |

| Feb | 2.18 | 1.96 | 2.31 | 15.34 |

| Mar | 1.81 | 1.66 | 1.91 | 13.08 |

| Apr | 1.51 | 1.39 | 1.72 | 19.17 |

| May | 1.61 | 1.52 | 1.83 | 17.00 |

| Jun | 1.83 | 1.72 | 1.91 | 9.69 |

| Jul | 1.70 | 1.57 | 1.86 | 16.05 |

| Aug | 1.75 | 1.52 | 1.89 | 19.53 |

| Sep | 1.90 | 1.79 | 2.17 | 17.87 |

| Oct | 2.32 | 2.16 | 2.63 | 17.81 |

| Nov | 2.26 | 1.94 | 2.42 | 19.90 |

| Dec | 1.79 | 1.59 | 2.01 | 20.80 |

Bitfarms (BITF) Monthly Stock Prediction for 2026

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 1.70 | 1.62 | 1.85 | 12.74 |

| Feb | 1.84 | 1.63 | 2.10 | 22.33 |

| Mar | 1.54 | 1.45 | 1.63 | 11.01 |

| Apr | 1.77 | 1.67 | 2.05 | 18.54 |

| May | 2.06 | 1.74 | 2.28 | 23.63 |

| Jun | 2.05 | 1.74 | 2.32 | 25.02 |

| Jul | 2.12 | 1.83 | 2.27 | 19.32 |

| Aug | 1.89 | 1.61 | 2.12 | 24.09 |

| Sep | 1.90 | 1.65 | 2.11 | 21.76 |

| Oct | 2.08 | 1.96 | 2.42 | 19.11 |

| Nov | 2.17 | 1.88 | 2.34 | 19.57 |

| Dec | 2.23 | 1.85 | 2.58 | 28.54 |

Bitfarms (BITF) Monthly Stock Prediction for 2027

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 2.28 | 1.90 | 2.57 | 25.95 |

| Feb | 2.17 | 1.79 | 2.38 | 24.82 |

| Mar | 2.18 | 1.80 | 2.28 | 20.86 |

| Apr | 1.96 | 1.66 | 2.24 | 25.84 |

| May | 2.03 | 1.88 | 2.30 | 18.43 |

| Jun | 2.33 | 1.92 | 2.59 | 25.57 |

| Jul | 2.34 | 2.04 | 2.67 | 23.57 |

| Aug | 2.41 | 2.27 | 2.53 | 10.05 |

| Sep | 2.08 | 1.78 | 2.30 | 22.53 |

| Oct | 2.28 | 2.05 | 2.59 | 20.91 |

| Nov | 2.23 | 2.10 | 2.42 | 13.20 |

| Dec | 2.61 | 2.46 | 2.79 | 11.95 |

Bitfarms (BITF) Monthly Stock Prediction for 2028

| Month | Target | Pes. | Opt. | Vol., % |

|---|---|---|---|---|

| Jan | 2.96 | 2.49 | 3.33 | 25.22 |

| Feb | 3.17 | 2.69 | 3.37 | 20.27 |

| Mar | 3.55 | 3.24 | 3.81 | 15.15 |

| Apr | 3.55 | 3.14 | 4.12 | 23.88 |

| May | 3.64 | 3.22 | 4.15 | 22.52 |

| Jun | 3.35 | 3.13 | 3.51 | 10.91 |

| Jul | 3.52 | 3.28 | 4.04 | 18.75 |

| Aug | 3.74 | 3.30 | 4.23 | 21.96 |

| Sep | 3.59 | 3.25 | 4.02 | 19.07 |

| Oct | 3.34 | 2.94 | 3.88 | 24.41 |

| Nov | 3.10 | 2.87 | 3.31 | 13.21 |

| Dec | 2.95 | 2.57 | 3.40 | 24.45 |

Bitfarms information and performance

1376 BAYVIEW AVE, UNIT 1, TORONTO, ON, CA

Market capitalization of the Bitfarms Ltd. is the total market value of all issued shares of a company. It is calculated by the formula multiplying the number of BITF shares in the company outstanding by the market price of one share.

EBITDA of Bitfarms is earnings before interest, income tax and depreciation of assets.

P/E ratio (price to earnings) - shows the ratio between the price of a share and the company's profit

Price/earnings to growth

Dividend Per Share is a financial indicator equal to the ratio of the company's net profit available for distribution to the annual average of ordinary shares.

Dividend yield is a ratio that shows how much a company pays in dividends each year at the stock price.

EPS shows how much of the net profit is accounted for by the common share.

Trailing P/E depends on what has already been done. It uses the current share price and divides it by the total earnings per share for the last 12 months.

Forward P/E uses projections of future earnings instead of final numbers.

Enterprise Value (EV) /Revenue

The EV / EBITDA ratio shows the ratio of the cost (EV) to its profit before tax, interest and amortization (EBITDA).

Number of issued ordinary shares

Number of freely tradable shares

Shares Short Prior Month - the number of shares in short positions in the last month.